Direct Income Capitalization Approach Formula

On this page we focus on the direct capitalization method.

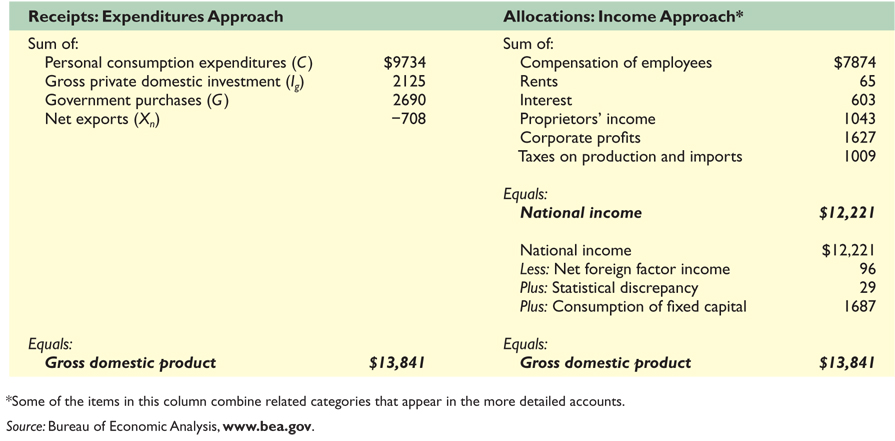

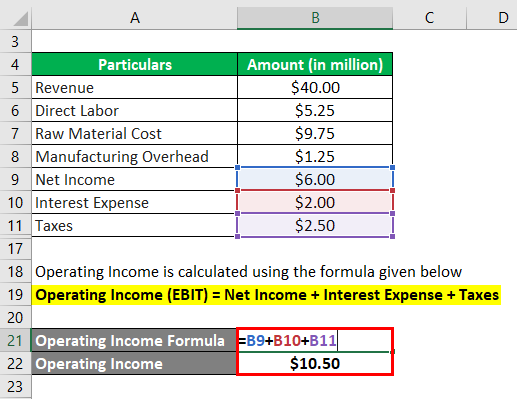

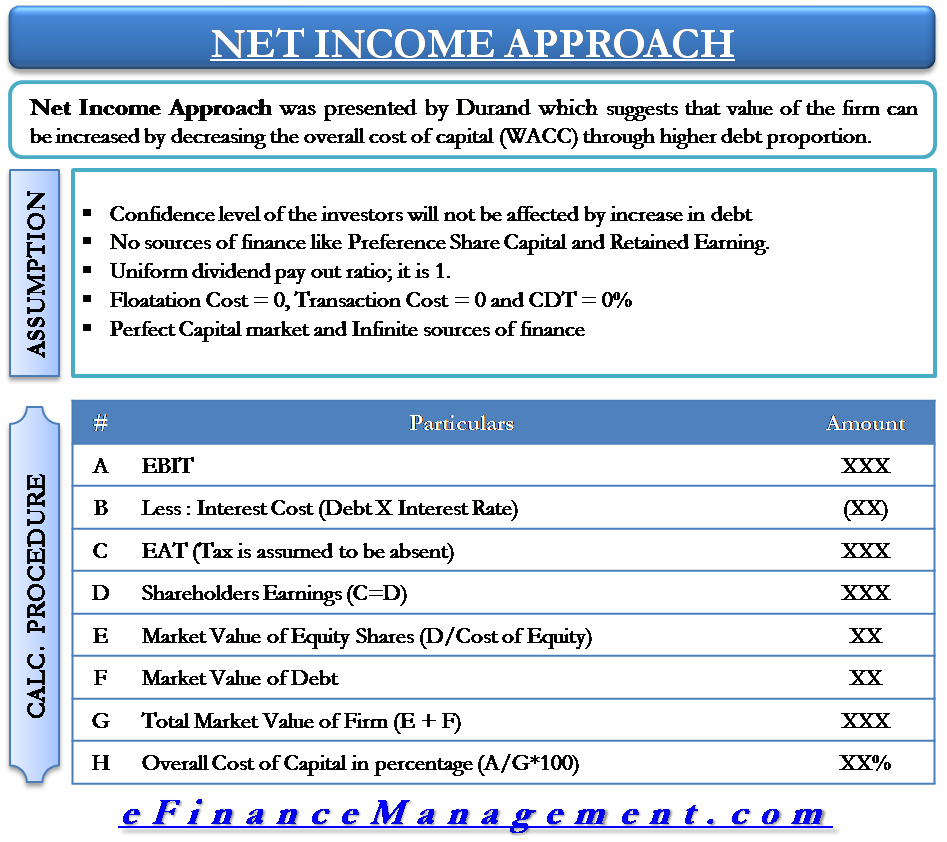

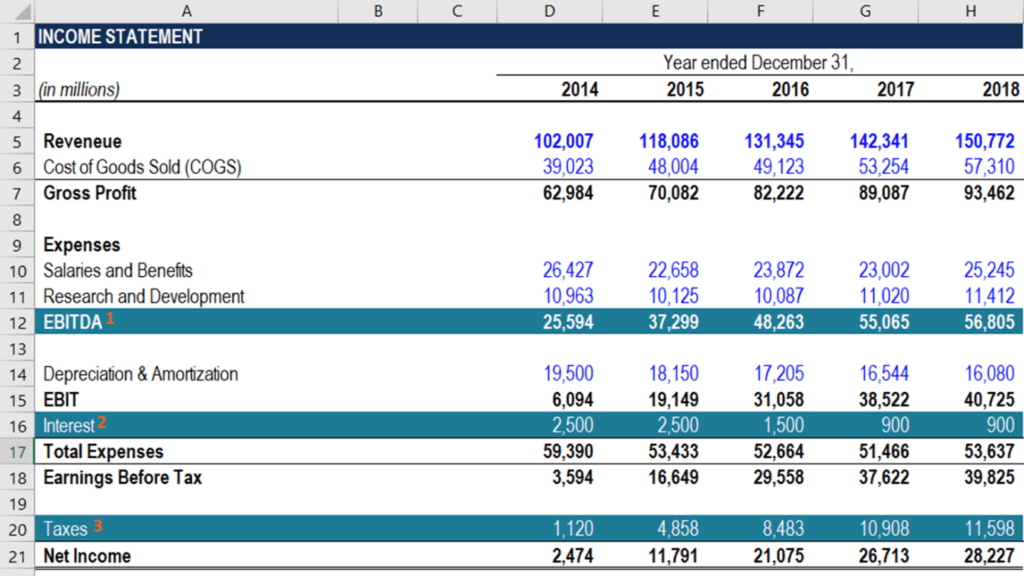

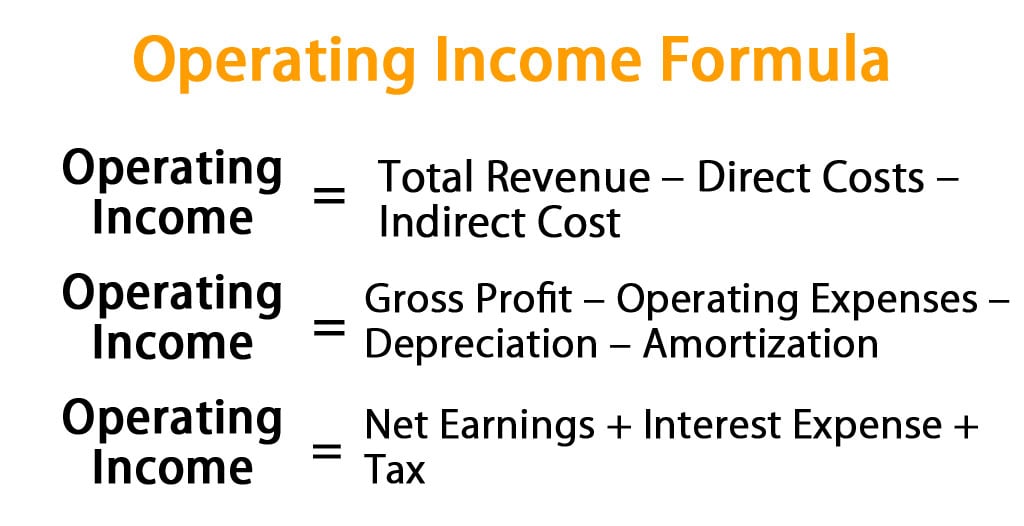

Direct income capitalization approach formula. The income measure can be potential gross income effective gross income or net operating income. Market value net operating income noi capitalization rate. It is based on the expectation of future benefits. In the direct capitalization method the income stream of a property as measured by the net operating income is considered a perpetuity and the property value equals noi divided by a discount rate.

The direct capitalization method estimates property value using a single year s income forecast. There are two approaches that fall under the income approach the direct capitalization approach and the discounted cash flow method. Estimating the net operating income. Effectively the math underlying this calculation presumes that the investment will continue producing income indefinitely.

The direct capitalization method. The capitalized income approach or direct capitalization income approach is a valuation method used for real estate. The basic formula for this approach commonly referred to as irv is. Net operating income i capitalization rate r value v you can break this formula down into these three steps.

The direct capitalization method estimates a single year s income. Determining the capitalization rate. Income capitalization is a valuation method that appraisers and real estate investors use to estimate the value of income producing real estate. The direct capitalization approach is just one of these and it relies on the same formula we introduced earlier.

Calculating a value in this way is known as the direct capitalization approach. Knowing what cap rate to use in the formula is the hard part. In financial terminology the direct capitalization method values a building as a perpetuity. The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on the.

The income capitalization formula is as follows. This method of valuation relates value to the market rent that a property can be expected to earn and to the resale value. Direct capitalization requires that there is good recent sales data from comparable properties. After calculating a property s net operating income a capitalization rate is determined by using market sales of comparable properties in the area.

Applying the irv formula to arrive at a value estimate.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)