Passive Income And 199a Deduction

199a deduction is allowed only for purposes of chapter 1 of the code income taxes.

Passive income and 199a deduction. The owners of many closely held businesses recently filed federal income tax returns on which they claimed for the first time the deduction based on qualified business income under section 199a of the code. If you have net rental income you do want the enterprise to be considered qbi in order to receive the 199a deduction but still consider the income passive and not subject to self employment tax. Niit was enacted to impose a medicare surcharge on passive income. The 199a qualified trade or business requirement and the proposed regulations pointing taxpayers to irc 162 leave lots of gray area for taxpayers and their tax advisors to navigate.

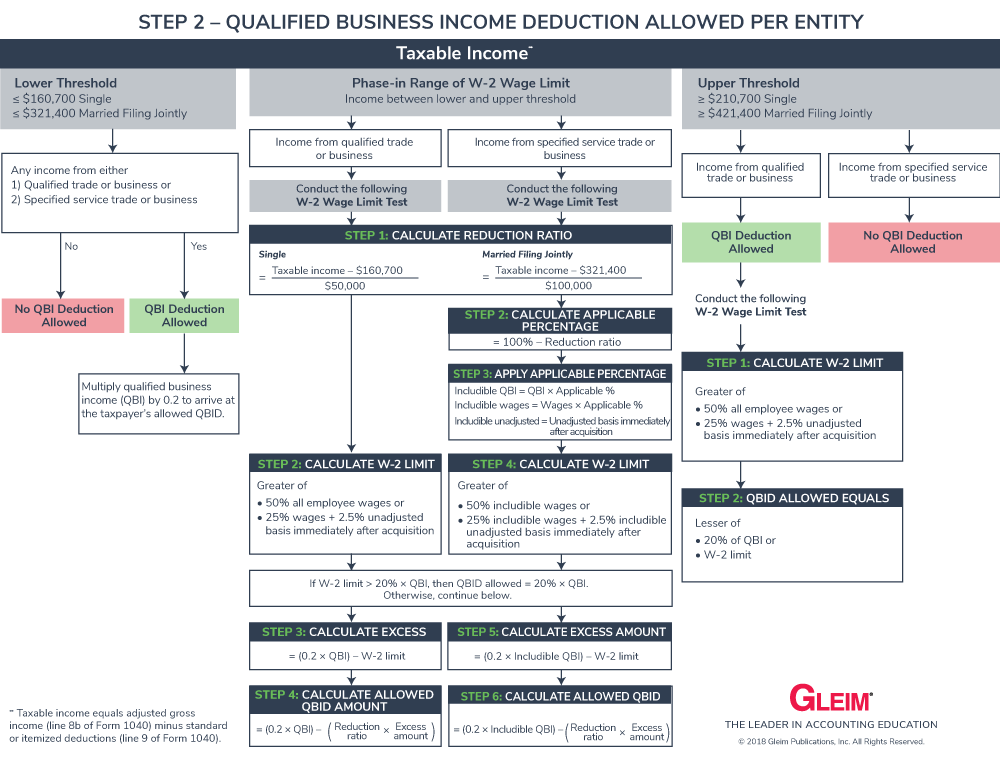

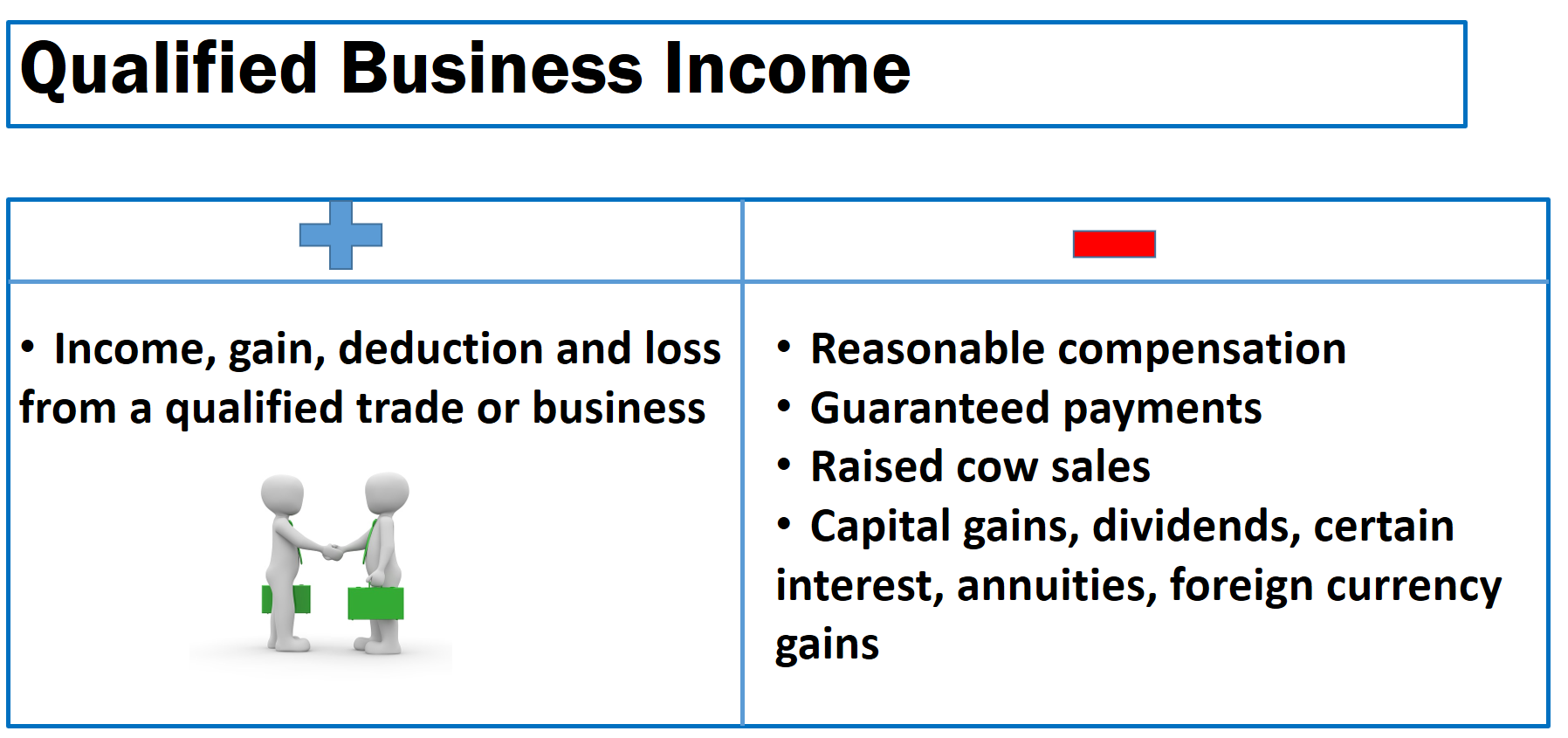

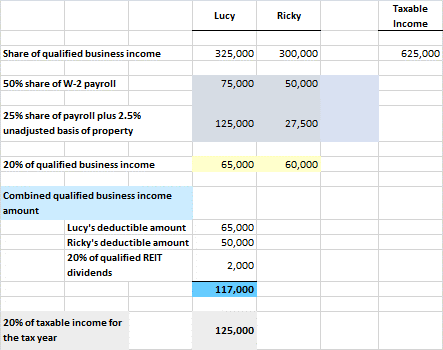

The 199a deduction allows for up to a 20 deduction of qualified business income for certain business owners trusts and estates. However the deduction comes with significant qualifications. These parallels quickly faded away as the tax community dug into the details of the qbi deduction. 199a deduction is also not allowed in determining a net operating loss deduction.

After the issuance of proposed regulations in irc 199a commenters immediately looked for parallels between niit and qbi. The question of what rental income will qualify for the 199a deduction is a key issue that impacts many taxpayers. 55 thus the deduction does not reduce a taxpayer s self employment income as this tax is levied under chapter 2 or net investment income chapter 2a. The irs will be issuing regulations and offering other administrative guidance in the coming months.

Passive activity losses pals are not taken into account for the qbi deduction if they are disallowed. In addition any losses disallowed before jan. 1 2018 are never taken into account for the qbi deduction. Much will be written now about new section 199a and the 20 deduction for pass thru businesses.

Section 199a was added to the internal revenue code under the tax cuts and jobs act of 2017 to provide taxpayers with a 20 deduction from income attributable to qualifying trades or businesses. Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. Many others will be doing so in october of this year. Consider the following scenario.