Passive Income Tax Rate Philippines

So below are easy passive income every pinoy must know and start right away.

Passive income tax rate philippines. T special aliens do not file a regular income tax return on their compensation income. Tax rate the corporate income tax rate for both resident and non resident companies is 30 except for certain items of passive income which may be taxable at a different rate. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. Let s say you won php 1 million in the lotto.

They require only two things. Income tax rates in the philippines. F nra netb and nrfc are subject to final tax only to passive income from sources in the philippines. Minimum corporate income tax mcit on gross income beginning in the fourth taxable year following the year of commencement of business operations.

Cit rate in general on net income from all sources. For local and foreign taxpayers living in the philippines here s the bir tax table showing the tax rates on passive income. What s more they re either managed or regulated by the philippine government. Time and good cash flow.

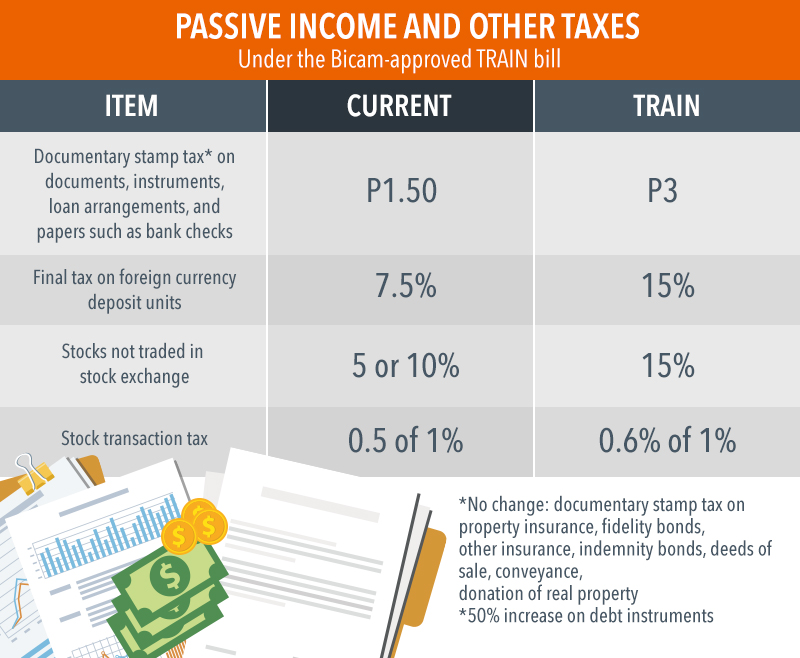

Yes the lowly savings account is the easiest passive income anyone can find. How to compute your income tax based on graduated rates. F the final tax on interest on tax free corporate covenant bonds applies only to resident individual or corporate taxpayers. Interests from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements.

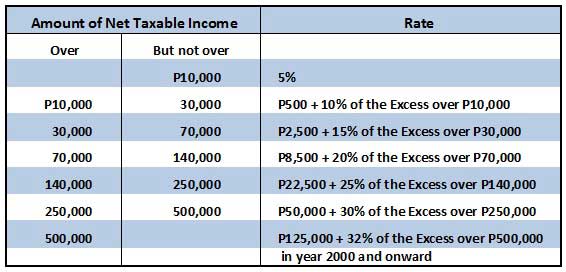

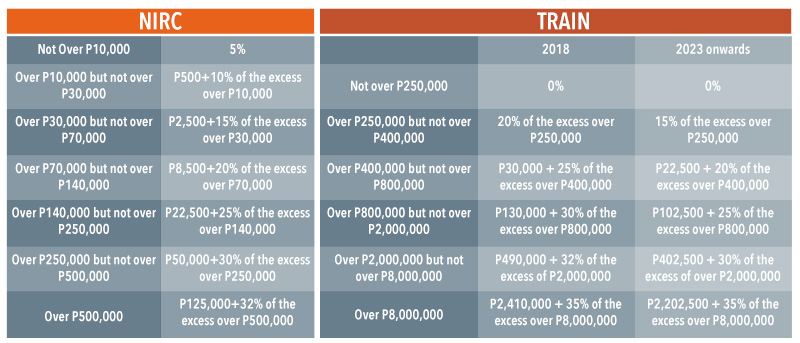

Interest from currency deposits trust funds deposit substitutes and similar arrangements received by domestic corporations. Royalties from sources within the philippines. Sample income tax computation for the taxable year 2020. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000.

Interest income from a depository bank under expanded foreign currency deposit system. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. The tax rate of 20 on prizes over php 10 000 is automatically deducted before you receive it. Those earning annual incomes between p400 000 and p800 000 will pay a fixed amount of p30 000 plus 25 of the excess over p400 000.

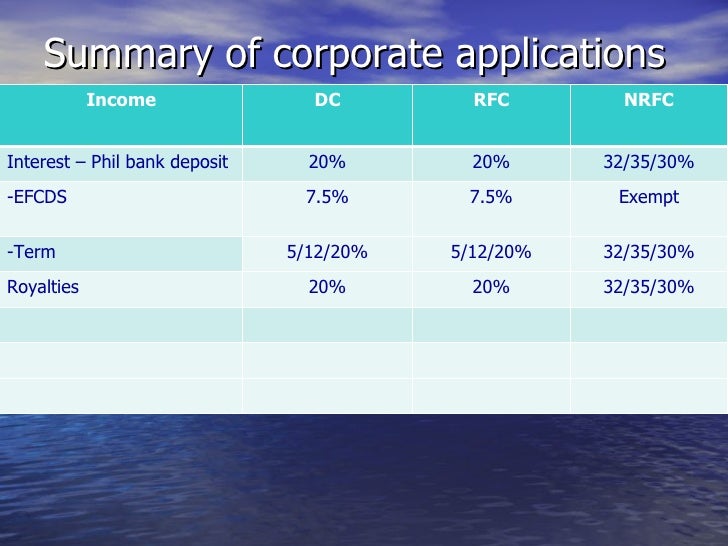

Mcit is imposed where the cit at 30 is less than 2 mcit on gross income. Graduated income tax rates for january 1 2023 and onwards. Before you claim your prize you can compute how much tax is deducted from it. Rates of tax on certain passive income of corporations.

Graduated income tax rates until december 31 2022.