Is Passive Income Qbi

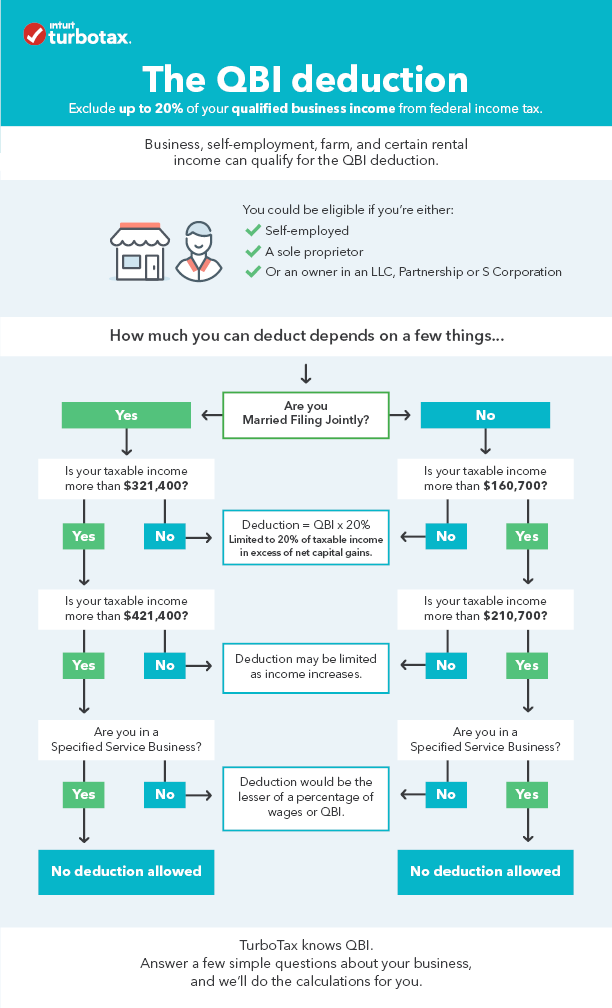

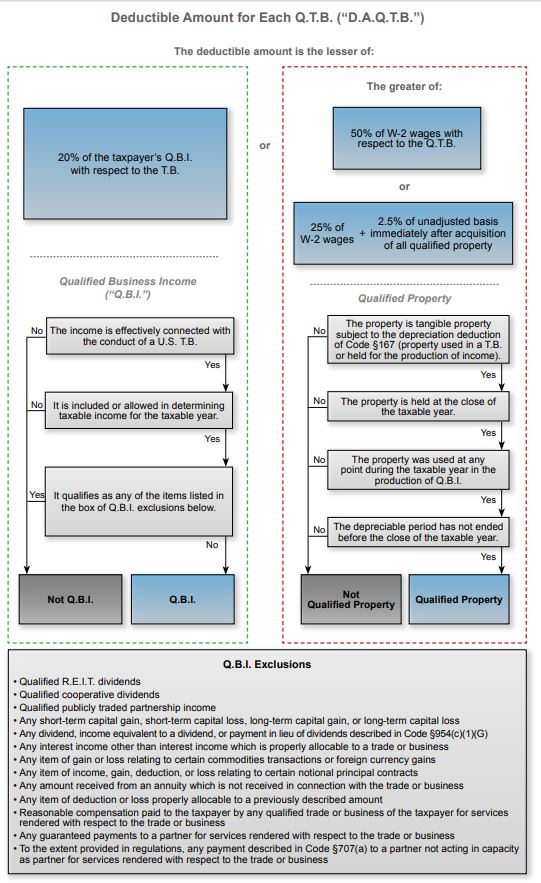

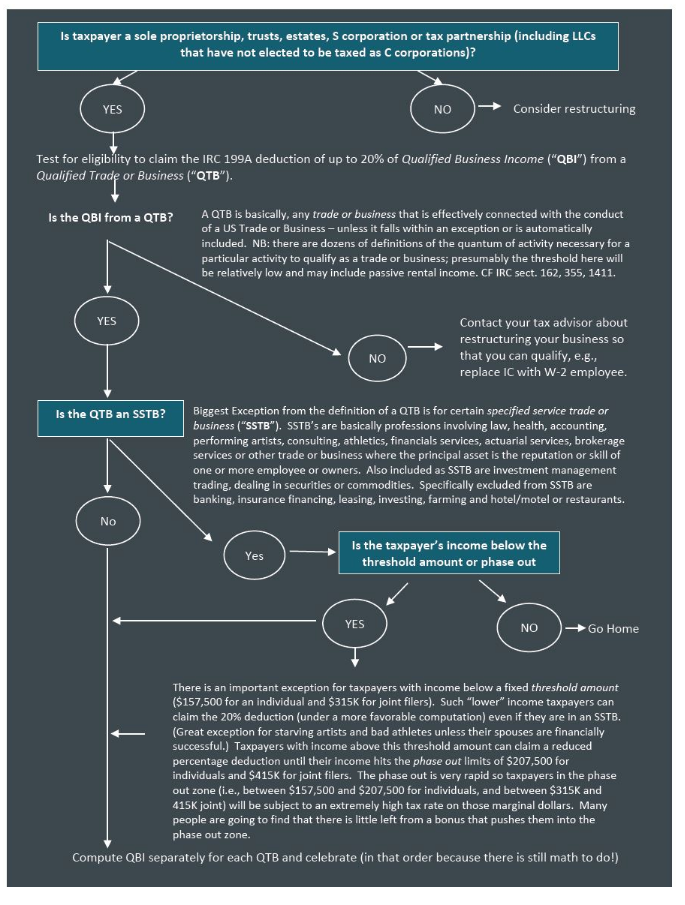

The qualified business income qbi deduction is a tax deduction for pass through entities.

Is passive income qbi. Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi. Mark this field to include the income or loss from this activity in the form 4562 section 179 business income. These parallels quickly faded away as the tax community dug into the details of the qbi deduction.

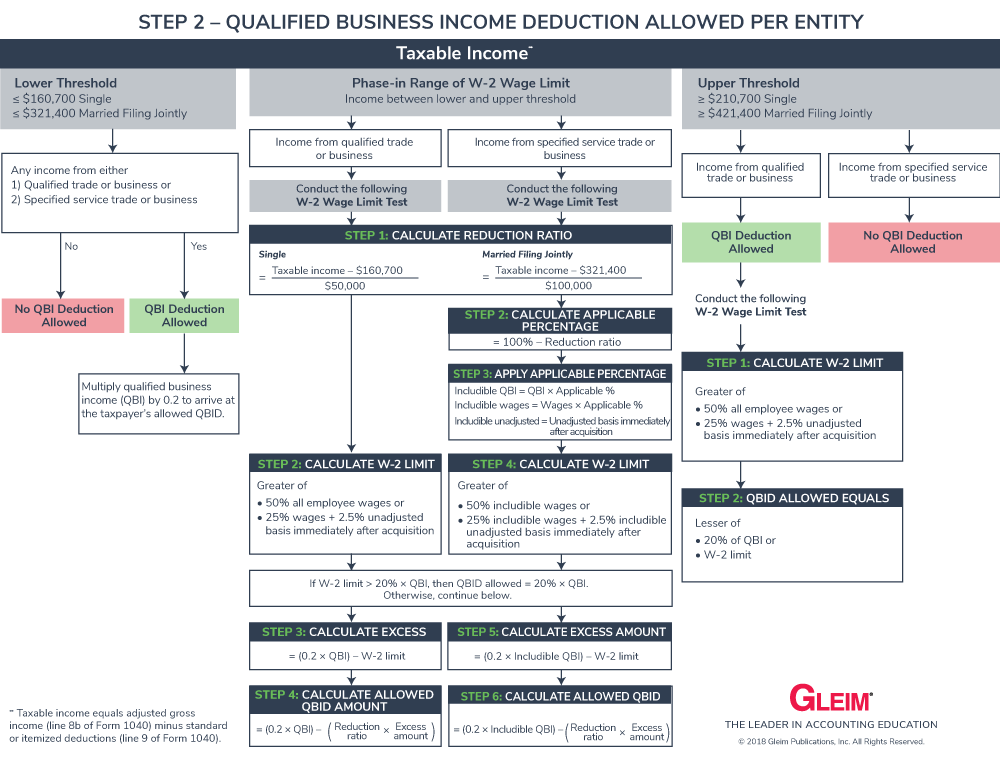

The calculation of business income for section 179 purposes does not include the income from passive activities. The passive activity code must be 2 for rental real estate with active participation for this option. The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year. Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017.

Typically rental real estate activity is classified as passive with income and expenses reported on schedule e form 1040 instead of schedule c form 1040. For example owning only commercial rental real estate is typically considered a trade or business because of the level of. If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction in the following year irc sec. Niit was enacted to impose a medicare surcharge on passive income.

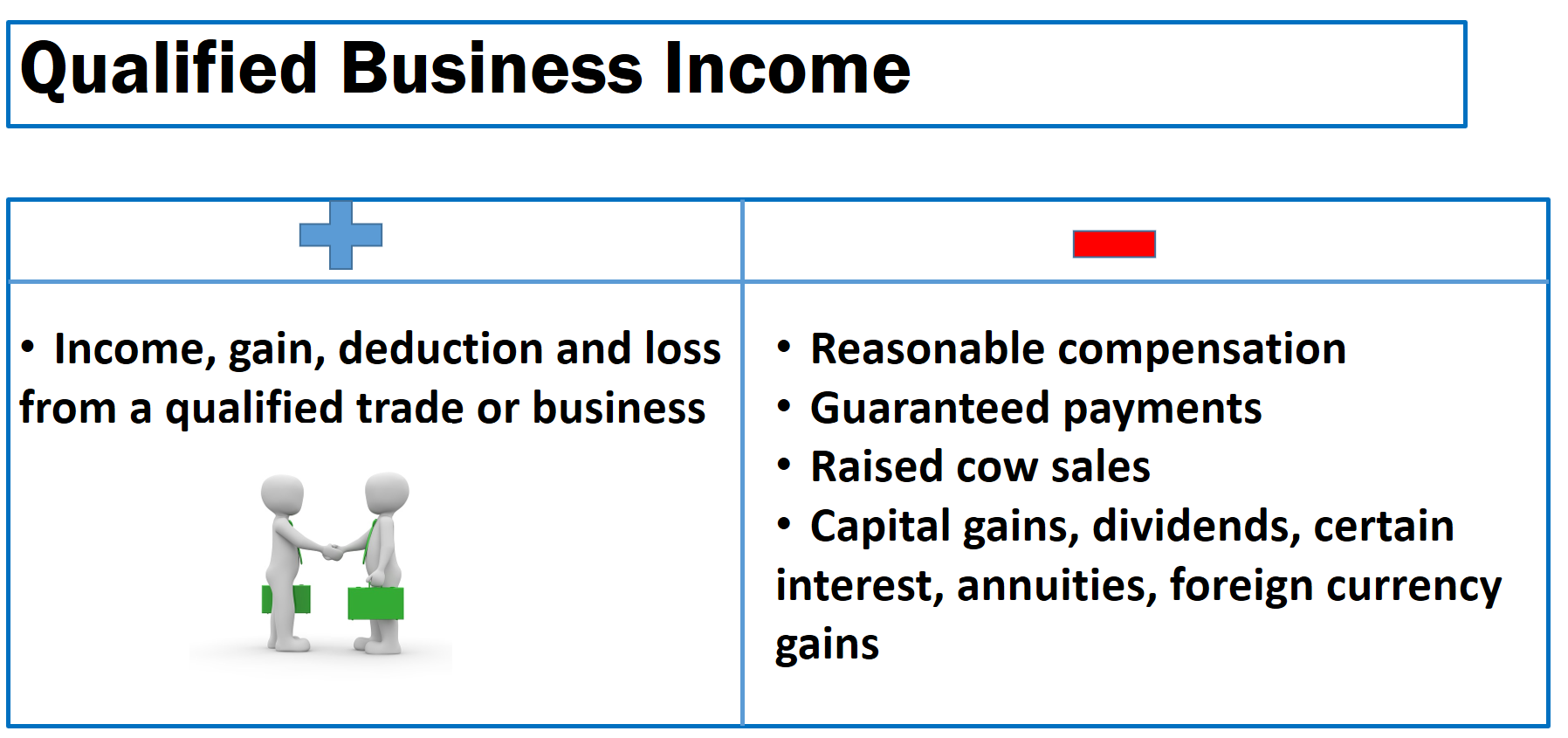

Netting income and losses qbi qbl final regs if net amount is a loss net loss is carried forward no w 2 or basis amounts carry forward if net of all positive and negative qbi positive the loss must be allocated among all the businesses that produce qbi in proportion final regs suspended losses before 1 1 18 are excluded. It is based on qualified business income qbi. Thus the qbid can be paired with either the standard deduction or itemized deductions. Qbi must come from a flow through entity.

This includes business income from a sole proprietorship reported on schedule c of form 1040 a partnership reported on form. Irs doesn t seem to want to say as i did further research so i was thinking maybe there is some current rulings or cases that help one to further determine whether royalties are eligible for qbi that s why you need to distinguish royalties vs working interest. Learn if your business qualifies for the qbi deduction of up to 20. After the issuance of proposed regulations in irc 199a commenters immediately looked for parallels between niit and qbi.

When doing tax planning for 2019 it is important to make sure qbi is not inadvertently lowered by used.