Singapore Retirement Passive Income

Singapore savings bonds are tax exempt bonds that are fully backed by the singapore government which means you are assured of your investment amount back in full with no capital loss.

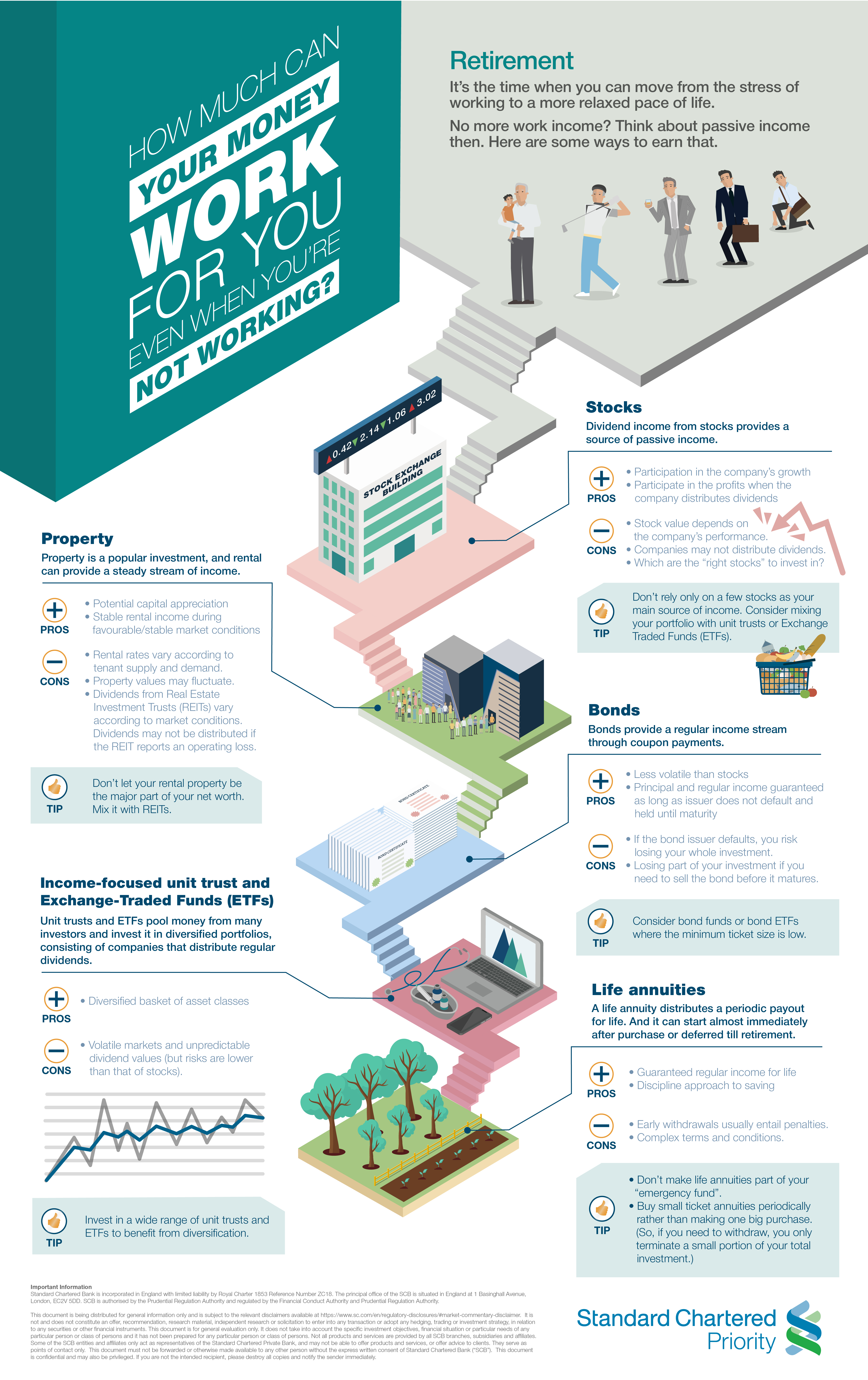

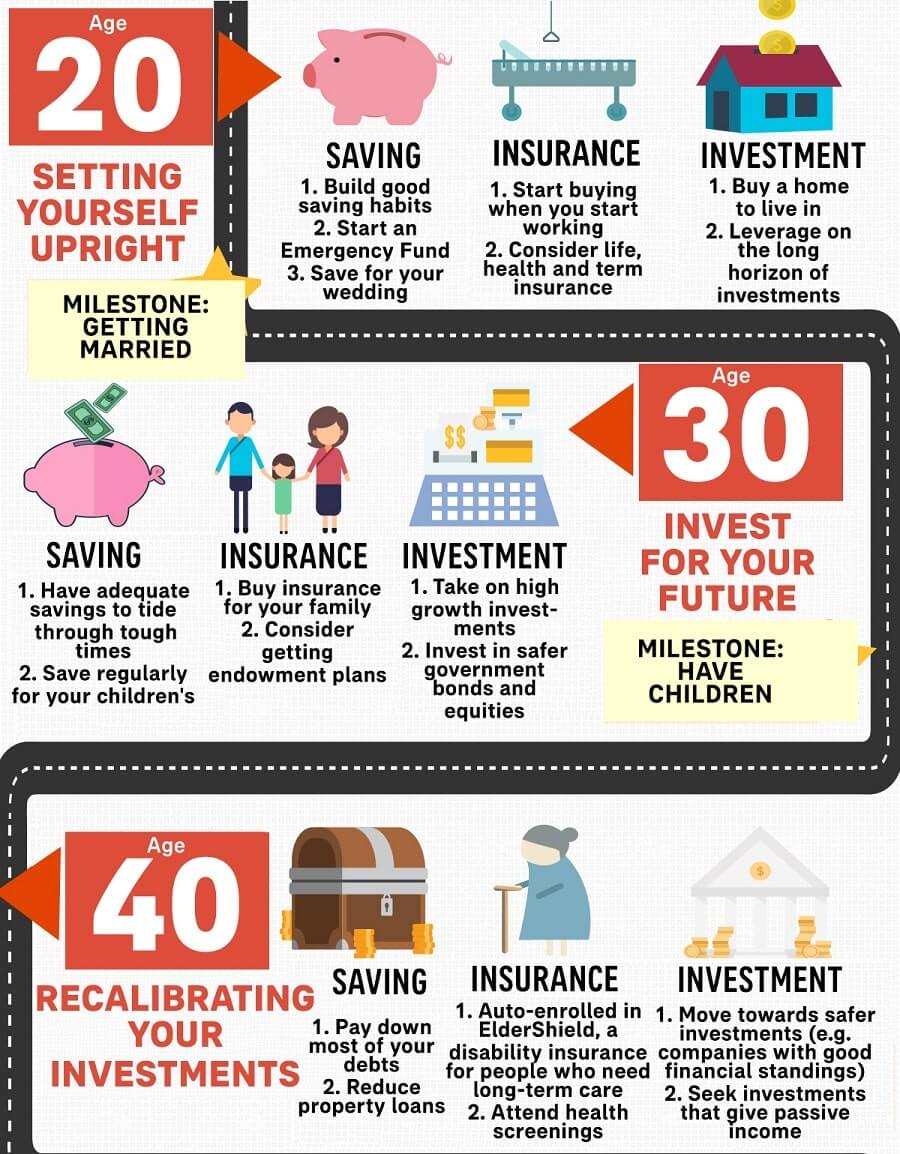

Singapore retirement passive income. In singapore those who seek to earn passive income usually do it for some of the following reasons. Having a retirement focused savings plan as part of your strategy to build your retirement nest egg is an easy way to have a steady stream of passive income during your golden years. Stocks are the best for getting passive income though the dividend yield they pay out periodically and also you get to benefit when the stock market prices appreciate. The money received on pension is rarely enough therefore earning some passive income over the productive years becomes very useful during sunset years.

Many singaporeans struggle with financial difficulty during their retirement years. There are only two problems with this 1 you have to live in one property which means you need a to buy a second property and 2 properties in singapore are crazily expensive. If you re worried about being able to save enough of your earnings to meet your retirement goals building wealth through passive income is a strategy that might appeal to you. Passive income through dividend portfolio.

While doing your research you ll find a wide choice of investments that can be used to earn passive income through stocks. 10 ways to earn passive income in singapore. You buy a property and rent it out to collect income. Here are some brilliant passive income ideas.

Depending on the plan and options you have selected you can even enjoy monthly payouts up to 30 years after retirement. You can start with as little as s 500 and earn step up interest on your savings while having the flexibility to access your funds within a month. These companies are the big familiar names so it s easier to understand their business. It gives a good accumulation of wealth which can be used during retirement.

This is one of the most commonly understood methods to receive passive income in singapore. Passive income is normally taxable. Another strategy on how to make passive income in singapore is by building your dividend paying stock portfolio. However it is regularly handled in another way with the aid of the tax bureau.

Let s jump right into it and get you started as fast as we can.