Passive Activity Loss Rules Llc

Thankfully three recent court decisions make it easier for those in your shoes to escape the pal rules and thereby deduct llc losses from non rental.

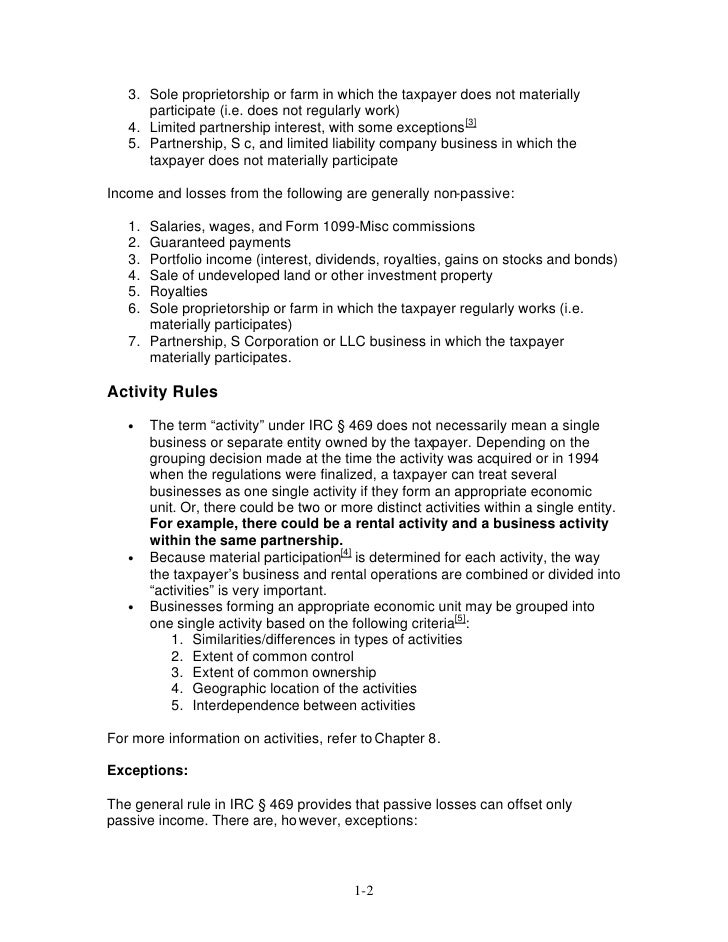

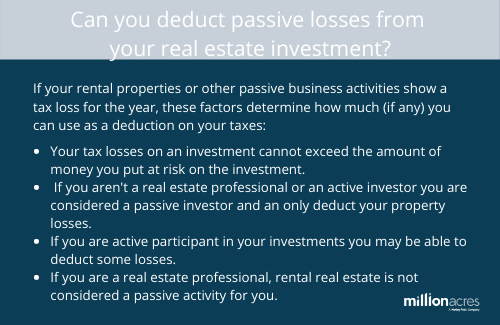

Passive activity loss rules llc. If your real estate rental income generates a net loss. The losses can generally be used to offset the individual s profits. For taxation purposes the irs looks at your annual income in terms of net gain or loss. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder.

In this common scenario the losses might be classified as passive and your ability to currently deduct them might be severely restricted by the dreaded passive activity loss pal rules. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. There are however limitations on the ability of individuals to use or employ these losses. 469 h 2 treats a limited partner s losses from an interest in a limited partnership as presumptively passive.

Irs issues proposed regulations after multiple court setbacks by hale e. Stephen gregg owned and managed ethix corp a managed health care company. Sheppard discusses the changing environment of passive activity rules and the issuance of new proposed regulations within the context of code sec. The tax court and the court of federal claims recently held that members of a limited liability company and partners in a limited liability partnership are not considered limited partners with respect to the passive activity loss rules contained in section 469 of the internal revenue code the code.

Passive activity loss rules. Passive income is generated from property rentals and investments in which you do not participate in the ongoing activities of the business. The author reviews case law. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you.

The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. Using suspended passive losses. Losses must clear all three of these hurdles to be used by owners.

The irs has taken the position that a taxpayer who is a member of an llc or llp that is taxed as a partnership should be treated as a limited partner and therefore any losses passed through to the member are passive activity losses.