In The Income Capitalization Approach To Value Annual Operating Expenses Are

Effective gross income total operating expenses capital expenditures reserve net operating income.

In the income capitalization approach to value annual operating expenses are. You can use the numbers from the previous examples to calculate the value. To determine her property s annual net operating income noelle must. The income capitalization approach formula is market value net operating income capitalization. Income operating expenses gross annual income gai.

To that add non rental income to determine annual gross income and then subtract annual operating expenses not to include debt service or mortgage payments to determine noi. The income capitalization approach to appraisal. This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market. Income approach example using yield capitalization.

The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies lower risk while a low capitalization rate implies higher risk. In order to estimate the subject property value using the income approach the first step is to create a proforma cash flow statement for the anticipated holding period. Net operating income.

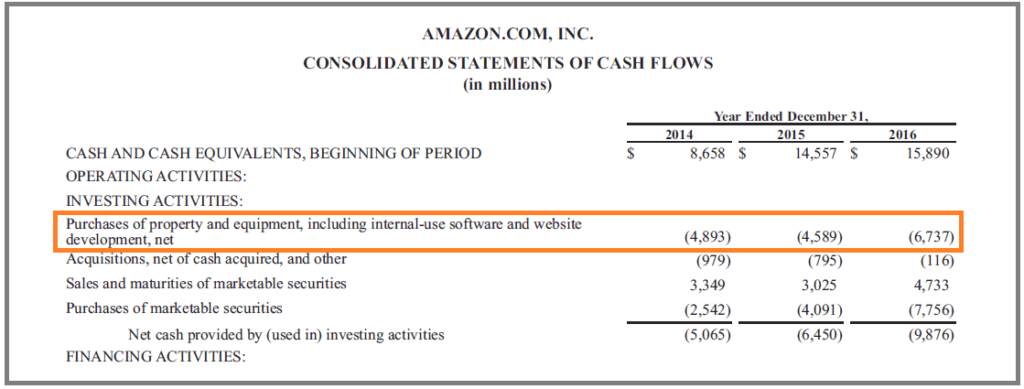

Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000. Estimated capitalization rate value by income approach 270 000. Adding the land value to the value of the improvements results in a total property value estimate of 2 535 000. Using the income capitalization approach first estimate potential annual gross income and subtract the vacancy allowance and collection losses.

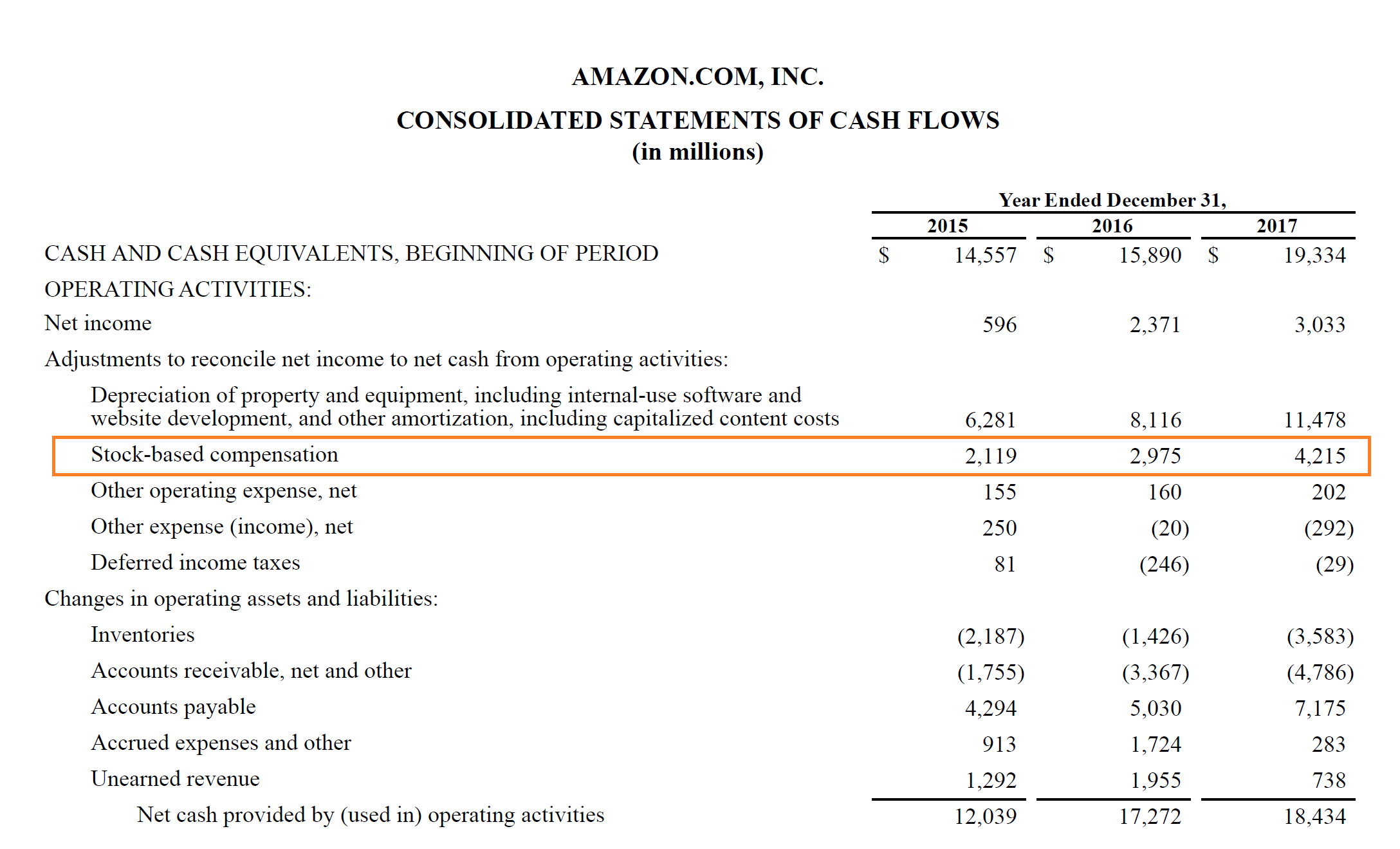

By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building. Operating income also referred to as operating profit or earnings before interest taxes ebit is the amount of revenue left after deducting operational direct and indirect costs. The income capitalization approach or income approach is more specifically used for appraising. Interest expense interest income and other non operational revenue sources are not considered in computing operating income.

Subtract the operating expenses from the effective gross income. Annual net operating income capitalization rate market value.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)