S Corp Passive Income Rules

1 469 5 k example 5.

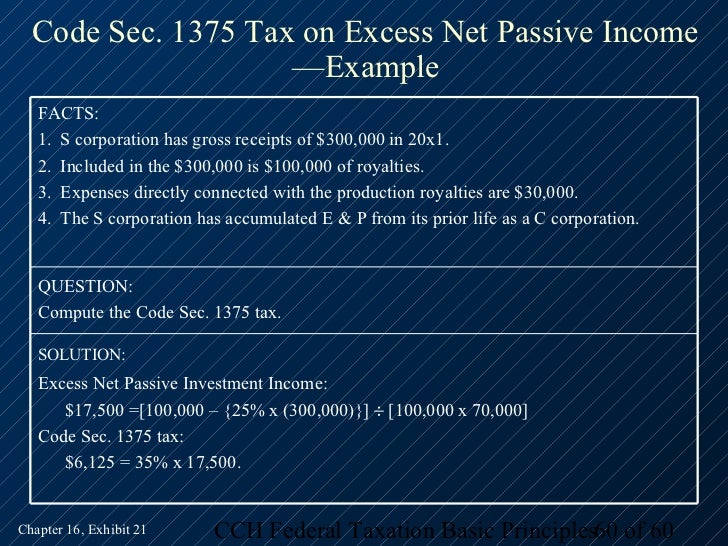

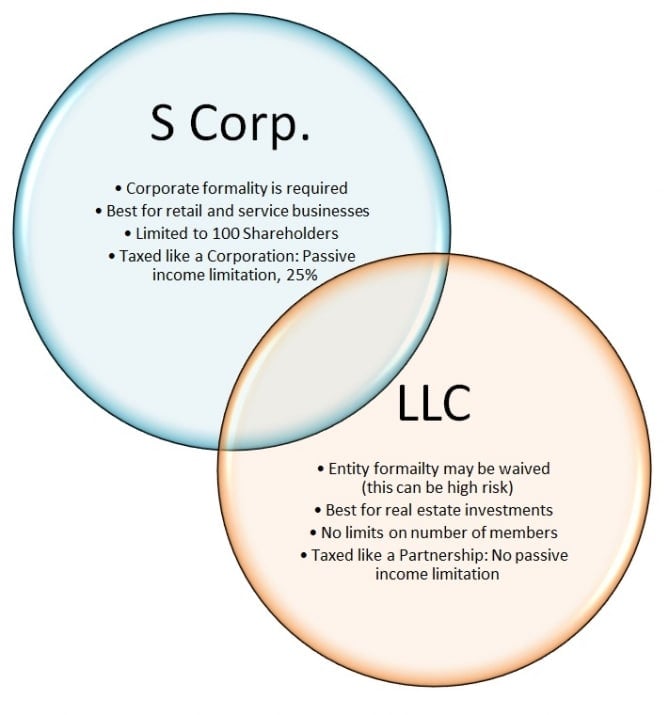

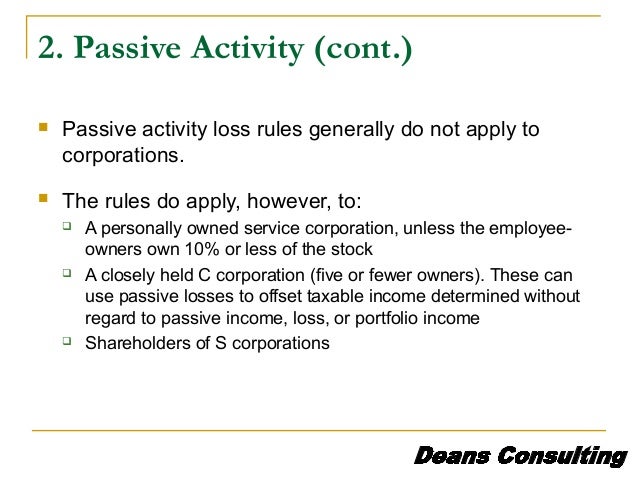

S corp passive income rules. Passive activity loss rules prevent investors from using losses incurred from income producing activities in which they are not materially involved. An s corporation is not permitted to generate more than 25 percent of its gross receipts from passive income in any given year if it has accumulated earnings and profits. The tax is imposed at the highest corporate tax rate 35. Since most of the time the s corp shareholder is actively involved in operating the business any loss is typically an active loss meaning it can be used to offset other ordinary income including wages.

The flow through income from an s corp is not earned income but it is not necessarily passive income loss. All shareholders in an s corporation will receive a schedule k 1. The irs has ruled plr 2012 29 007 that an s corporation s rental income is not passive income under section 1362 d 3 c i. Passive income exceeds the passive investment income limitation if the s corporation has accumulated earnings and profits at the close of each of three consecutive tax years this would occur only if the corporation or its predecessor had been a c corporation and has gross receipts for each of those tax years more than 25 of which are passive investment income sec.

Under the five out of ten year test an s corporation shareholder who materially participates in the business for at least five years and then retires will continue to receive nonpassive income or loss from the corporation through the sixth tax year following retirement regs. If an s corporation has income earnings for the year no more than 25 percent of its gross receipts for the year may be generated by passive income. If more than that comes from passive income the. If the business does generate more than 25 percent of its receipts from passive income the excess is taxed at the highest corporate income rate.

More than 25 of its gross receipts for the year are passive investment income and. 1 being materially involved with earned or. The private letter ruling addresses an s corporation that through its employees and other agents provided certain services regarding rental real estate property it owned. 1362 d 3 and regs.

Passive income includes income from interest dividends annuities rents and royalties. The corporation has accumulated e p from tax years in which it was a c corporation. The excess net passive income tax applies if passive income is more than 25 of the s corporation s gross receipts. Schedule k 1 is similar to a w 2 or form 1099 int and shows a variety of investment income information related to s corporations.

The code imposes a corporate level tax on an s corporation for a taxable year if. Passive income like rents and royalties.