Tax Rate For Passive Income In Canada

0 15 and 20 based on your income bracket.

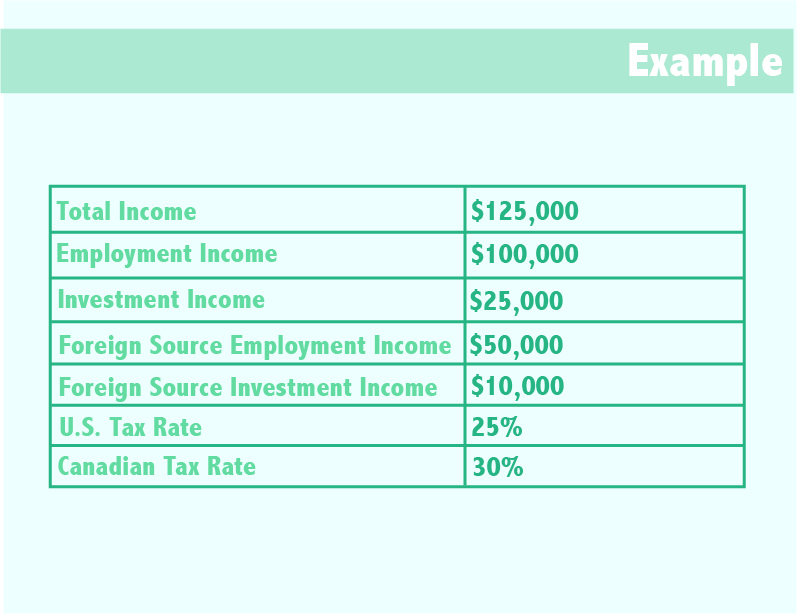

Tax rate for passive income in canada. The 2018 federal budget saw the introduction of a set of new passive income rules in canada to restrict the small business deduction for ccpcs that alone or as part of an associated group earn more than 50 000 of passive investment income. At 150 000 of passive income none of the active business income will qualify for the small business tax rate. Passive income tax rate for 2017 for 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. With the exception of inter corporate dividends passive income earned by ccpcs or any corporation in canada is ineligible for deductions and consequently fully taxable at the corporation s combined provincial and federal tax rate.

As outlined the effective tax rate on passive income is 50 7 while dividend income is taxed at 38 3. However a portion of the federal tax on passive and dividend income is refundable when a taxable dividend is paid to a corporation s shareholder. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. Long term passive income tax rates long term capital gains assets held for more than one year are taxed at three rates.

This is a federal calculation only as the provinces do not have a refundable component. These types of passive investment income earned inside a ccpc are part i tax and will be taxed at a federal rate of 38 67. This uses a projected top marginal tax rate on eligible dividends received by an individual in 2019 of 31 71 percent and similarly a top marginal tax rate on non eligible dividends of 42 56 percent. Since 2009 a ccpc using the sbd could claim the small business tax rate on the first 500 000 of its active business income carried on in canada representing a fairly substantial reduction in tax.

Of the 38 67 the ccpc will receive a refundable dividend tax on hand credit rdtoh of 30 67 when a taxable non eligible dividend is paid out to the shareholders. When you are caught up in the hustle and bustle of your 9 5 job i e. This is frequently higher than the marginal tax rate payable by the individual which reduces the desirability. This assumes that 500 000 of income is taxed at corporate tax rates and then paid out to the shareholders as a taxable dividend.

I must confess but often when i lay awake at night it s because my mind is continually racing to figure out how to earn enough passive income so i can free up my time to do other things. This has a dramatic effect on the amount of tax on that 500 000. For this ccpc 150 000 of passive investment income results in 135 500 of tax on active business income at the combined corporate tax rate of 27.