Passive Activity Loss On Disposition

How do the disposition rules work.

Passive activity loss on disposition. If all gain or loss realized on such disposition is recognized any loss from such activity which has not previously been allowed as a deduction and in the case of a passive activity for the taxable year any loss realized on such disposition shall not be treated as a passive activity loss and shall be allowable as a. Suspended passive losses are fully activated upon disposition of the activity. 469 g on the entire disposition of a passive activity in a fully taxable transaction previously suspended passive losses from that activity are freed up. Gain or loss from the disposition of property retains the nonpassive or passive character of the activity in which the asset was used temp.

Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. Any gain or loss from the disposition of a passive activity is generally also passive. A read as follows. Passive activity deductions generally include any loss from a disposition of property used in a passive activity at the time of the disposition and any loss from a disposition of less than your entire interest in a passive activity.

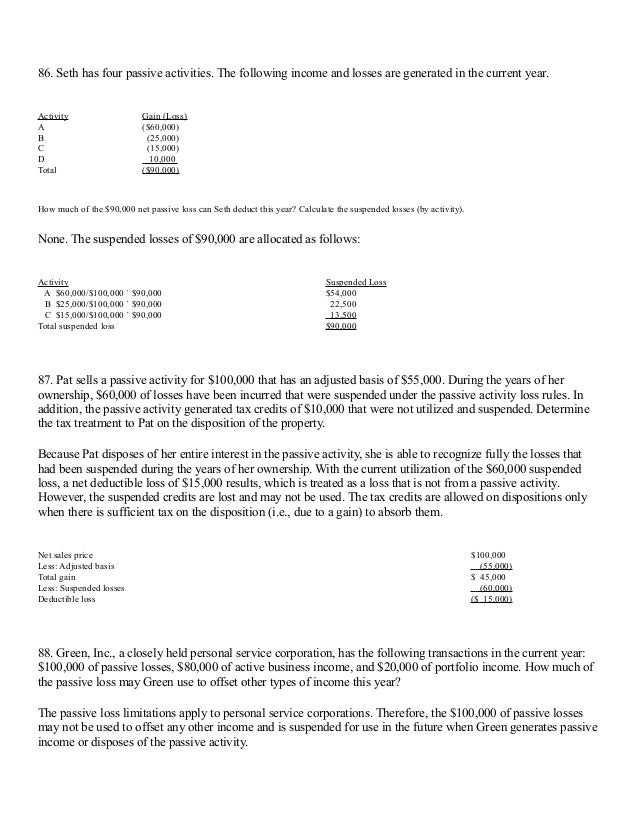

Chapter 5 of the irs passive activity loss audit technique guide december 2004 indicates that taxpayers may need to maintain separate books and records of their activities to be able to establish with reasonable certainty the suspended and current deductions and credits allocable on disposition. However when there is a qualifying disposition of a passive activity losses from that activity that have been carried over can be claimed in full without regard to passive activity income. Unused losses are suspended and carried over only to be used to offset passive activity income in future years. Thus the 100 000 of suspended passive losses could be treated as losses that are not from a passive activity in other words they were deductible from the landlord s other nonpassive.

This requires a disposition of the taxpayer s interest in all entities engaged in the activity and all assets used or created in the activity. Gains are taxed and any previously suspended losses are allowed. To qualify as a disposition the entire interest in the activity must be disposed of. If the gain from the disposition of the activity exceeds its suspended losses the gain may be used to offset losses from other passive activities.

However special rules apply to dispositions.