Passive Income Tax Rate Train Law

The current tax rates for short term gains are as follows.

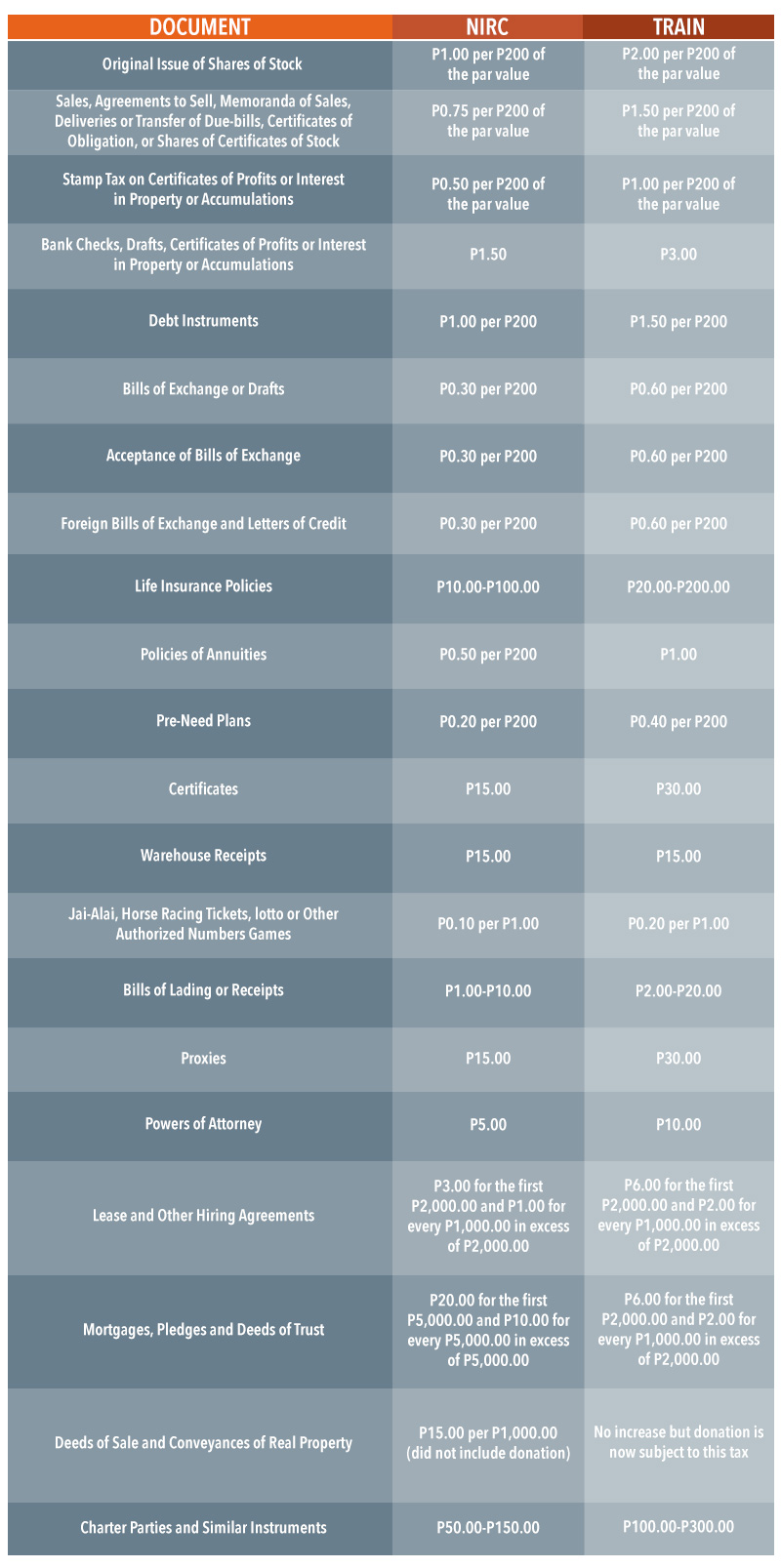

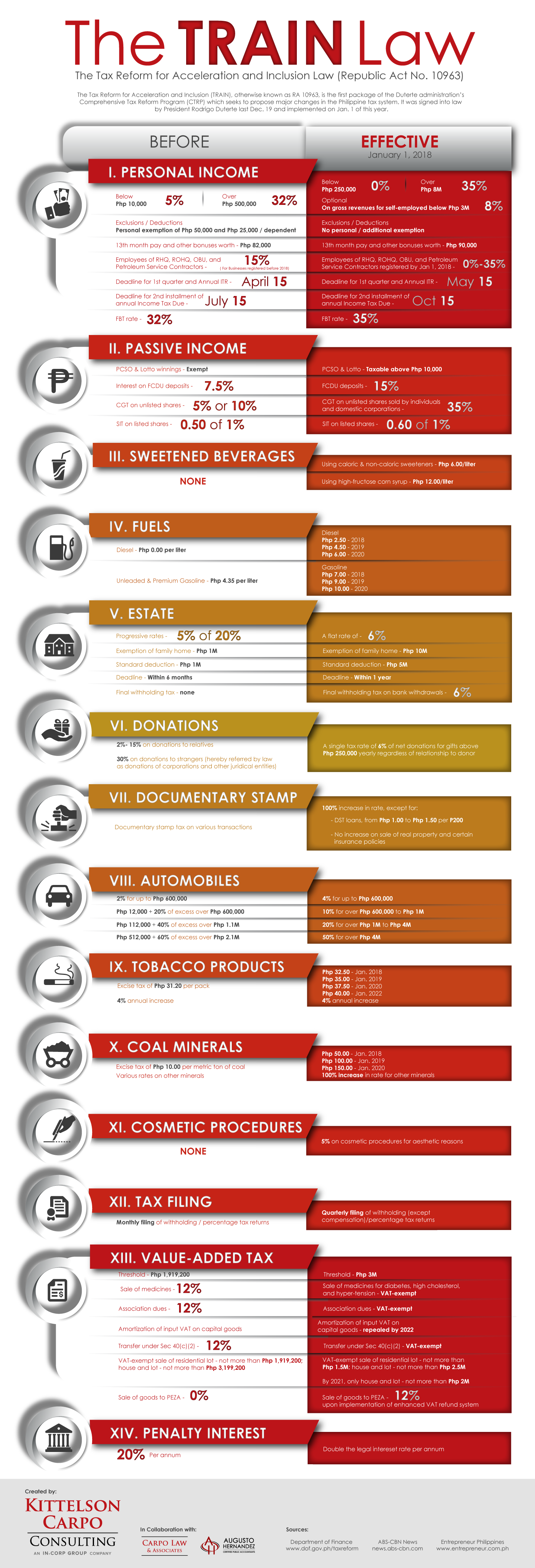

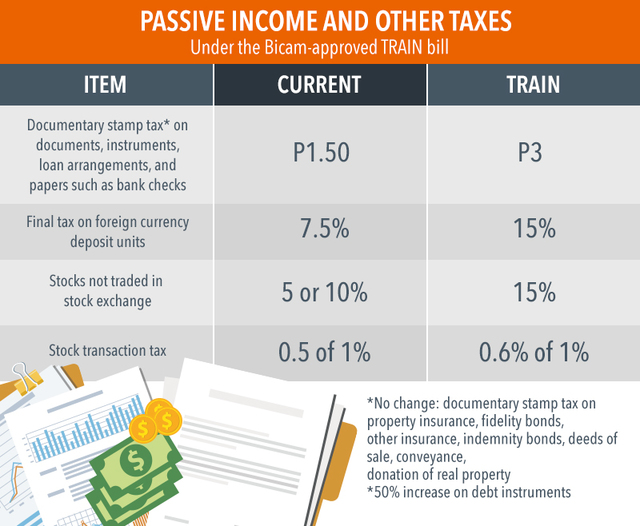

Passive income tax rate train law. The newly approved train tax reform law also adjusted the tax rates on certain passive income in addition to revised personal income tax rates and new taxes imposed on oil sugary beverages tobacco mining etc. Previously the effective income tax rate charged to this taxpayer was 3 33. Short term passive income tax rates. This is because the train tax rates were reduced even further from 2023 onwards.

Employee with a gross monthly salary of php 30 000 and receiving 13th month pay of the same amount. Income tax due taxable income gross income allowable deductions x tax rate tax withheld sample income tax computation for the taxable year 2020. Certain passive income final withholding tax interest income from local cdu short term. From 2023 onwards the new effective income tax rate paying p7 500 income tax on p300 000 annual income is down to just 2 5.

How about the employee making p1 million a year. In other words short term capital gains are taxed at the same rate as your income tax. 10 12 22 24 32 35 and 37. 8 2018 which discusses the income tax provisions of the train law.