Income Approach Fair Value

Uses estimated future cash flows or earnings.

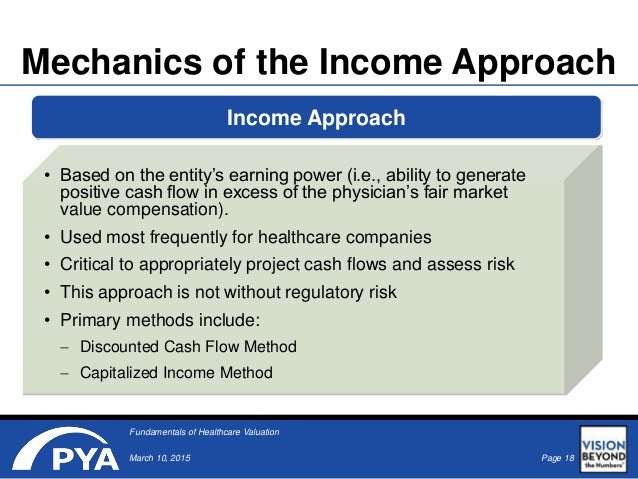

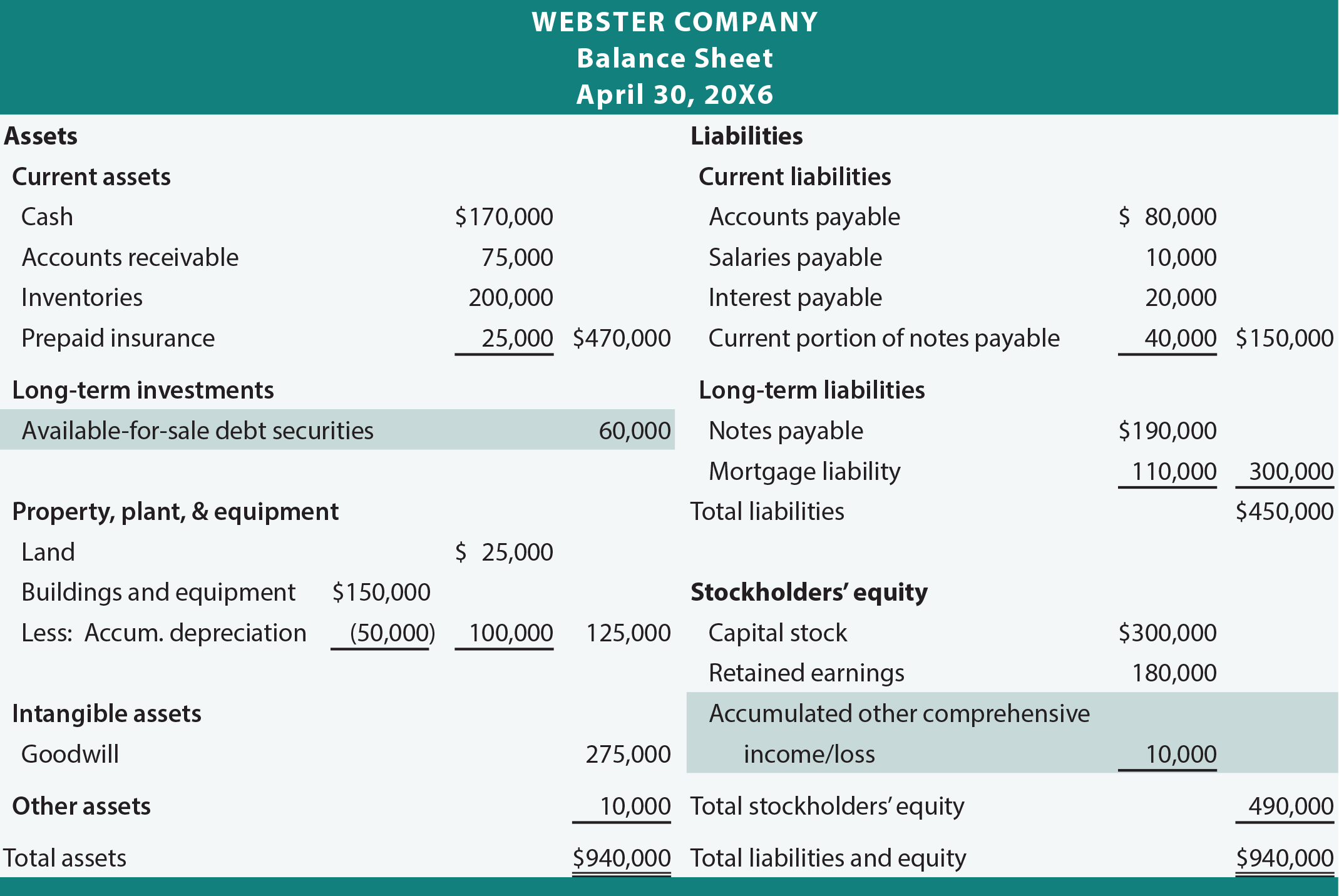

Income approach fair value. The income approach measures fair value as the present value of the expected future cash flows that the entity generates or an intangible asset generates as part of an entity discounted for the risk of receiving those cash flows. The income approach is one of the three basic valuation techniques to measure fair value described in the financial accounting standards board s accounting standards codification 820 fair value measurements and disclosures asc 820. The income approach is a real estate valuation method that uses the income the property generates to estimate fair value. The standard defines fair value on the basis of an exit price notion and uses a fair value hierarchy which results in a market based rather than entity specific measurement.

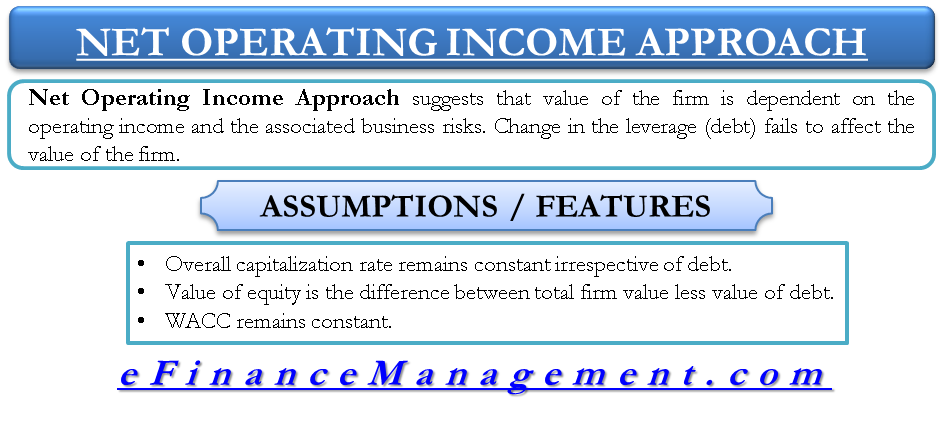

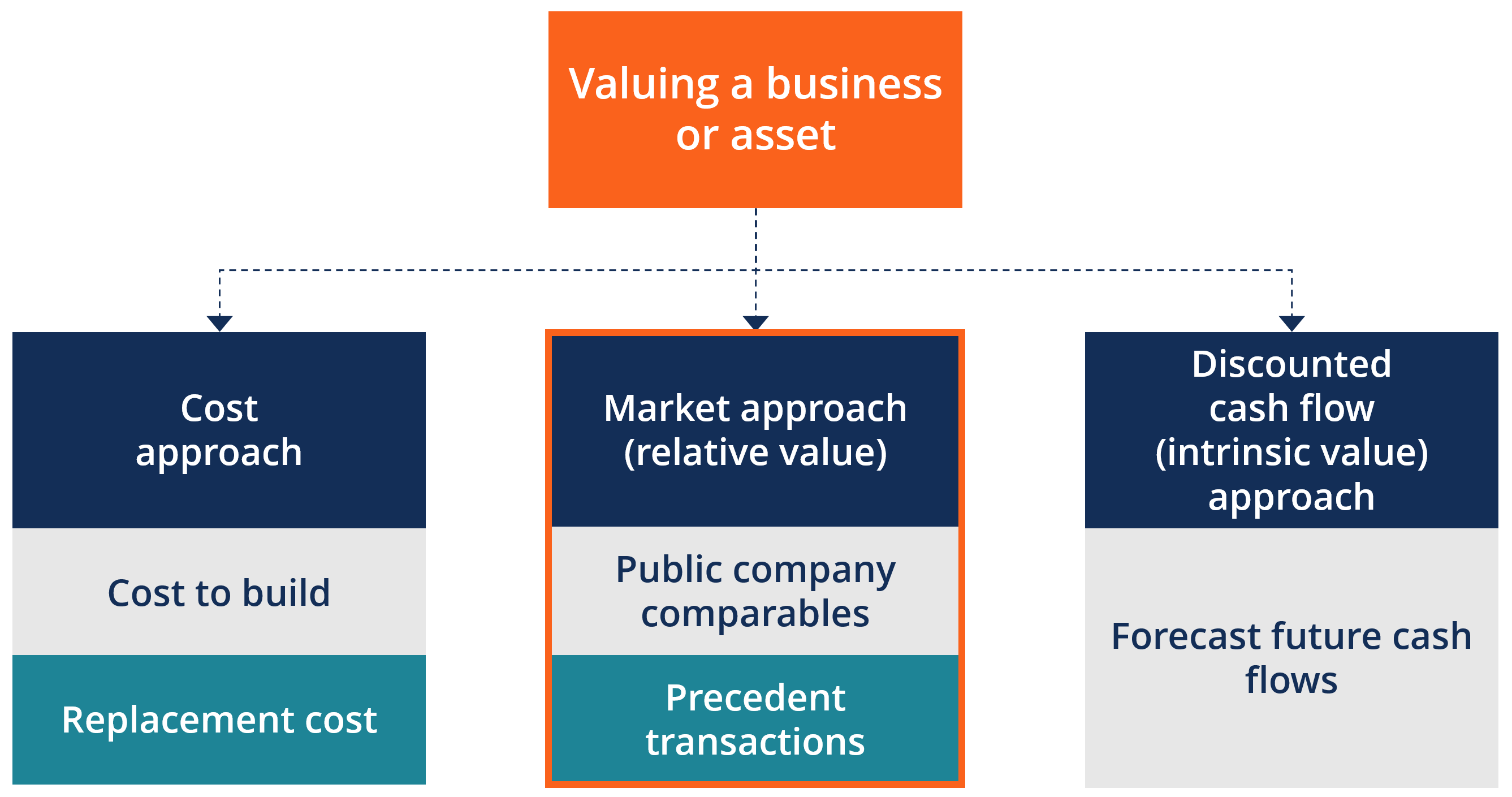

Discount rate adjustment rate technique and expected present value technique. Fair value is the estimated price at which an asset can be sold or a liability settled in an orderly transaction to a third party under current market conditions. This approach uses the principles of economics. The income approach is one of the three approaches along with the market approach and asset approach used to estimate enterprise and equity value the income approach seeks to identify the future economic benefits to be generated by an entity and to compare them with a required rate of return.

It doesn t rely on a report of profits and losses but instead just looks at actual value. It s calculated by dividing the net operating income by the capitalization. True measure of income. Company business value income generated by the company.

This chapter presents various methods used to estimate the fair value under the income approach. Ifrs 13 applies to ifrss that require or permit fair value measurements or disclosures and provides a single ifrs framework for measuring fair value and requires disclosures about fair value measurement. These methods are used to value a company based on the amount of income the company is expected to generate in the future. Adaptable to different types of assets.

With fair value accounting it is total asset value that reflects the actual income of a company. Fair value accounting uses current market values as the basis for recognizing certain assets and liabilities. The method indicates that the business value is equal to the current value of the income that is generated by the company. A fair value using this approach will reflect current market expectations about future cashflows or income and expenses.

There is a formula for this form of approach.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)