Passive Income And Qbi

If you are interested in affiliate advertising and marketing or constructing an online business in general however do not recognize where to begin after that this brand new course freedom breakthrough the affiliate blueprint academy from jonathan montoya is well worth a look.

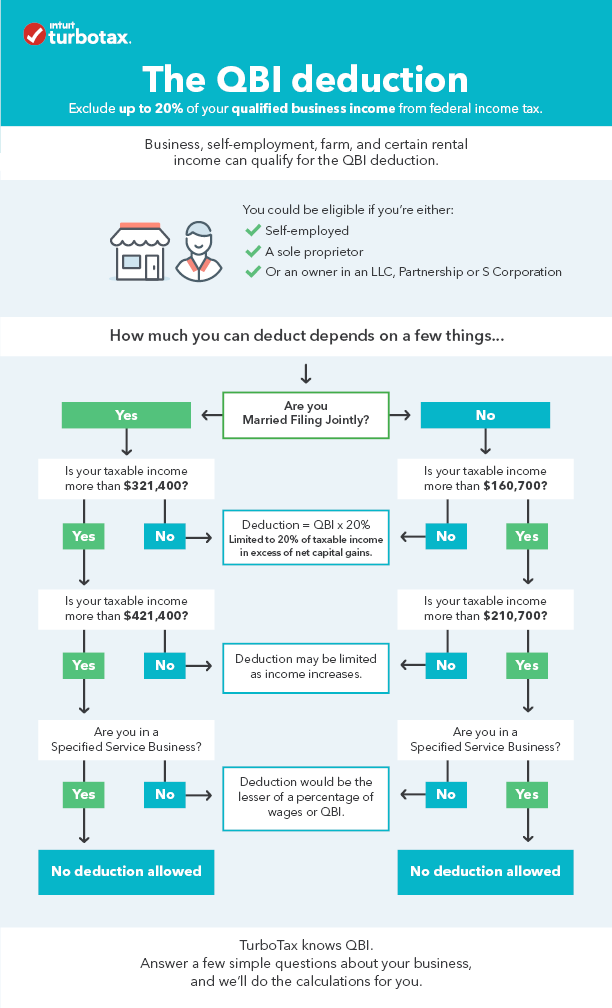

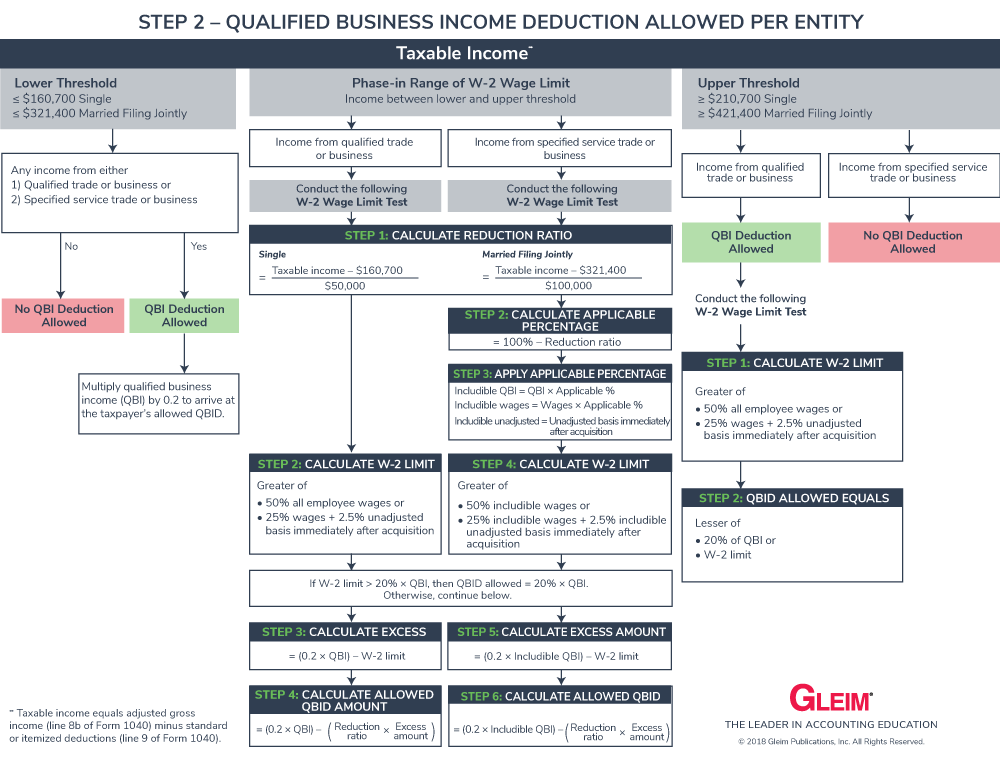

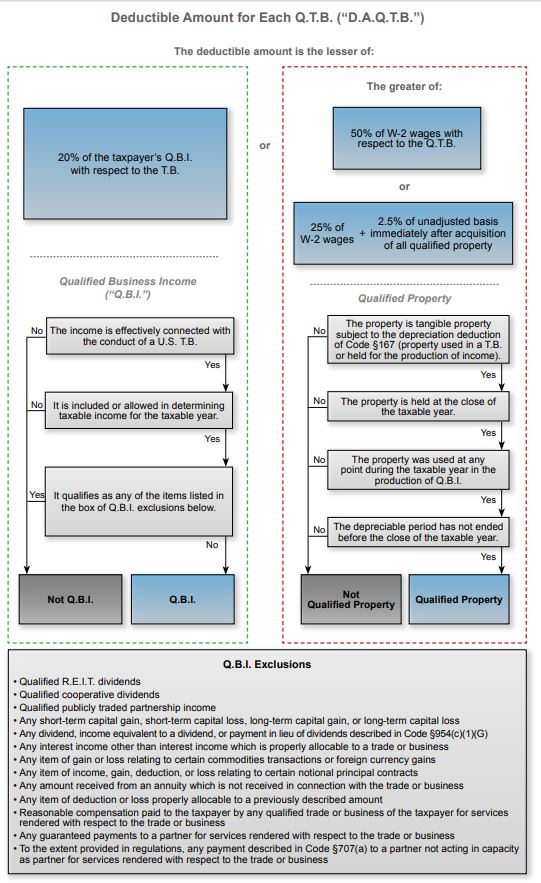

Passive income and qbi. The qualified business income qbi deduction is a tax deduction for pass through entities. Qbi for passive income. Qbi for passive income. If you are interested in affiliate advertising and marketing or constructing an online business generally but do not know where to start after that this new training course freedom breakthrough the affiliate blueprint academy from jonathan montoya is well worth a look.

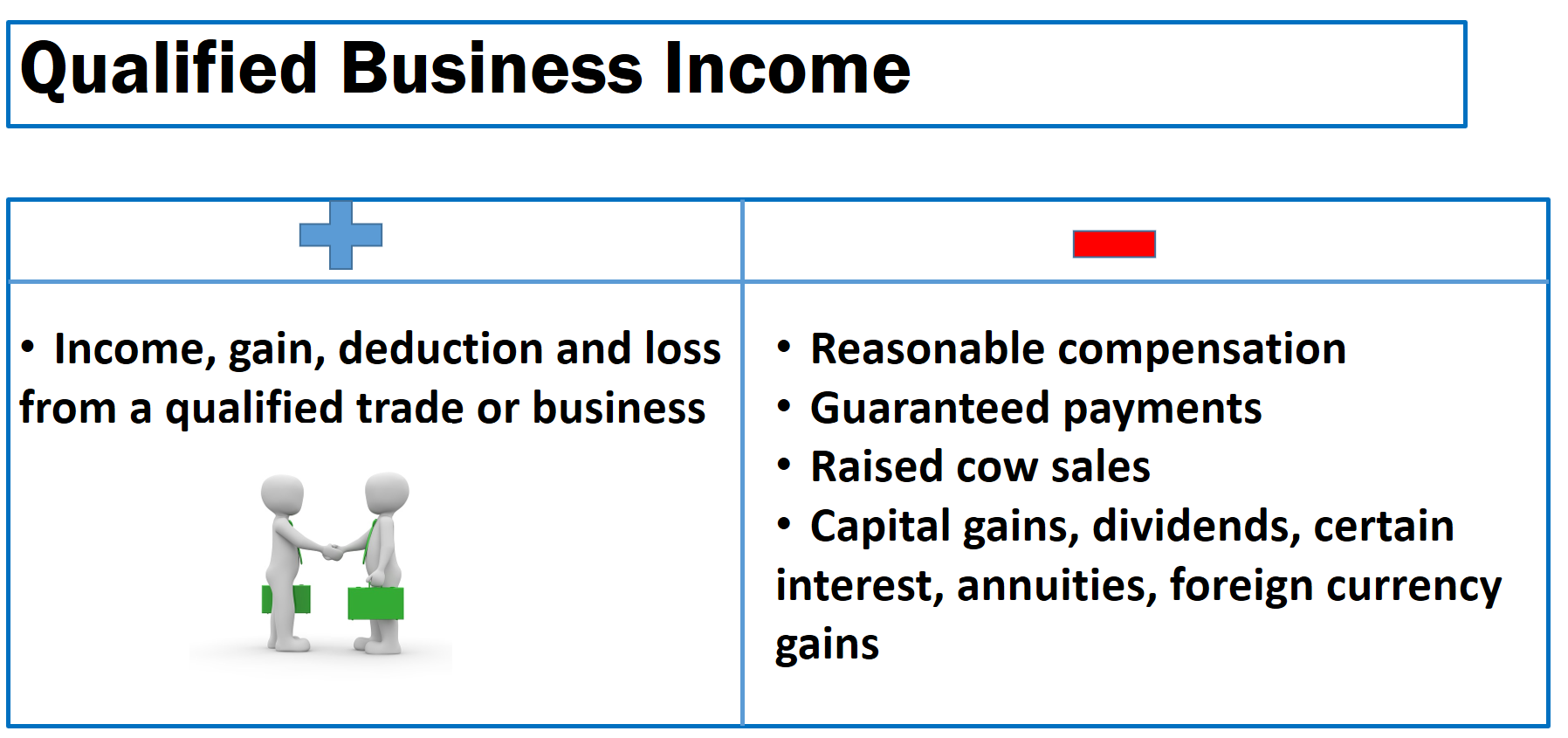

Net passive income recharacterized as nonpassive income from rental of nondepreciable property code 1 equity finance lending activity code 2 or licensing of intangible property code 5 will be treated as. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. Income from these types of rentals is specifically excluded for the purposes of the qbi deduction.

For more information on the recharacterization of passive income see irs publication 925 passive activity and at risk rules.