Ontario Canadian Income Tax Brackets

Calculate your combined federal and provincial tax bill in each province and territory.

Ontario canadian income tax brackets. The first 10 382 incurs no tax. Please read the article understanding the tables of personal income tax rates. Ontario tax rates current marginal tax rates ontario personal income tax rates ontario 2020 and 2019 personal marginal income tax rates. The following table shows the top 2020 provincial territorial tax rates and surtaxes.

This salary example for ontario was produced using standard tax return information for an employee earning 500 000 00 a year in ontario in 2020 this tax ans salary calculation was. All except quebec use the federal definition of taxable income. How to calculate income tax in ontario. Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year.

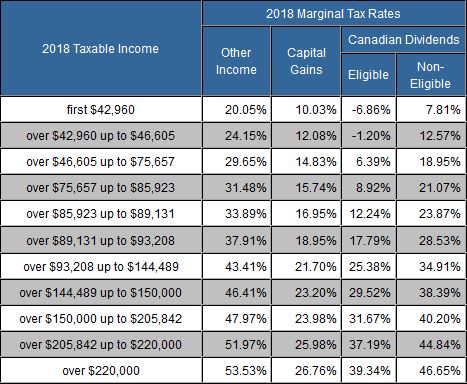

Please read the article understanding the tables of personal income tax rates. 2020 includes all rate changes announced up to july 31 2020. While the marginal tax rate would be 39 41 this is not applied to the full 80 000 only the amount from 76 987 to 80 000. For 2018 and previous tax years you can find the federal tax rates on schedule 1 for 2019 and later tax years you can find the federal tax rates on the income tax and benefit return you will find the provincial or territorial tax rates on form 428 for the.

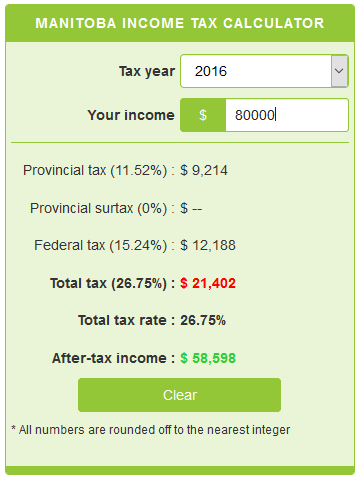

All provinces and territories compute income tax using tax on income systems i e. An income of 80 000 in ontario for the 2010 tax year would incur 19 050 in income tax. If paul has a taxable income gross income minus any deductions of 36 000 his income falls within the first tax bracket so his ontario tax payable would 36 000 x 5 05 1818. Updated for the 2020 21 tax year this illustration provides a tax return tax refund calculation for a canadian resident living in ontario earning 500 000 00 per annum based on the 2020 ontario tax tables.

33 these amounts are adjusted for inflation and other factors in each tax year. Calculate the tax savings your rrsp contribution generates. Ontario tax rates current marginal tax rates ontario personal income tax rates ontario 2021 and 2020 personal marginal income tax rates. I don t think you ve quite grasped the concept of marginal tax and the brackets.

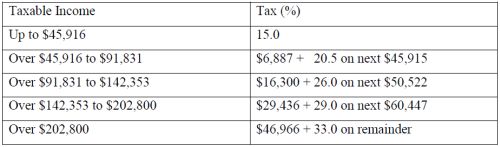

They set their own rates brackets and credits. Canadian corporate tax rates for active business income. Let s look at a couple of examples. Annual income taxable tax brackets tax rates maximum taxes per bracket maximum total tax.

The federal and ontario tax brackets and personal amounts are increased for 2020 by an indexation factor of 1 019 except for the ontario 150 000 and 220 000 bracket amounts. The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010.