Passive Loss Rules Cares Act

Revenue procedure 2020 24 pdf provides guidance to taxpayers with net operating losses that are carried back under the cares act by providing procedures for.

Passive loss rules cares act. The cares act allows individuals estates and taxable trusts with certain business losses in 2018 2019 and 2020 including losses from pass through entities to obtain refunds of taxes paid in the prior five years. Changing the qip to a 15 year life and taking 100 bonus may cause what was previously taxable income to become a taxable loss for the year which would increase existing net operating losses nols if any. Other cares act changes. A passive activity is one wherein the taxpayer did not materially.

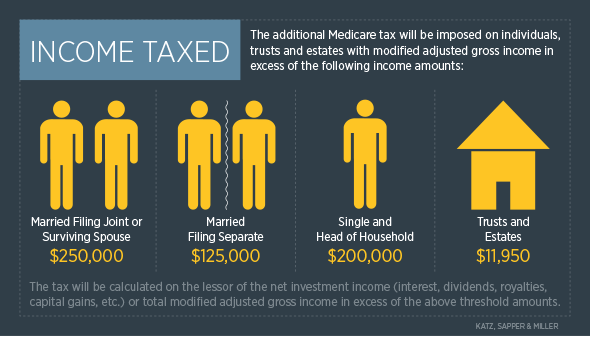

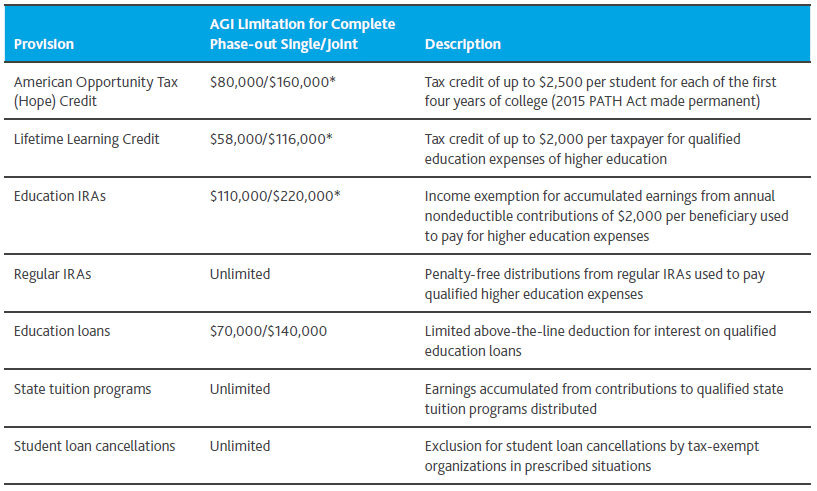

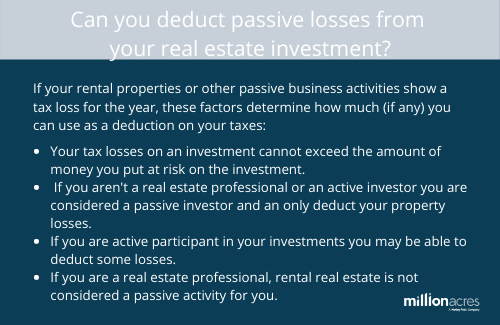

Provided a five year carryback for losses earned in 2018 2019 or 2020 which allows firms to modify tax returns up to five years prior to offset taxable income from those tax years. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Nols generated from 2018 2019 and 2020 can now be carried back five years or forward indefinitely. The cares act made three changes to nols that improves cash flow for struggling businesses.

Under the tax cuts and jobs act of 2017 tcja for tax years beginning in 2018 and thereafter nol carrybacks are not. Waiving the carryback period in the case of a net operating loss arising in a taxable year beginning after dec. The cares act removes the limitation on excess business losses for taxpayers other than corporations for tax. 461 l 1 as amended by act.

The coronavirus aid relief and economic act cares act signed into law by president trump on march 27 2020 made significant changes to the net operating loss nol carryback rules for both individuals and businesses. Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income. This provision works together with other provisions that limit the ability of noncorporate taxpayers to deduct losses such as the passive activity loss rules under code section 469 and the at risk rules under code section 465. Prior to 2018 as long as an individual owner of rental real estate was treated as a real estate professional for purposes of the passive loss limitations the owner was free to use such losses to.

The cares act temporarily modifies the loss limitation for noncorporate taxpayers so they can deduct excess business losses arising in 2018 2019 and 2020.