Passive Loss Rules Real Estate

Rental real estate activities generally are considered passive activities regardless of whether the taxpayer materially participates.

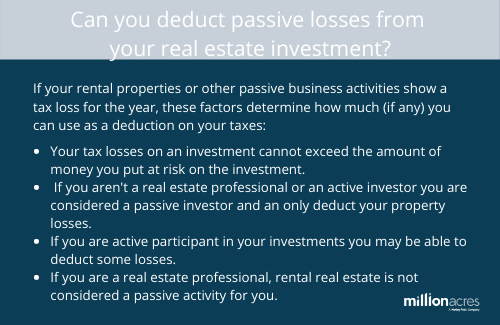

Passive loss rules real estate. Any rental real estate loss allowed because you materially participated in the rental activity as a real estate professional as discussed later under activities that aren t passive activities. What is a passive business activity. A pal is the amount by which the taxpayer s aggregate losses from all passive activities for the year exceed the aggregate income from all of those activities. When you own an income property and are earning your income through monthly rent payments this is considered passive income by the irs.

He owns 2 rental properties that generate 28 000 of losses in which he materially participates in the management. This is his main source of income. The other exception to the pal rules is the one for real estate professionals. However the rules for who is a real estate professional for tax purposes are rather specific and the irs enforces these rules rather strictly.

Llc and files a schedule c as a real estate trade or business. Thus at first glance it appears the taxpayers took every necessary step to help ensure they could treat the real estate activities as nonpassive activities. According to the irs a passive activity is one in which the taxpayer doesn t. Unlike the 25 000 exception described above this is a complete exemption from the rules that is landlords who qualify as real estate professionals may deduct any amount of losses from their other non passive income.

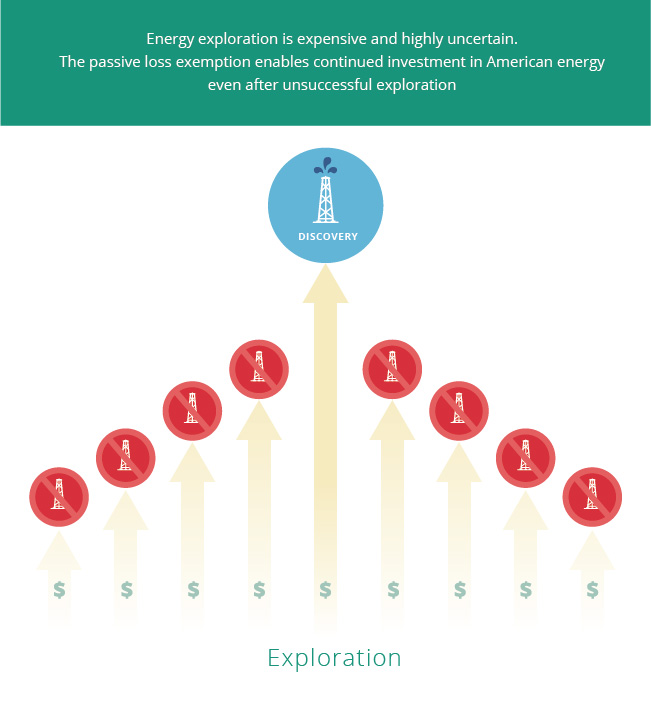

This is different than typical active income that would come with a standard. His modified agi is 175 000 before the losses. Passive loss rules were established by the irs back in 1986 and they are something that all rental property owners need to know about. Here s what all real estate investors need to know about the passive loss rules.

In general taxpayers in the real property business or real estate professionals can exclude their rental activity or activities from the passive activity loss rules. Any overall loss from a publicly traded partnership see publicly traded partnerships ptps in the instructions for form 8582. However since rental real estate income is considered to be passive in nature there are special rules called the passive activity loss rules that can limit the amount of rental real estate or. Since he is a real estate professional the.

If one is classified as a real estate professional any losses are treated as ordinary losses and may be deducted against other income sources.