Passive Income Rules For Solar Itc

So if the solar project is determined to be an active activity for the investor the itc would be active and available to offset tax on all sources of income.

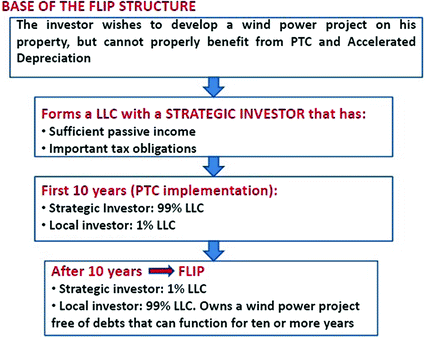

Passive income rules for solar itc. Considered a passive investor irs rules require that a tax credit associated with a passive investment only be used against passive income tax liability which only applies to income generated from either a rental activity or a business in which the individual does not materially participate. Under these rules tax losses and itcs generated from passive activities are generally limited to offsetting a taxpayer. Portfolio income interest dividends capital gains and royalties passive income. Many homeowners will therefore not.

For details on net active income see the instructions for form 8810. For the definition of passive activity gross income see passive activity income later. But if the activity is determined to be passive the itc would be. The first step is to calculate the income tax on 350 000 of taxable income 91 029 and then excluding the 50 000 of passive income on 300 000 of taxable income 74 529.

For a closely held corporation the passive activity loss is the excess of passive activity deductions over the sum of passive activity gross income and net active income. If you are interested in affiliate advertising and marketing or building an online business as a whole but do not understand where to begin after that this new program freedom breakthrough the affiliate blueprint academy from jonathan montoya is well worth a look. The 16 500 difference 91 029 74 529 in income tax is the tax equivalent amount on the 50 000 of passive income and is the allowable credit. Investors and solar developers that decide to self fund and that are subject to the passive loss rules individuals closely held c corps etc that invest in a solar investment tax credit transaction should ensure they have or will have sufficient passive income to effectively use the tax credits and losses generated from the solar.

The rules on passive income taxes and credits can t be effectively changed because as tax attorney greg jenner puts it it would be like pulling on the thread in a sweater. For purposes of applying the passive loss and credit rules income should be classified in three different categories. Together these benefits often eliminate the taxable income and with it the associated tax liability of a solar installation during the early years of the project s life. The solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance.

The passive loss rules are the primary defense in the tax code against tax shelters and once you start to unravel them there will be no turning back. Passive income rules for solar itc.