Passive Activity Loss Death

If the passive activity is a partnership interest the losses of the partnership in the year of death attributable to the decedent s interest are fully allocated to the decedent s estate since the tax year of the partnership does not close due to the death of a partner irc sec.

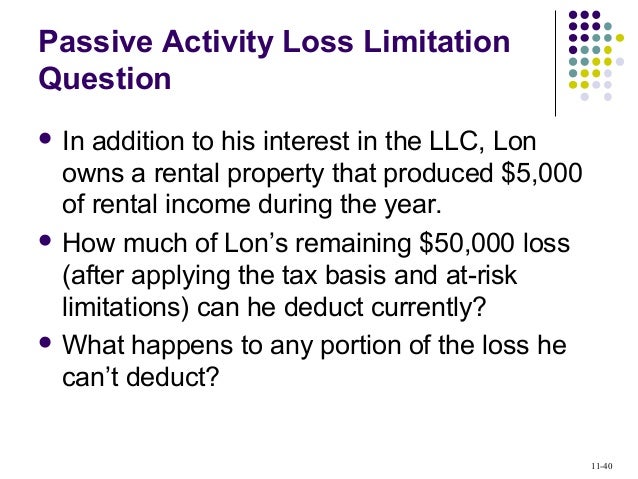

Passive activity loss death. Passive activity loss carryovers. Suspended losses transfers by. Suspended passive activity losses pals must be traced to the owner of the activity. If all or any part of your passive activity loss is disallowed for the tax year a ratable portion of the loss if any from each of your passive activities is disallowed.

If the passive activity is a partnership interest the losses of the partnership in the year of death attributable to the decedent s interest are fully allocated to the decedent s estate since the tax year of the partnership does not close due to the death of a partner irc sec. The passive activity loss and the passive activity credit and the 25 000 amount under subsection i shall be allocated to activities and within activities on a pro rata basis in such manner as the secretary may prescribe. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. Allocation of disallowed passive activity loss among activities.

For individuals with large pals it is important that practitioners be aware of the rules relating to the disposition and transfer of passive assets and be proactive in. The decedent s losses are allowed only. For example gain or loss from the sale of assets used in a trade or business is nonpassive if the taxpayer materially participates in the business. As a deduction against the decedent s income in the year of death.

469 g 2 b any of the decedent s pal carryovers are allowed on the final joint return for the year of death as the activity is considered disposed of. Passive activity losses pals generated when a taxpayer incurs ordinary losses in a passive investment may be treated differently in the case of a taxpayer s death. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.