Passive Activity Loss Limitations Rental Real Estate

The passive activity loss rules are perhaps the largest limiting factor when it comes to deducting rental income losses and they apply to non active rental property investors.

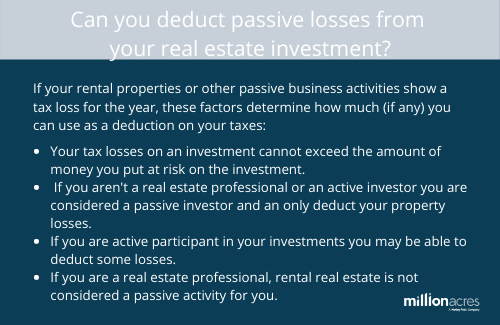

Passive activity loss limitations rental real estate. The irs defines passive activity as any income generating pursuit that the taxpayer doesn t have to work for such as investment income and proceeds from rentals. Rental real estate activities generally are considered passive activities regardless of whether the taxpayer materially participates. In the rental property investment realm these are passive loss limitations. A pal is the amount by which the taxpayer s aggregate losses from all passive activities for the year exceed the aggregate income from all of those activities.

However there may be some limitations to this under the excess business loss limits found in the tax cuts and jobs act but we won t go into that here. This special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. The irs recognizes two types of passive activities. Since rental real estate activities are considered passive activities even if the taxpayer does materially participate in the activity except for real estate professionals losses from such.

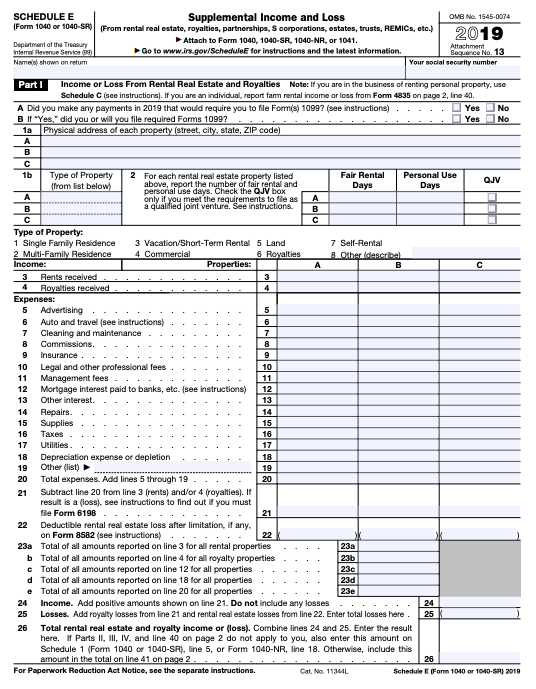

However since rental real estate income is considered to be passive in nature there are special rules called the passive activity loss rules that can limit the amount of rental real estate or. The real estate professional status the real estate professional status historically allowed real estate investors to take unlimited rental losses against their ordinary income. What is a passive activity. The entry will be included in form 8582 worksheet 1.

If you aren t a. D uring 2018 through 2025 real estate professionals who materially participate in their rental activity can deduct a total of 250 000 in rental and other business losses if they are single 500 000 if they are married filing jointly. Rentals including both equipment and rental real estate regardless of the level of participation. After 2025 the deduction is not subject to any annual limit.

Form 8582 passive activity loss limitations gain reported on 4797 from a rental disposition enter here the gain from the sale of rental real estate activity reported on form 4797 in which the taxpayer actively participated. Under irs rules landlords and other real estate professionals cannot deduct losses from these passive activities unless they have an equal amount of. Passive activity loss rules. Passive limitation calculation for sch d transactions.