Passive Income Limitation S Corp

If the s corporation has accumulated earnings and profits from its days as a c corporation the irs limits its passive income to 25 percent of its gross receipts.

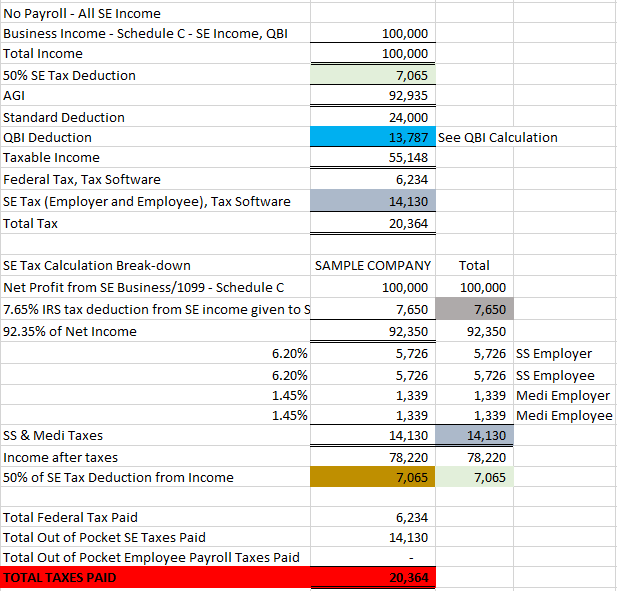

Passive income limitation s corp. This risk occurs when an s corporation has prior accumulated earnings and profits at the close of three consecutive tax years and when passive investment income exceeds 25 of gross receipts see irc section 1362 d 3 a i. According to the record before the court after s corp. The s corporation would have to pay tax on 10 000 or the difference between the total passive income it generated and how much passive income it was permitted to earn without. The excess net passive income tax applies if passive income is more than 25 of the s corporation s gross receipts.

Excess net passive income is a corporate level tax on the passive income earned by an s corporation. And was the guarantor of the loan. For example if an s corporation earns 100 000 in a year 35 000 of which is from passive income the total passive income percentage for the year would be 35 percent. When the shareholder s interest in the passive activity is disposed of in a fully taxable transaction to an unrelated party any suspended passive activity losses attributable to the activity are.

Taxpayer signed the renewal note as president of s corp. All shareholders in an s corporation will receive a schedule k 1. S corporation passive income restrictions. This means it falls somewhere in between but without the medicare and social security tax features.

Passive income includes income from interest dividends annuities rents and royalties. Schedule k 1 is similar to a w 2 or form 1099 int and shows a variety of investment income information related to s. This determination is made at the individual 1040 level so even though section 179 flows through on the business return i e. An s corporation ceases to qualify as an s corporation if it does not meet the criteria in sec.

Remained the named borrower of the renewed loan. Passive losses and credits are carried over to the next year but may only offset passive income or tax attributable to passive activities. When a corporation elects s corporation status one of the primary reasons is the tax benefits it provides. An s corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation.

An s corporation can lose its taxfavored s status if it fails to carefully monitor passive rental income. Was liquidated the operations of the business somehow continued under its former name s corp s loan with bank was somehow renewed and s corp.