Non Passive Income Rules

She has a full time job as a physician and she did some side work before her second kid was born.

Non passive income rules. Nonpassive losses include losses incurred in the active management of a business. In a nutshell a taxpayer that spends less than 750 hours in an activity has passive income or loss. Simply put non passive income consists of any income that cannot be classified as passive. Non passive income consists of any type of active income such as wages business income income resulting from a business activity or investment income.

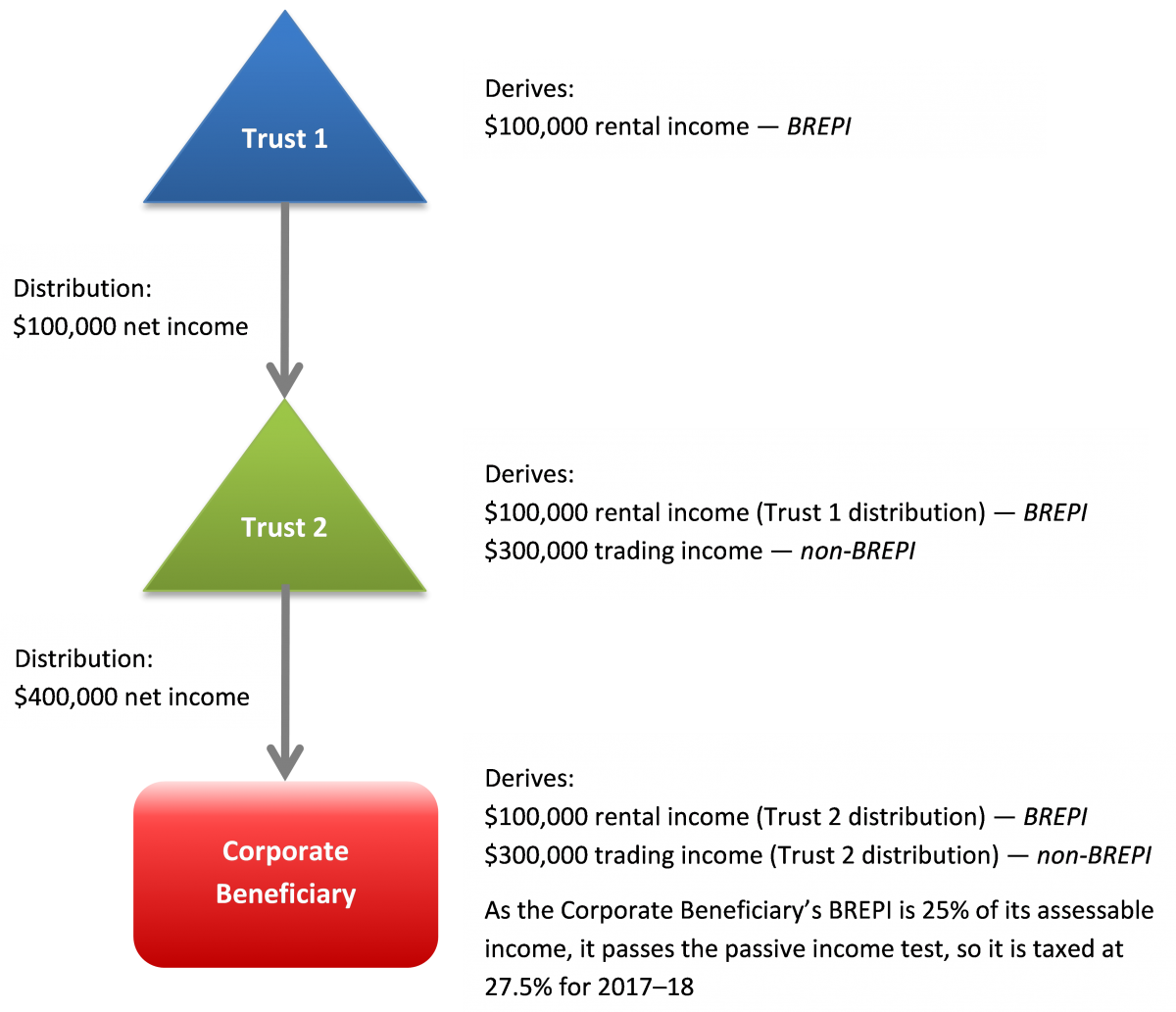

However as this ccpc s passive investment income moves beyond the 50 000 passive income threshold less and less of that 500 000 qualifies for the sbd. For example if an employee has worked for eight hours the income received reflects the eight hours worked. Because a taxpayer qualifies in one year does not automatically qualify him or her in subsequent tax years. The rules on how to determine a passive activity are pretty straight forward.

Also you could be considered non passive if your spouse is considered non passive in regards to the activity. At 150 000 of passive income none of the active business income will qualify for the small business tax rate. On the other hand if you re self renting which means that you have your own space and that you re renting it it doesn t count as passive income either unless the agreement has been signed before 1988. If you are a limited partner with a limited interest you would you would be passive unless you can meet the requirements in 1 5 or 6 above.

Nonpassive income includes any active income such as wages business income or investment income. Non passive losses include losses incurred in the active management of business. This has a dramatic effect on the amount of tax on that 500 000. To that end if you re a real estate professional then the income generated through rental is regarded as active income or non passive income.

In addition there are still other rules that might change your classification. Non passive income for this purpose includes. Non passive income encompasses all cash flow received directly in relation to work completed. This is determined on an annual basis.

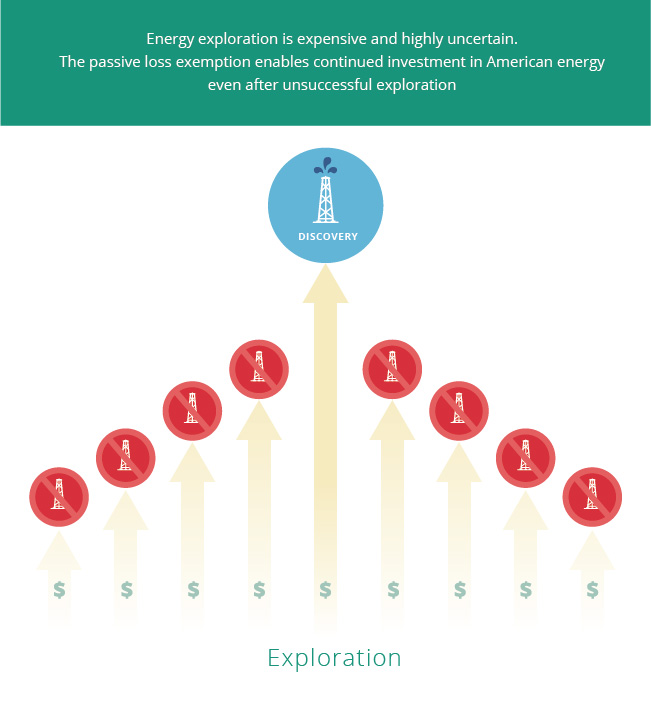

That works out to. You can t deduct the excess expenses losses against earned income or against other non passive income.