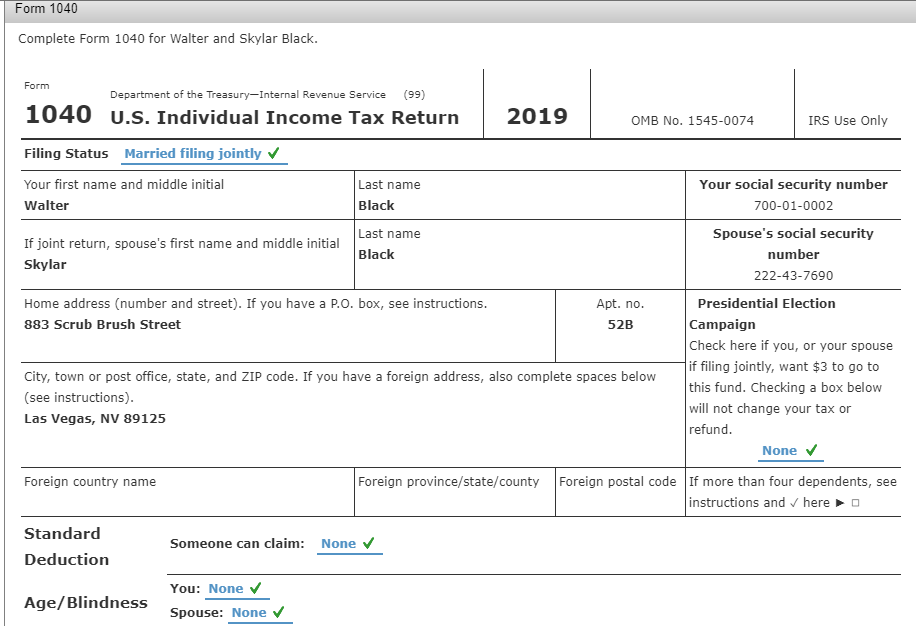

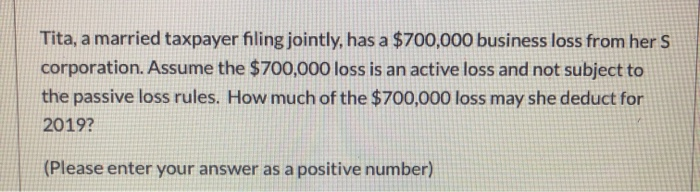

Passive Activity Loss Married Filing Jointly

469 c 7 b is only available to taxpayers who file a joint return.

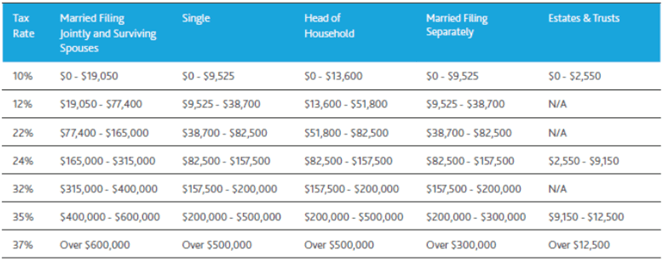

Passive activity loss married filing jointly. The amount of losses from their rental activity that they can deduct is capped at 25 000 in losses per year. For the 2017 tax year the amount of passive income that you can offset against non passive income is 25 000 if you are single or married filing jointly and 12 500 for married filing separately. Single or head of household 160 700. 469 c 2 rental activities are generally.

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. Additional losses are carried forward to the next tax year. If your modified adjusted gross income is 150 000 or more or 75 000 or more if you re married and filing separately you usually can t claim passive activity loss against other income. A passive activity is any trade or business in which the taxpayer does not materially participate.

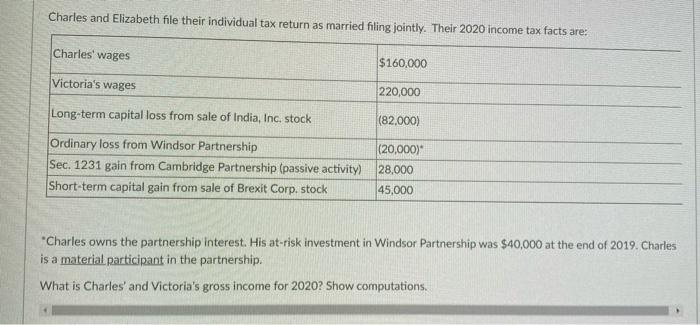

Passive activity losses and sec. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. The meaning of material participation is the same as under the passive activity loss rules however although rental real estate income is generally classified as passive income meeting the above mentioned requirement and filing as a qualified joint venture will not alter the character of passive income or loss. Taxable income thresholds that potentially affect the phaseout of the deduction have been adjusted for tax year 2019 as well see rev.

Part i 2019 passive activity loss. Married filing jointly 321 400. Generally if your modified adjusted gross income is 150 000 or more 75 000 or more if married filing separately there is no special allowance. See the irs instructions for form 8582 for more information.

A passive activity loss is defined as the excess of the aggregate losses from all passive activities for the year over the aggregate income from all passive activities for the year. And married filing separately 160 725. For married couples filing jointly or single persons making more than 100 000 the amount of losses that can be deducted goes down by 50 cents for each dollar over 100k they. 469 c 7 b to avoid passive activity loss treatment the court concluded.

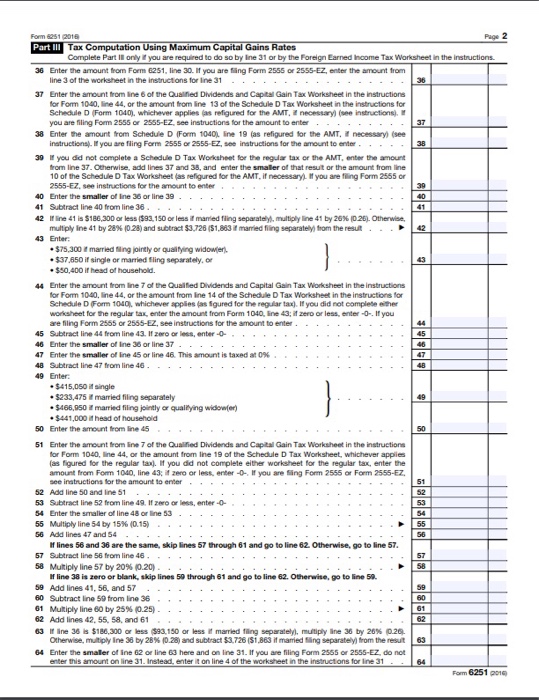

Use worksheets 1 2 and 3 to determine the entries for lines 1 3 of part i as follows.