Taxable Income Brackets Kenya

Fringe benefits are taxable to the employee at either actual or deemed cost.

Taxable income brackets kenya. Income tax rates for employment income in kenya are graduated rates from ten per cent 10 to the highest being thirty per cent 30. Taxable income income tax is imposed on all income accruing in or derived from kenya. Residents are also taxed on any other income that has accrued in or is derived from kenya. Income tax rates and thresholds annual tax rate taxable income threshold.

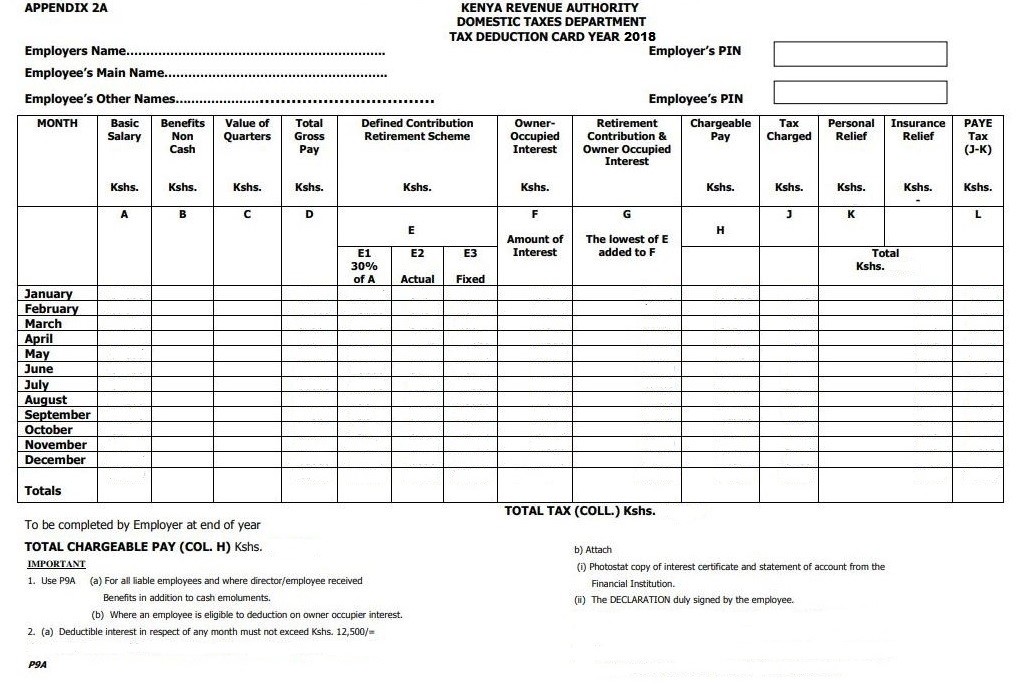

Ksh12 196 80 plus ksh17 236 80 tax on taxable income of ksh114 912. Personal income tax rates. 16 896 per annum kshs 1 408 per month. This act revised the tax rates and increased personal relief from ksh.

For taxable income under ksh121 968. The new rates took effect in january 2017. Kra paye new rates 2020 in kenya income tax brackets. Effective 25 april 2020 the tax rates applicable to taxable income are tabulated as follows.

Annual income tax brackets. Personal relief of kshs. Any amount paid to non resident individuals in respect of any employment with or services rendered to an employer who is resident in kenya or to a permanent establishment in kenya is subject to income tax charged at the prevailing individual income tax rates. Employment income in their kenya taxable income.

Tax on taxable income. Ksh12 196 80 on taxable income of ksh121 968. For taxable income from ksh236 881 but under ksh351 792. Employment income is defined broadly and includes amounts paid outside kenya.

The minimum taxable income comes from the lowest earners kes 12 298 and below who pay a tax rate of 10 while the highest band from kes 47 059 and above give 30. Kenya residents income tax tables in 2019. This is a change from the kenyan income tax brackets in 2016 and earlier. For taxable income from ksh121 968 but under ksh236 880.

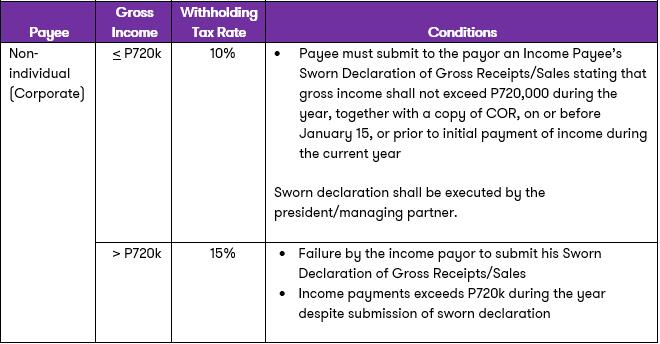

Non resident employees are taxable only on their income earned from within kenya or derived from kenya. Income tax rates for individual taxpayers persons who transact business in kenya as individuals sole proprietorships or partners must account for their individual income tax. In the new structure kra had widened the tax bands. This is a form of income tax that is levied on corporate bodies such as limited companies trusts and co operatives on their annual income.

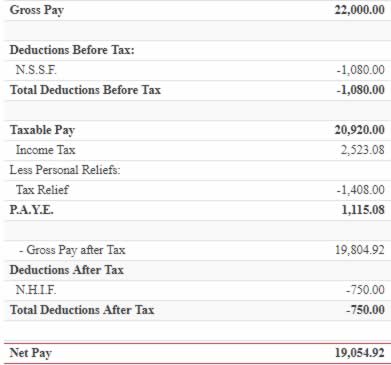

Kenya paye calculator with income tax rates of april 2020 calculate kra paye deductions salary net pay personal relief nhif and nssf contributions. Taxation for non resident s employment income.