Income Brackets Tax Australia

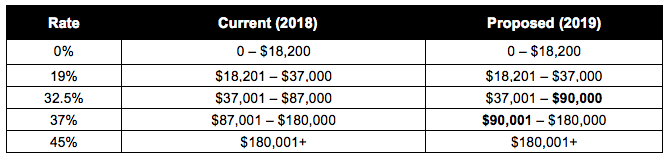

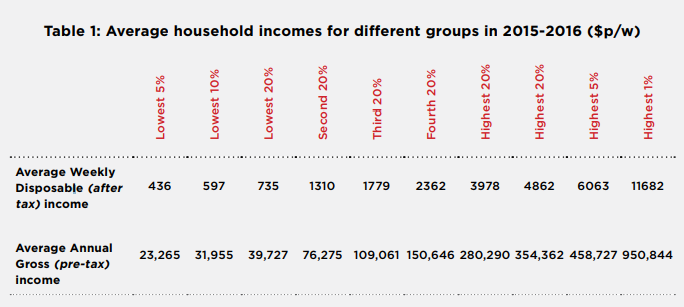

The above table illustrates the income brackets in australia and the percentage rate at which each is taxed.

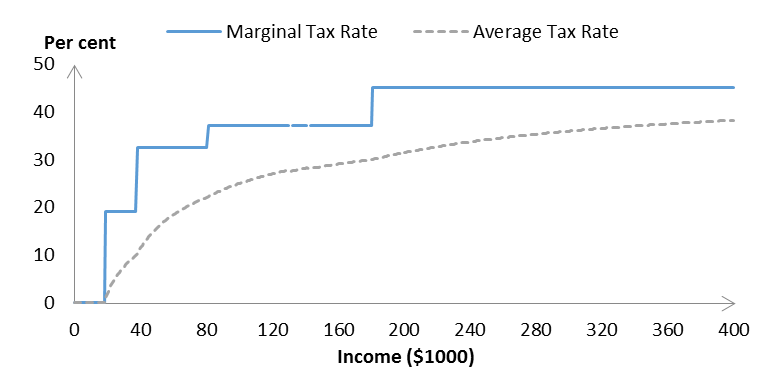

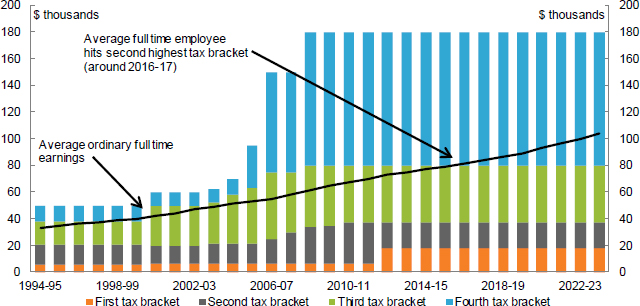

Income brackets tax australia. Once you re earning over 18 201 you already have to start paying a high tax rate of 19. If you earn money in australia you ll most likely have to pay income tax. Tax brackets in australia are set by the federal government and the australian tax office ato. The specific bracket depends on their taxable income for the financial year.

Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you need. 19c for each 1 over 18 200. They determine the rate of tax that each australian taxpayer pays based on their annual income. Tax on this income.

Any amount earning below this is included in the ato s tax free threshold. Tax rates and codes you can find our most popular tax rates and codes listed here or refine your search options below. In addition to the above rates a medicare levy is deducted at 2 0 percent of your taxable income. 3 572 plus 32 5c for each 1 over 37 000.

The tax free threshold is 18 200 so if you earn anything below that you won t be required to pay income tax. For australian residents the tax free threshold is currently 18 200 meaning the first 18 200 of your income is tax free but you are taxed progressively on income above that amount. Total tax levied on 50 000 31 897. Tax on this income.

If you have a low income you may pay a reduced levy or be. 32 5c for each 1. This rockets up by over 13 as soon as you reach 37 001. State governments have not imposed income taxes since world war ii on individuals income tax is levied at progressive rates and at one of two rates for corporations the income of partnerships and trusts is not taxed directly but is taxed on its distribution to the partners or.

Resident tax rates 2019 20. Tax file number tfn you can register for tax online when you arrive in australia by following this link to get a tax file number. Income tax in australia is imposed by the federal government on the taxable income of individuals and corporations. 54 097 plus 45c for each 1 over 180 000.

But this still pales in comparison to the highest tax bracket of 180 000 at 45. 20 797 plus 37c for each 1 over 90 000. 62 550 plus 45c for each 1 over 180 000. 29 250 plus 37c for each 1 over 90 000.

The tax free schedule is due to stay at 18 200 until at least 2024 25. Australian tax brackets the amount of tax you ll pay is directly related to your income. The following tax rates apply to taxable income derived by a foreign resident in the period 1 july 2019 to 30 june 2020.