Passive Income Definition Ato

When ones income covers their cost of living.

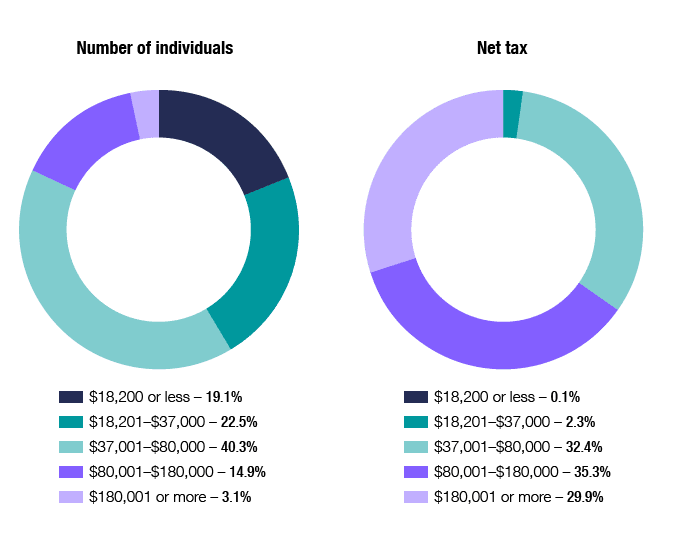

Passive income definition ato. Taxation ruling 2019 1 income tax. Investors are limited in their deduction of passive losses against active sources of income such as wages salaries and pension income. Some jurisdictions taxing authorities such as the internal revenue service in the. The bright line test has no regard for actual activity intention assets or profitability.

01 may 2019 qc 31733. Actually that is the definition of financial independence. Work out whether you re in business for tax and reporting purposes or if your activities are a hobby. Passive income is income that requires little to no effort to earn and maintain.

Passive income loss a special category of income loss derived from passive activities including real estate limited partnerships and other forms of tax advantaged investments. It is called progressive passive income when the earner expends little effort to grow the income. Passive income is the goal for most of us on the path to financial independence. Examples of passive income include rental income and any business activities in which the earner does not materially participate.

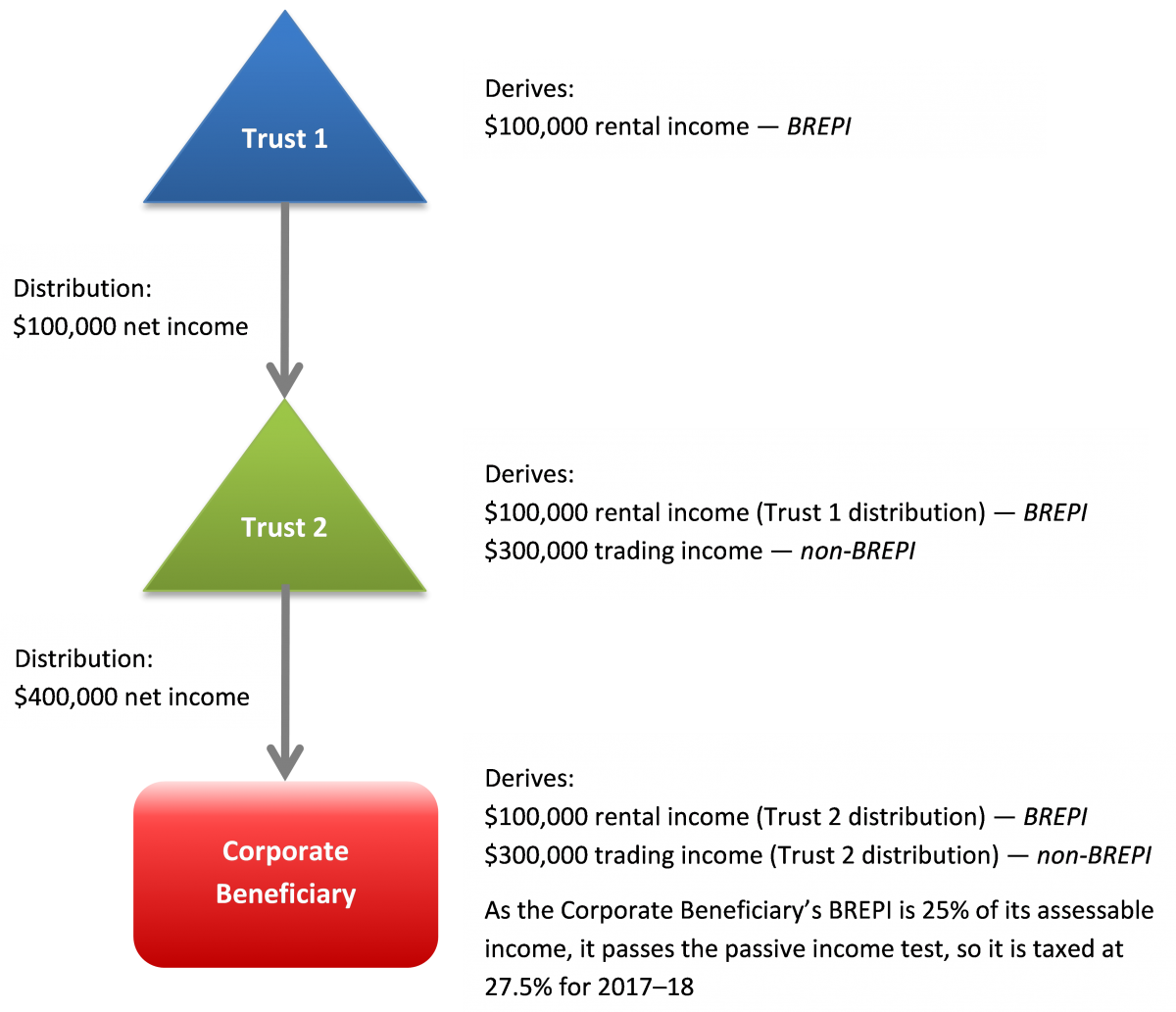

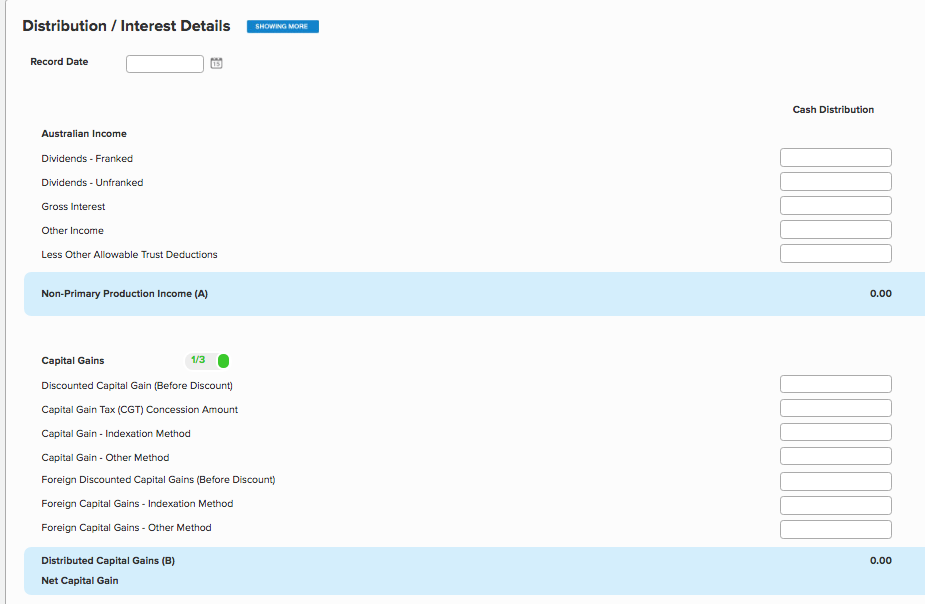

An amount included in the assessable income of a partner in a partnership or a beneficiary of a trust to the extent it is traceable either directly or indirectly to an amount that is otherwise base rate entity passive income. By definition passive income is earnings derived from a rental property in which an investor is not actively involved. When does a company carry on a business. Do you have what it takes to run your own real estate business.

This test deems a company to be passive for a particular income year if more than 80 per cent of its assessable income comprises specific types of passive income. Passive income is earnings derived from a rental property limited partnership or other enterprise in which a person is not actively involved. It allows us to continue living our best life whilst our assets tick away in the background providing us with enough income to cover our cost of living.