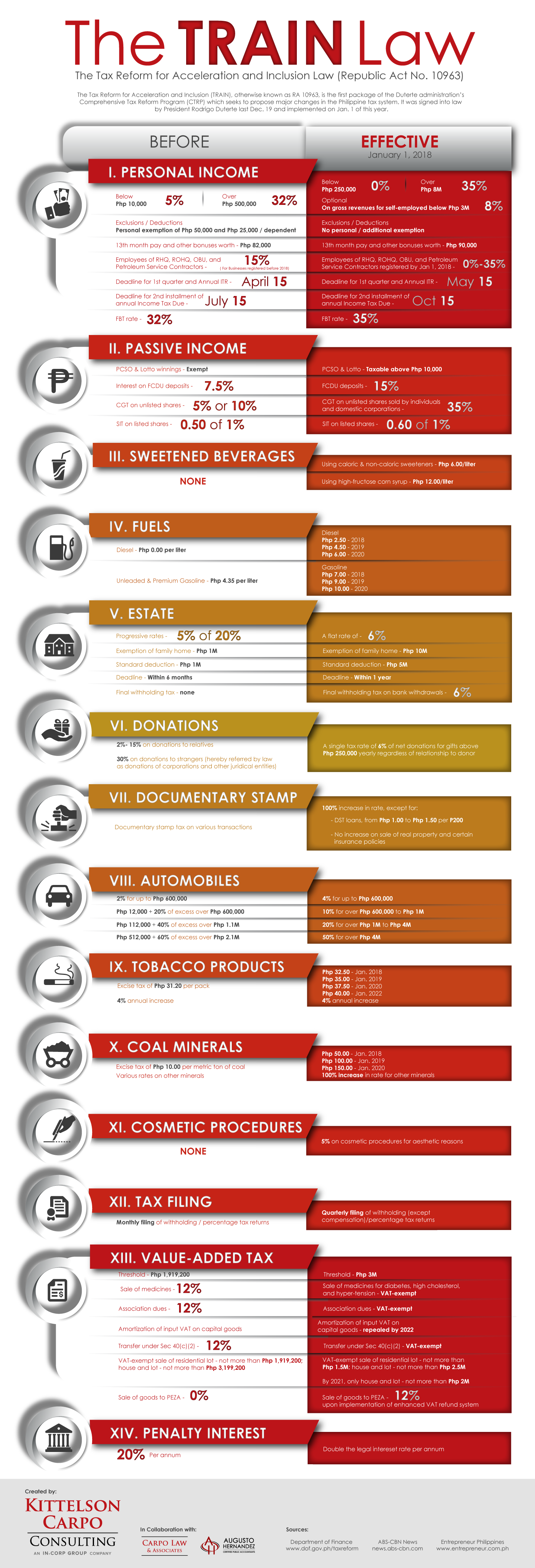

Passive Income Tax Rate Under Train Law

The rr took effect on jan.

Passive income tax rate under train law. 8 2018 which discusses the income tax provisions of the train law. Employee with a gross monthly salary of php 30 000 and receiving 13th month pay of the same amount. Last february 2018 the bureau of internal revenue bir released revenue regulations no. 1 which is also the effectivity date of the train law.

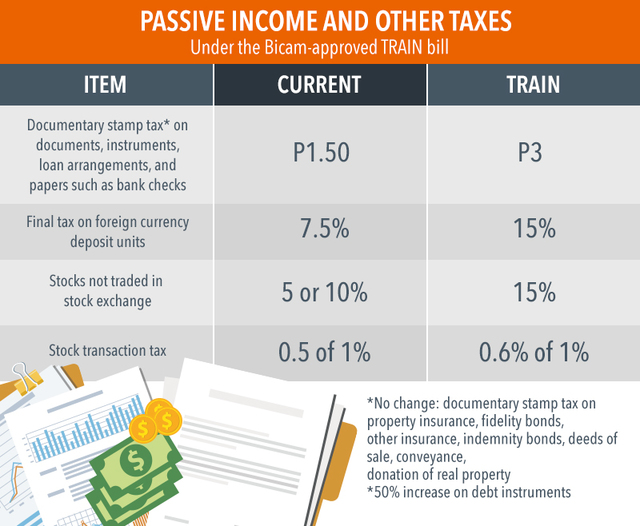

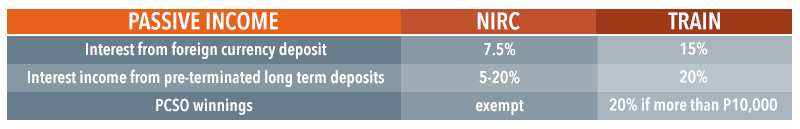

View tax rates train law xlsx from math 123 at academy of business computers karimabad karachi. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000. Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax. Certain passive income final withholding tax interest income from local cdu short term.

Those earning annual incomes between p400 000 and p800. Other provisions on the exclusions and deductions of gross income income tax rates on non resident alien individuals fringe benefit tax and income tax rates on certain passive income are also included under this issuance.