Qbi On Passive Income

Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another.

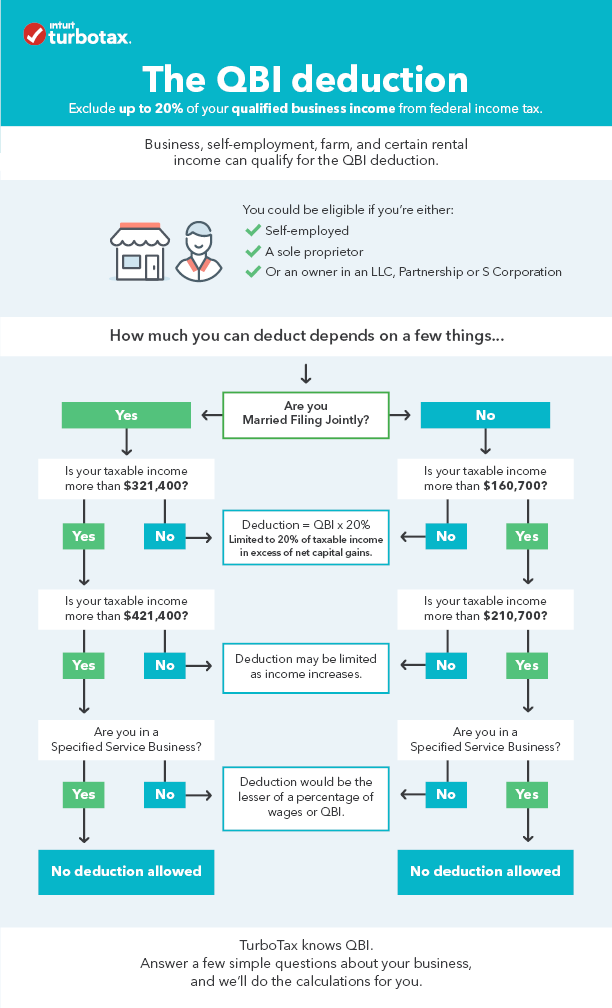

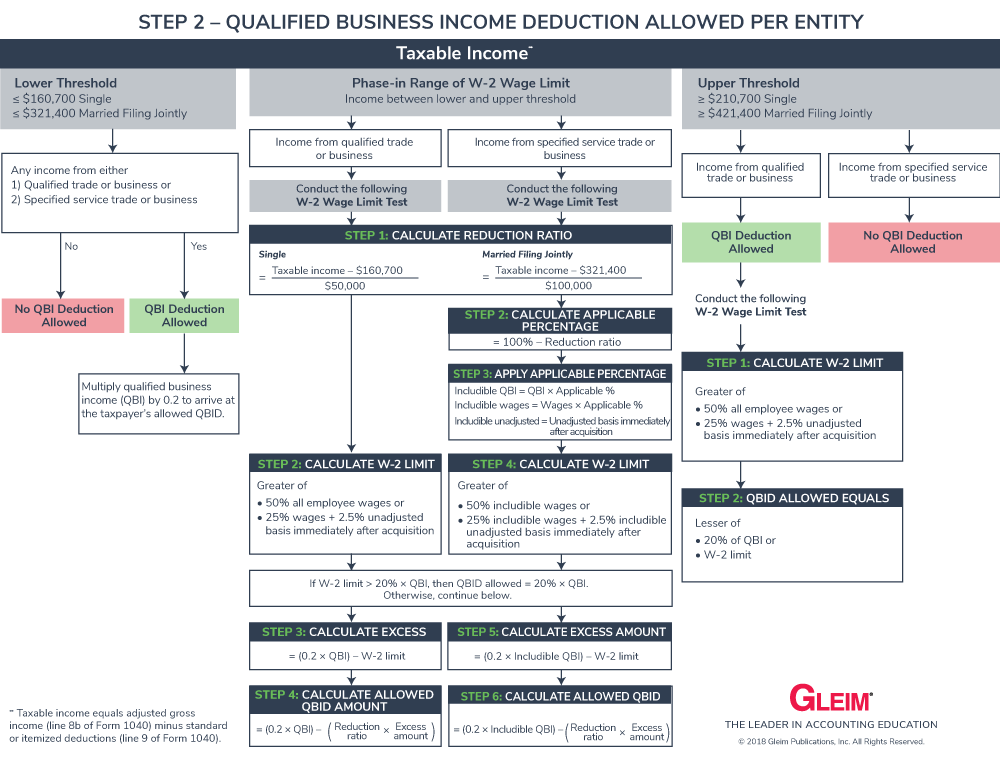

Qbi on passive income. When doing tax planning for 2019 it is important to make sure qbi is not inadvertently lowered by used disallowed losses from before 2018 and to review calculations made by the software to ensure they. However it does not include any qualified reit dividends or qualified ptp income. The tax cuts and jobs act tcja added a new tax deduction for owners of pass through entities a 20 deduction of qualified business income qbi from a qualified trade or business. In example 1 qbi would equal the full 35 000 in 2019.

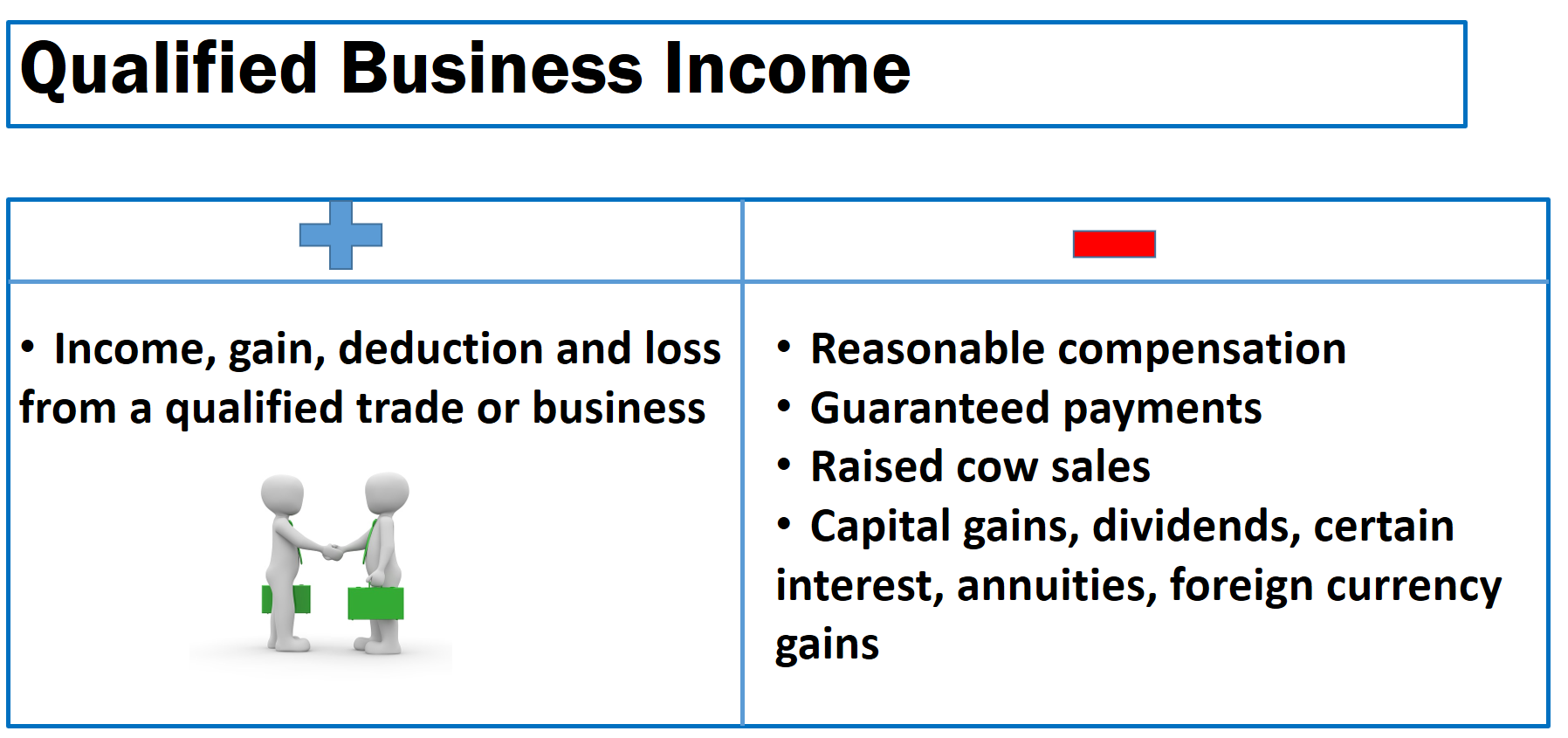

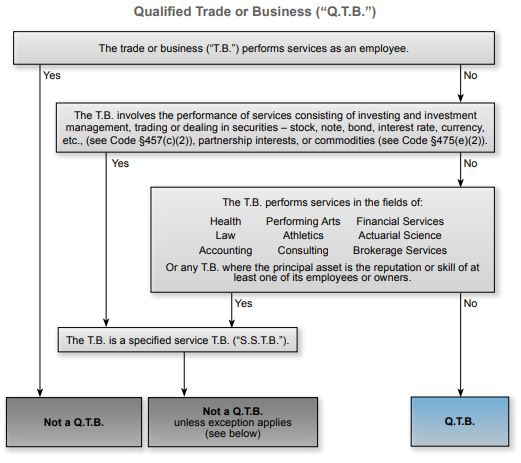

This new provision may potentially lower the maximum individual tax rate of 37 on pass through income to 29 8 which makes it more comparable to the new c corporation tax rate of 21. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi. Qualified business income or qbi is the net income generated by any qualified trade or business under internal revenue code irc 162. Qbi for passive income.

The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year. If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction in the following year irc sec. The qbi deduction offers a way to lower the effective tax rate on the profits of owners of pass through entities trade or business where the income passes through to the owner s individual tax return. Qualified business income qbi is essentially your share of profits from the business.

Starting in 2018 individuals may be able to claim a qualified business income qbi deduction of as much as 20 of the income passing through from partnerships limited liability companies llcs s corporations and sole proprietorships. Rental properties are usually treated as passive activities and passive activities are excluded from the definition of a qualified trade or business. But more specifically it is the net amount of income gain deduction and loss from your business. The full qbi deduction is worth the lesser of 20 of your qualified business income plus 20 of your qualified reit dividends and qualified ptp income or 20 of your taxable income minus your net capital gain the exact value of your deduction depends on how much income you have.

If you are interested in affiliate advertising and marketing or constructing an online business generally but do not know where to start after that this new training course freedom breakthrough the affiliate blueprint academy from jonathan montoya is well worth a look. It drastically cut the corporate tax rate but it also introduced the qualified business income qbi deduction. Qbi for passive income. The qbi deduction will expire after 2025 without further congressional action.