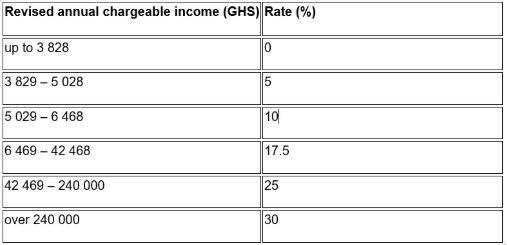

Income Tax Brackets Zimbabwe

The personal income tax rate in zimbabwe stands at 24 72 percent.

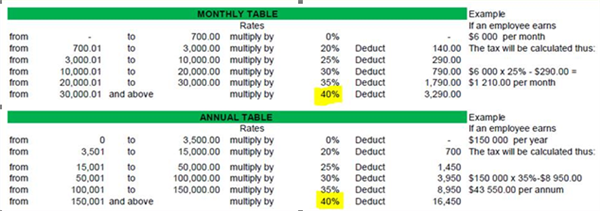

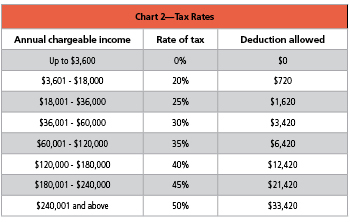

Income tax brackets zimbabwe. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020. Will a non resident of zimbabwe who as part of their employment within a group company is also appointed as a statutory director i e. 35 760 35 for each usd above 120 001. Taxable rate amount cumulative income income band of tax within band tax liability.

6 001 12 000 00 25 696. Income tax rates deduction. Rates of tax usd 0 to 4 200. Tax rates individuals employment income year ended 31 december 2017.

1 981 6 000 00 20 396. This page provides zimbabwe personal income tax rate actual values. Please click here for updated tax tables. The tax brackets below have changed.

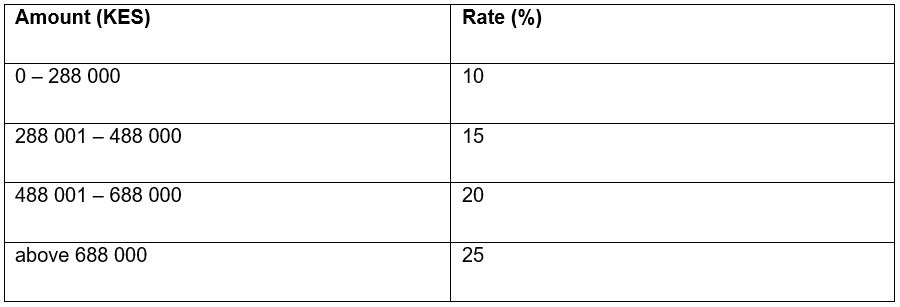

What categories are subject to income tax in general situations. The following tax rates and allowances are to be used when answering the questions. Income of company or trust. Calculate your take home pay in zimbabwe that s your salary after tax with the zimbabwe salary calculator.

Choose a specific income tax year to see the zimbabwe income tax rates and personal allowances used in the associated income tax calculator for the same tax year. Sunday september 13 2020 newsdzezimbabwe 0 treasury has unveiled foreign currency denominated income tax bands that will see the tax free threshold pegged at us 350 while the highest bracket will. Zimbabwe personal income tax. 17 660 30 for each usd above 60 001.

Income of pension fund from trade or investment. Review the latest income tax rates thresholds and personal allowances in zimbabwe which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in zimbabwe. Aug dec 2020 tax tables usd pdf. Tax rates and allowances.

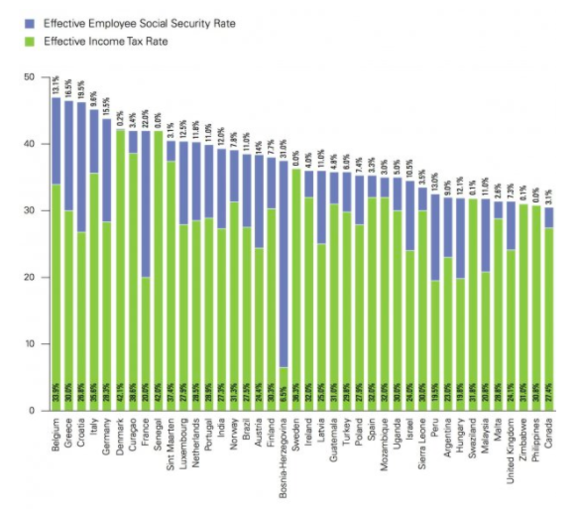

A quick and efficient way to compare salaries in zimbabwe review income tax deductions for income in zimbabwe and estimate your tax returns for your salary in zimbabwe the zimbabwe tax calculator is a diverse tool and we may refer to it as the zimbabwe wage calculator salary. August to december 2020 paye usd tax tables. Zimbabwe individual income tax is imposed at progressive rates up to 35. Income of individual from trade and investments.

0 20 for each usd above 4 201. Taxation zimbabwe tx zwe f6 june and december 2018. 0 1 980 00 0. 56 760 40 for each usd above 180 001.

The 3 aids levy is also imposed.