Net Investment Income Tax Passive Activity

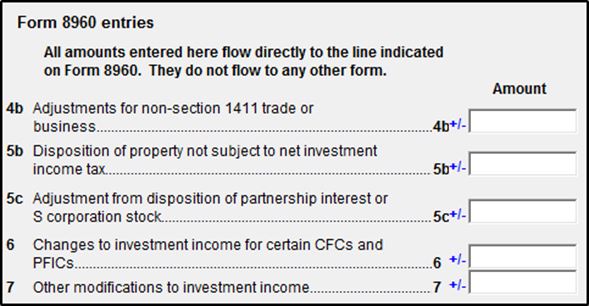

Pass through interest by active owner sale of assets within a pass through active interest in a pass through that has rental activity self rental recharacterization rules properly allocable deductions.

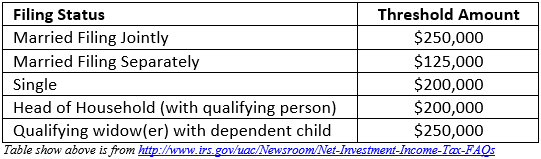

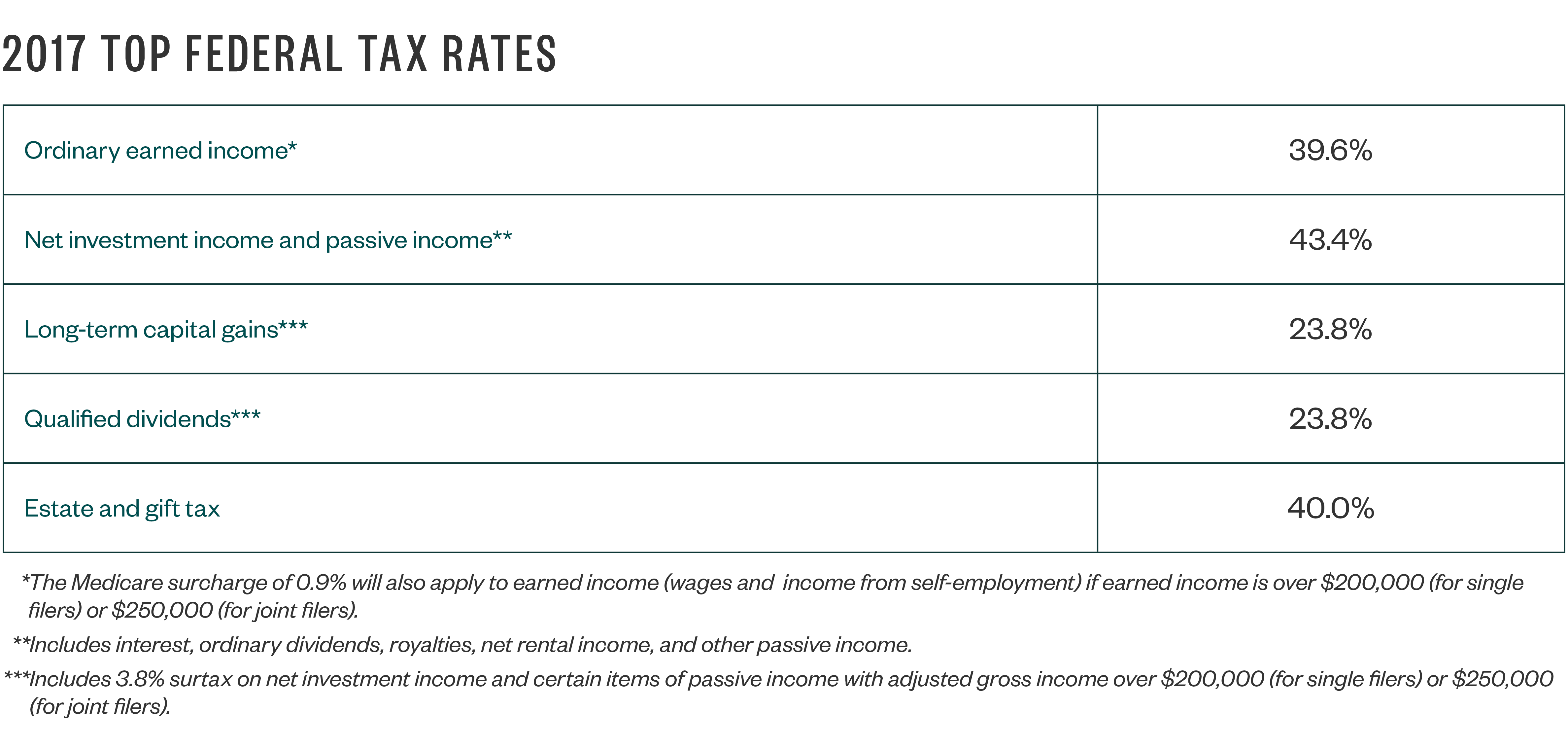

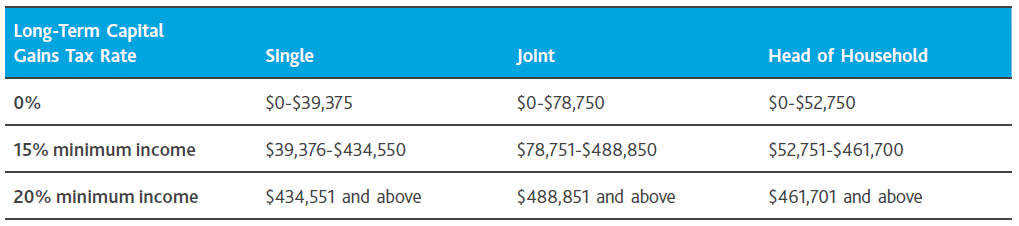

Net investment income tax passive activity. It would then seem intuitive that to avoid this additional surtax of 3 8 on net investment income you would simply need to have income derived from a business since income derived from a business is neither passive nor portfolio. In our last few tax letters we have discussed passive activities versus nonpassive activities in the context of the 3 8 percent net investment income nii tax. Net gain from the disposition of property. In summary portfolio and passive income are two categories of income subject to the niit.

The rules in sec. If the real estate activity is considered a passive activity any gain on the sale of property would generate gain that would be subject to the net investment income tax. Making a distinction between passive and active income is important for several reasons. Gross investment income is comprised of five buckets of investment and unearned income.

Meeting the standard of material participation and thereby turning an activity from passive to nonpassive is obviously a critical consideration for if an activity is passive all of the income. This article focuses on a nuance in the passive activity rules that in the right circumstances may allow taxpayers to avoid the 3 8 percent net investment income tax on certain income. 469 originally were created to limit a taxpayer s ability to deduct passive losses against nonpassive income. Understanding passive activity.

Other income from a trade or business that is a passive activity. A taxpayer can claim a passive loss against income generated from passive. So a taxpayer with income from a partnership or s corporation will generally include all of it in net investment income if the activity is a passive activity with respect to the taxpayer. Other income from a trade or business of trading in financial instruments or commodities.

However if the taxpayer qualifies as a real estate professional and the activity is considered an active trade or business any gain on the sale of the property may be.