Income Tax Calculator Canada Ey

To determine the value of other non refundable tax credits that may be available see the individual rate cards.

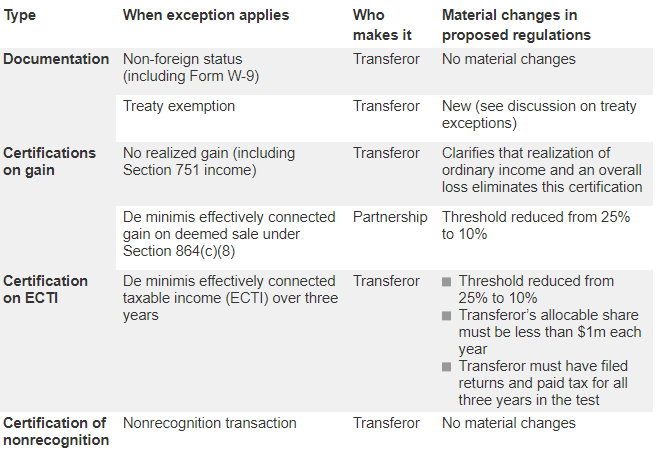

Income tax calculator canada ey. You can calculate your annual take home pay based of your annual gross income and the tax allowances tax credits and tax brackets as defined in the 2020 tax tables use the simple annual canada tax calculator or switch to the advanced canada annual tax calculator to review nis payments and income tax deductions for 2020. Canadian corporate tax rates for active business income. Eligible dividends are those paid by public corporations and private. To determine the value of other non refundable tax credits that may be available see the individual rate cards.

Tax alerts canada. Calculate your annual federal and provincial combined tax rate with our easy online tool. Eligible dividends are those paid by public corporations and private. These calculations do not include non refundable tax credits other than the basic personal tax credit.

The rates apply to the actual amount of taxable dividends received from taxable canadian corporations. Tax calculators rates. Organizations should consider co sourcing talent and technology to succeed in a complex environment finds the ey tax and finance operate global survey. The rates apply to the actual amount of taxable dividends received from taxable canadian corporations.

Calculate your combined federal and provincial tax bill in each province and territory. 2020 includes all rate changes announced up to july 31 2020. Find out more.