On An Income And Expense Statement Covering January 1 To June 30

The federal government s fiscal year runs from october 1 to september 30.

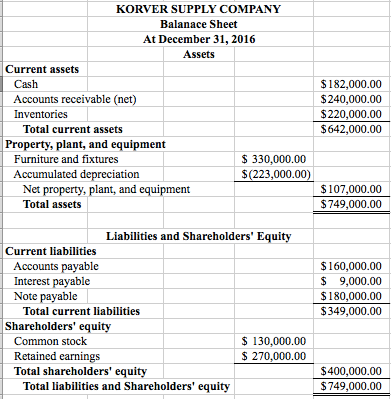

On an income and expense statement covering january 1 to june 30. The 2 400 payment was recorded on december 1 with a debit to the income statement account insurance expense and a credit to the current asset cash. On january 1 2013 phoenix co. On december 1 your company paid its insurance agent 2 400 for the annual insurance premium covering the twelve month period beginning on december 1. The principal and interest will be paid on june 30 2017.

Acquired 100 percent of the outstanding voting shares of sedona inc. Inheritance granted in april to be paid in september e. At january 1 2013 sedona s net assets had a total carrying amount of 420 0. To find out if you can claim an exclusion review the rpie filing information.

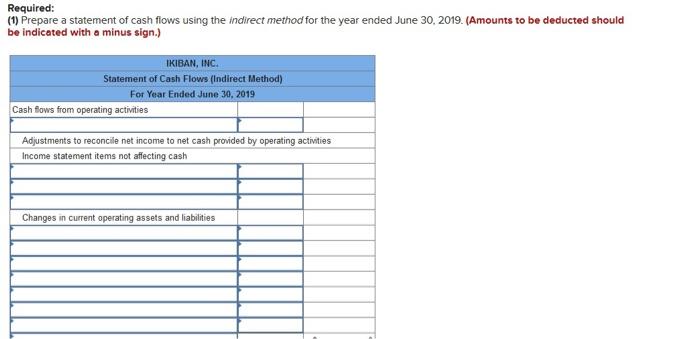

Wages and salaries received in that six months b. 03 17 2020 qc cs 204679 1 prepare a cash receipts budget for july august and september. Just like in step 1 we will use income summary as the offset account but this time we will debit income summary. Operating expenses are paid in the month incurred and consist of sales commissions 10 of sales office salaries 4 600 per month and rent 7 100 per month.

On an income and expense statement covering january 1 to june 30 would not be included as income. Ex 9 2 a primarily formed committee is formed in may to support a city council candidate in the november election. Income tax refund received april 14. How much interest expense should be reported on the income statement for the year ended december 31 2016.

Owners of income producing properties with an actual assessed value of more than 40 000 on the tentative assessment roll must file a real property income and expense statement or a claim of exclusion. Period covering january 1 through june 30 due on or before july 31 and a semi annual statement for the period july 1 through december 31 due on or before january 31. The expense accounts have debit balances so to get rid of their balances we will do the opposite or credit the accounts. On july 1 2016 allen company signed a 100 000 one year 6 percent note payable.

An accounting period is the period of time covered by a company s financial statements. Businesses often use the calendar year january 1 to december 31. Auto sold with payment received may 15 d. State governments and therefore state agencies and many community based and non profit organizations that receive state funding usually use july 1 to june 30.

The committee must file a semi annual statement for the. Interest received on june 30 c.

:max_bytes(150000):strip_icc()/Microsoft-f881c1b42e8b4a8d9cf9597a3f651290.jpg)