Example Of Income Capitalization Approach

The owner requires an 8 return.

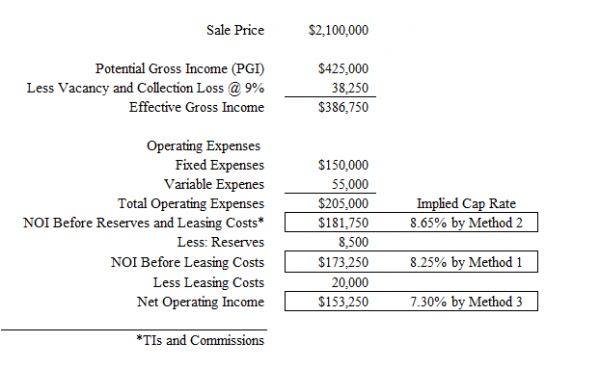

Example of income capitalization approach. By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building. In order to estimate the subject property value using the income approach the first step is to create a proforma cash flow statement for the anticipated holding period. In essence it focuses on the income the investment property produces. Income capitalization approach as we have mentioned is one of the three main methods used by real estate appraisers and real estate investors to estimate the value of an investment property.

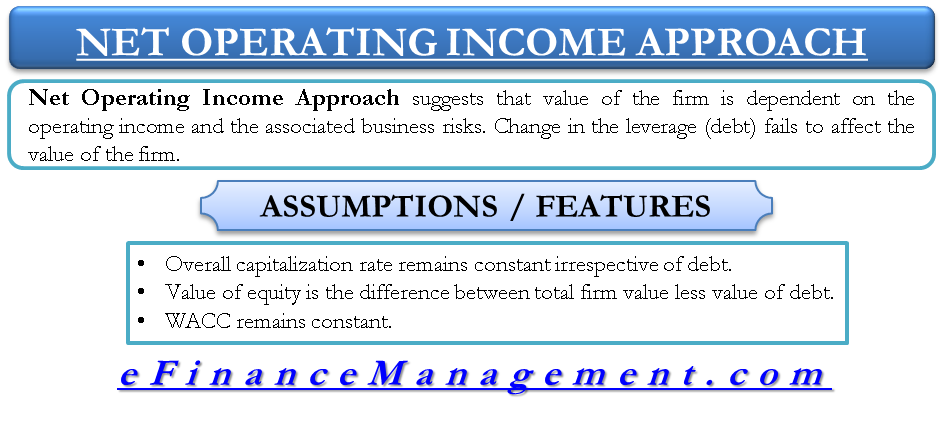

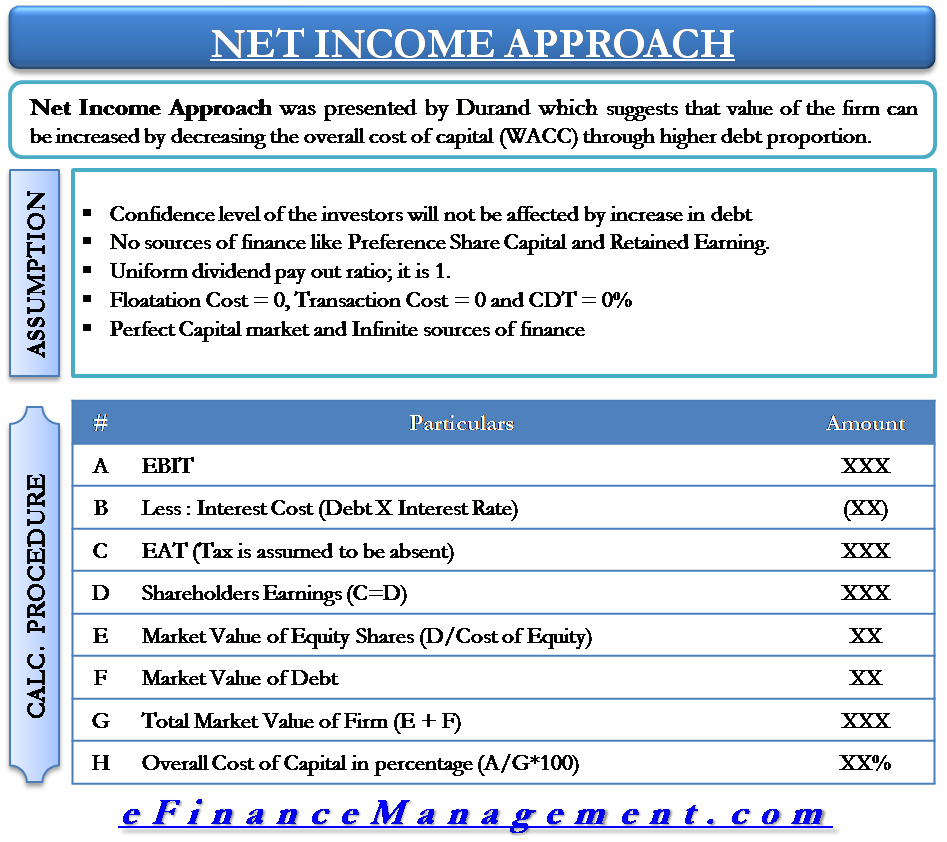

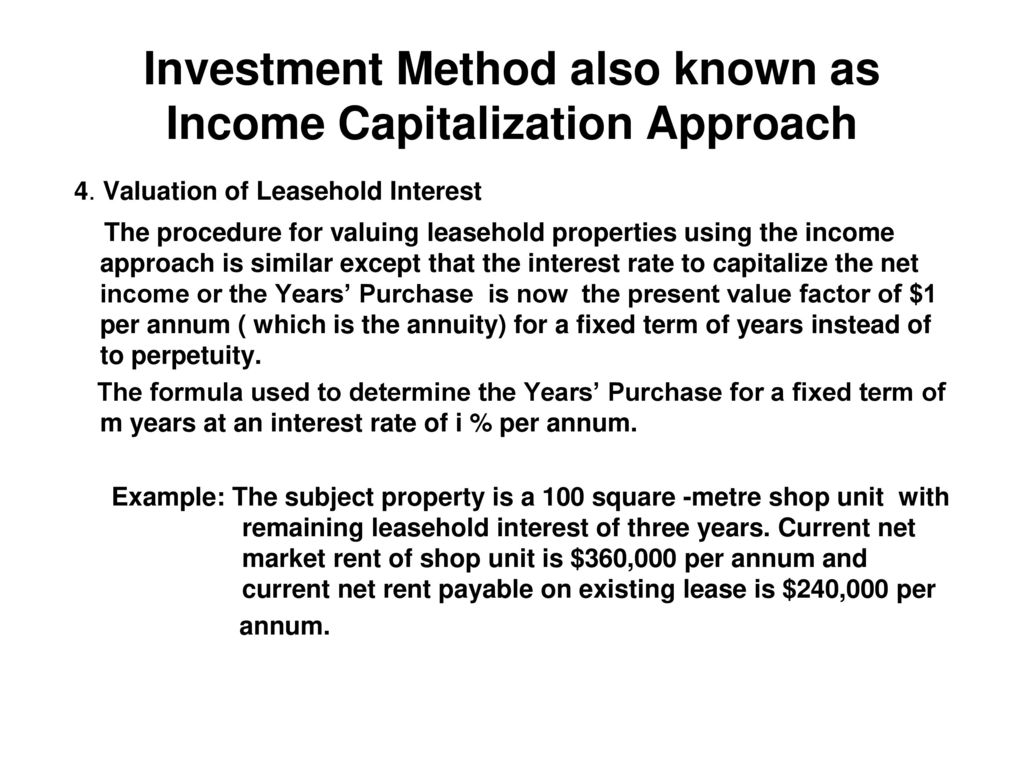

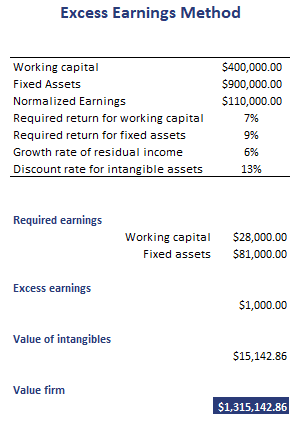

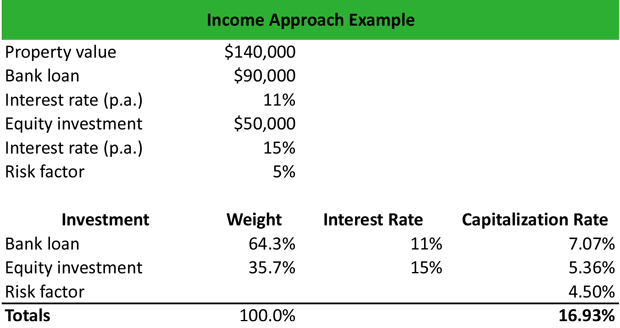

Net income per annum 100 yp in perpetuity at 8 1 1 12 5 i 0 08 capital value 1250 if the stream of income in receivable for 25 years only then the. Income capitalization approach example. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. These methods are used to value a company based on the amount of income the company is expected to generate in the future.

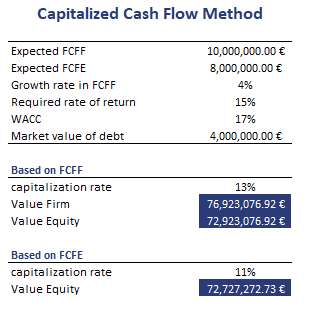

In discussing the offer they have requested a presentation by the company s cfo. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. Capitalization of earnings example. There are two income based approaches that are primarily used when valuing a business the capitalization of cash flow method and the discounted cash flow method.

You can use the numbers from the previous examples to calculate the value. He is asked to calculate the capitalization rate of a real estate investment for a client using the income approach valuation method and determine the property s present value. This is an income valuation approach that determines the value of a business by looking at the current cash flow the annual rate of return. What is the capital value of 100 per annum receivable in perpetuity.

Under the capitalization of earnings approach no growth in cash flows is considered. Therefore it is a way of turning the property s income into value. Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000. Using the following market assumptions let s estimate the cash flows to the owner over a five year holding period.

Is company engaged in real estate management. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies lower risk while a low capitalization rate implies higher risk. In december 2016 the company s board of directors has received a takeover offer.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)