Passive Income Tax Rate Australia

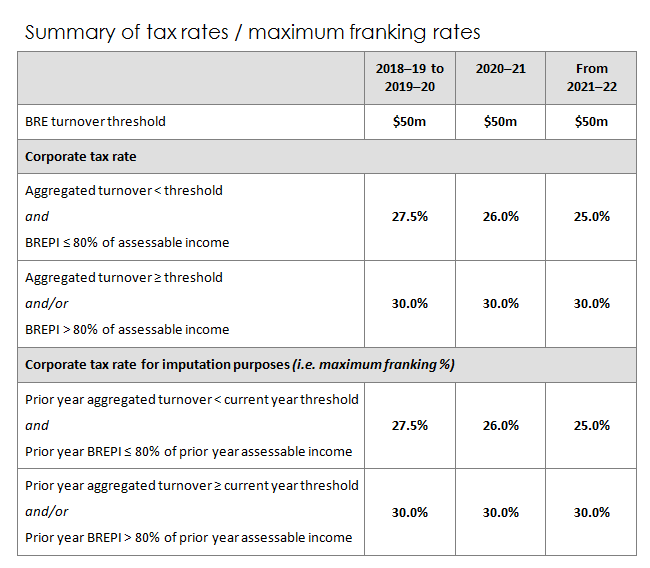

The reduced tax rate applies only to those companies that together with certain connected entities fall below the aggregated turnover threshold of aud 50 million aud 25 million for the 2017 18 income year.

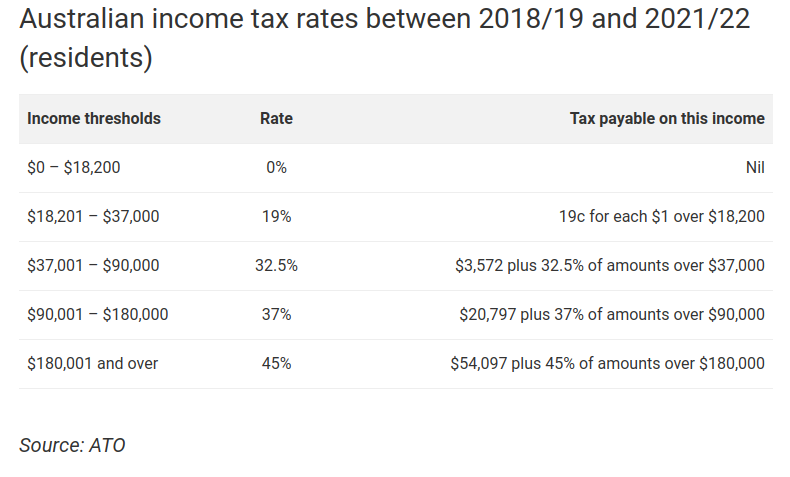

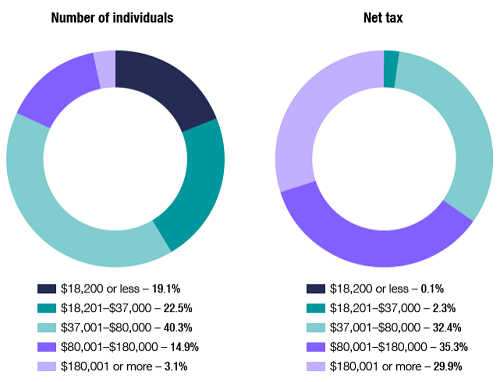

Passive income tax rate australia. Rate the corporate tax rate generally is 30. 19 cents for each 1 over 18 200. Individual income tax rates in australia. The current tax rates for short term gains are as follows.

Here are 22 passive income ideas that could help you on your way toward financial independence. Resident tax rates 2020 21. 10 12 22 24 32 35 and 37. Your aggregated turnover in the 2016 17 income year was less than 25 million and 80 or less of your assessable income was base rate entity passive income.

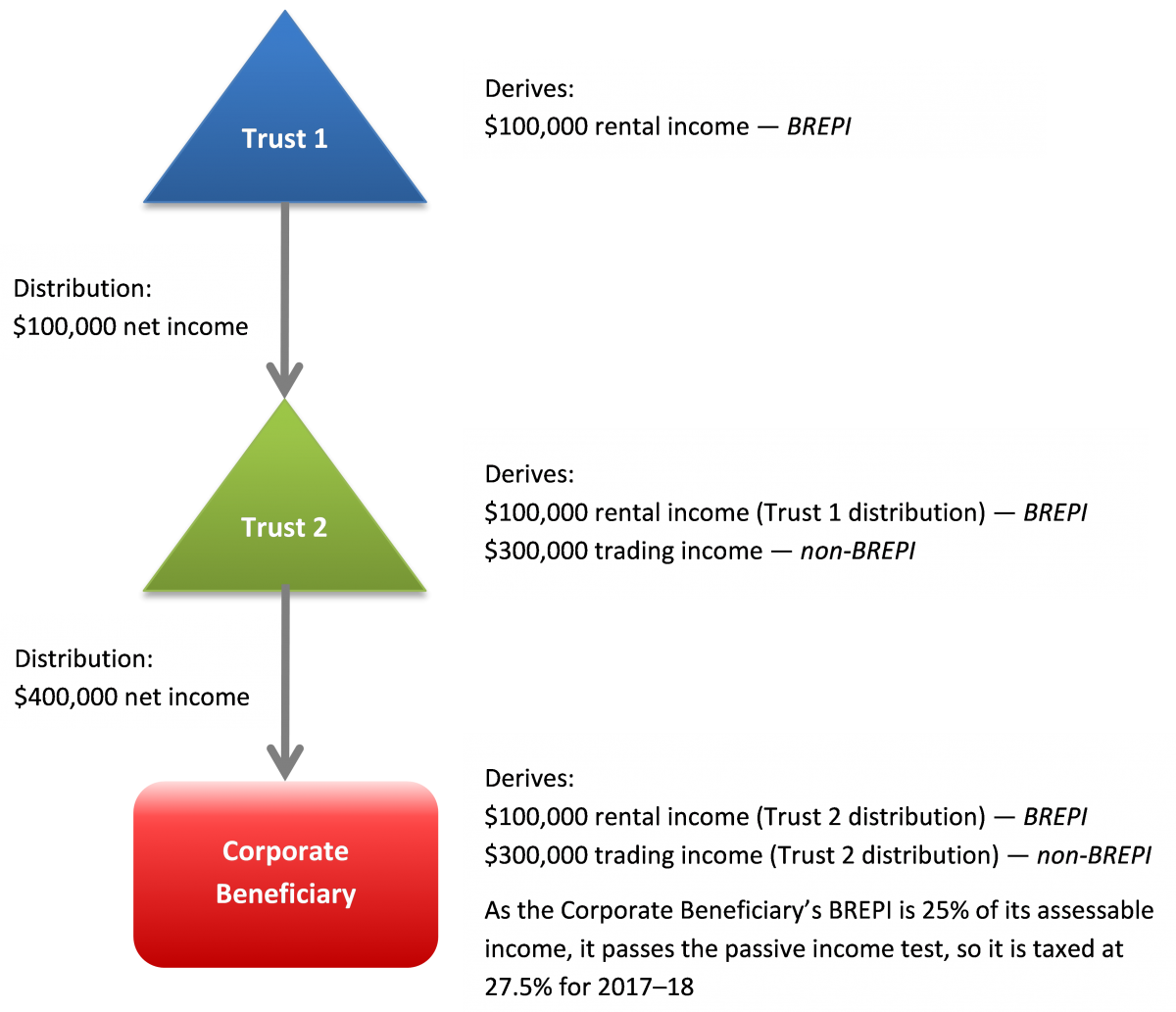

However for companies with an aggregate annual turnover of less than aud 50 million and that derive no more than 80 of their assessable income from base rate entity passive income the tax rate is 26 for the 2020 21 income year reduced from 27 5. Find the latest income tax rates set by the ato. The federal government has recently introduced a bill into parliament to ensure that companies with more than 80 passive income will not qualify for the reduced 27 5 company tax rate otherwise available to companies that carry on a business and have an aggregated turnover below the prescribed relevant threshold 25 million for 2017 2018. For the 2017 18 income year your corporate tax rate for imputation purposes is 27 5 if either.

Passive income tax rate for 2017 for 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. Paying tax on passive income from etf and lics in australia. In other words short term capital gains are taxed at the same rate as your income tax.

Short term passive income tax rates as mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. Tax on this income. For the 2018 19 income year this threshold has been increased to 50 million. All companies are subject to a federal tax rate of 30 on their taxable income except for small business companies which are subject to a reduced tax rate of 27 5 up to and including the 2019 20 income year.