Income Approach Formula Appraisal

This approach is applicable for those properties that generate income like the rental properties which includes non owner.

Income approach formula appraisal. Income approach to business valuation. The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on the. The income approach is a methodology used by appraisers that estimates the market value of a property based on the income of the property. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold.

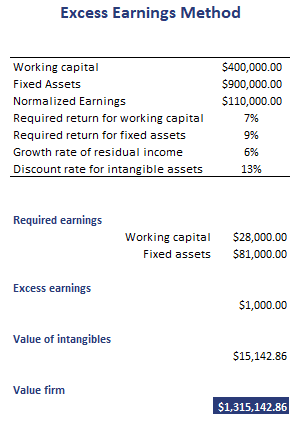

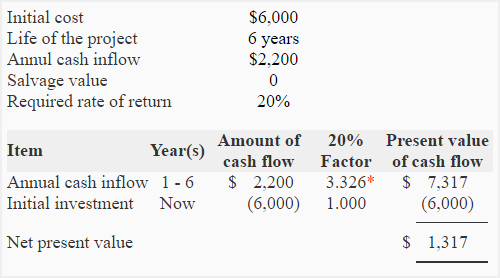

In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. It weighs the potential income of the. The income approach is an application of discounted cash flow analysis in finance. The fundamental math is similar to the methods used for financial valuation securities analysis or bond pricing.

However there are some significant and important modifications when used in real estate or business valuation. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. It is particularly common in commercial real estate appraisal and in business appraisal. An income approach for appraisal is an ideal method in this case.

The income approach to value also known as income capitalization approach is used to determine the value of an income generating property by deriving a value indication by conversion of expected benefits like cash flows and reversion into value of property. The income approach to property valuation is suitable for income producing real estate. Future earnings cash flows are determined by projecting the business s earnings cash flows and adjusting them for changes in growth rate cost structure and taxes etc. With the income approach a property s value today is the present value of the future cash flows the owner can expect to receive.

:max_bytes(150000):strip_icc()/Sinking-fund-factor-1bb9180a4a4340c79a7c3cf470a907ca.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-02-ba61fb5a7de74ce8b29266f0607d3a88.jpg)