Passive Income Tax Rate Alberta

Similar to other provinces alberta has a progressive tax system and you pay more taxes as your income increases.

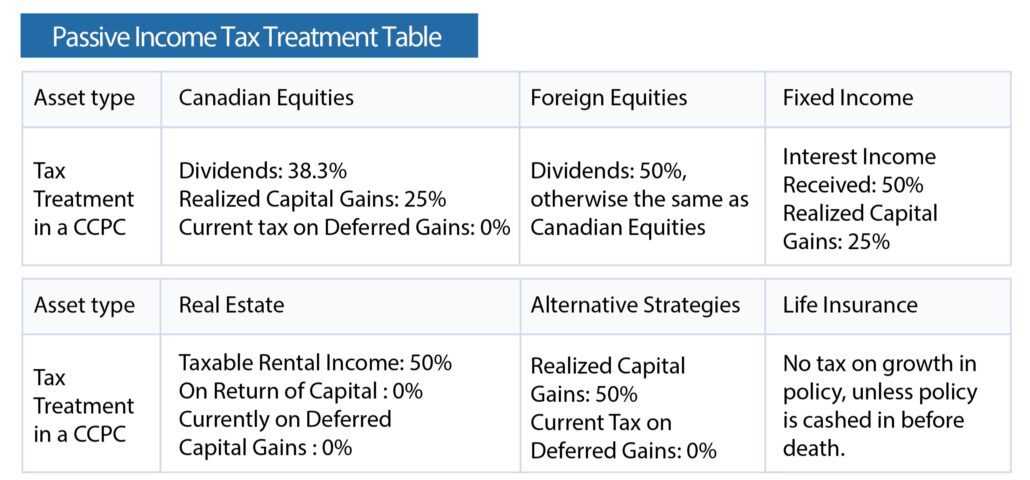

Passive income tax rate alberta. This is frequently higher than the marginal tax rate payable by the individual which reduces the desirability. Alberta s tax rate for personal income ranges from 10 to 15 and the combined federal and provincial tax rate for is between 25 and 48. These new cra passive income changes will first apply to fiscal years that start in 2019 and will reduce the maximum small business deduction available to a ccpc or associated group of ccpcs by 5 for every 1 of passive investment income earned in the previous fiscal year in excess of 50 000. With the exception of inter corporate dividends passive income earned by ccpcs or any corporation in canada is ineligible for deductions and consequently fully taxable at the corporation s combined provincial and federal tax rate.

Assumed average provincial tax rate on this type of income 3. Rental royalties interest income. 0 15 and 20 based on your income bracket. Ontario tax brackets and rates.

The marginal tax rates above have been adjusted to reflect this change. 1 the 2020 federal personal amount is increased from 12 298 to 13 229 for taxpayers with net income of 150 473 or less. Of the 38 67 the ccpc will receive a refundable dividend tax on hand credit rdtoh of 30 67 when a taxable non eligible dividend is paid out to the shareholders. That s an average tax rate of just under 17.

Net tax rate on active business income up to 500 000. Effective tax rate on income eligible for the small business deduction. In total i owed 127 44 as a result of the 752 59 in passive income i earned. To define passive business income determine net income by using allowable deductions and apply appropriate aish exemptions.

Long term passive income tax rates long term capital gains assets held for more than one year are taxed at three rates. This results in a net corporate tax of 8. I find it interesting that i paid the most tax on the savings account interest. Below is a summary table showing how much i earned from each passive income stream and the tax for each.

Assured income for the severely handicapped general regulation sections 2 01 1 c. And schedule 1 1 section 1 and table 2 ministerial order 2020 017 canada emergency response benefit. For incomes above this threshold the additional amount of 931 is reduced until it becomes zero at net income of 214 368. The combined general corporate income tax rate will be 27 percent 15 percent federal tax plus 12 percent alberta tax.

These types of passive investment income earned inside a ccpc are part i tax and will be taxed at a federal rate of 38 67.