Passive Activity Loss Threshold

Under the passive activity loss rules contained in irc sec.

Passive activity loss threshold. The level of participation may have significant tax implications that you should be aware of p articularly when it comes to deducting farming losses. Regardless of scale t hese activities must meet certain threshold tests to be considered active rather than passive activities. The pal rules apply to all business activities but are particularly strict for real estate rentals because. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations.

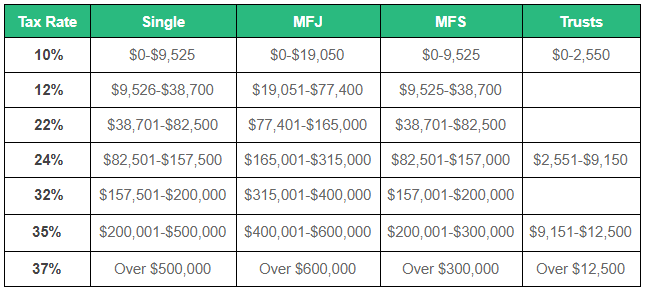

469 if a taxpayer has a flow through loss from a passive activity the. All this came to an abrupt end in 1986 when congress enacted the passive activity loss rules. If your modified adjusted gross income is 150 000 or more or 75 000 or more if you re married and filing separately you usually can t claim passive activity loss against other income. Taxable year plus a threshold amount of 500 000 for married taxpayer filing jointly or 250 000 for all other taxpayers.

Section 469 these rules were designed to limit a taxpayer s ability to use real estate or business losses to offset other income. Learn what a passive activity loss is and whether you can as a real estate investor deduct those losses from your taxes. Above this threshold the maximum deduction begins to phase out and. See the instructions for form 461 limitation on business losses.

Your allowable passive business losses may also be subject to an excess business loss. One of those tax breaks that goes away as your income exceeds certain thresholds is the allowance of passive losses against nonpassive and portfolio income such as salary and interest income. Any passive activity losses but not credits that haven t been allowed including current year losses are generally allowed in full in the tax year you dispose of your entire interest in the passive or former passive activity. However for the losses to be allowed you must dispose of your entire interest in the activity in a transaction.