Passive Income Offset Passive Loss

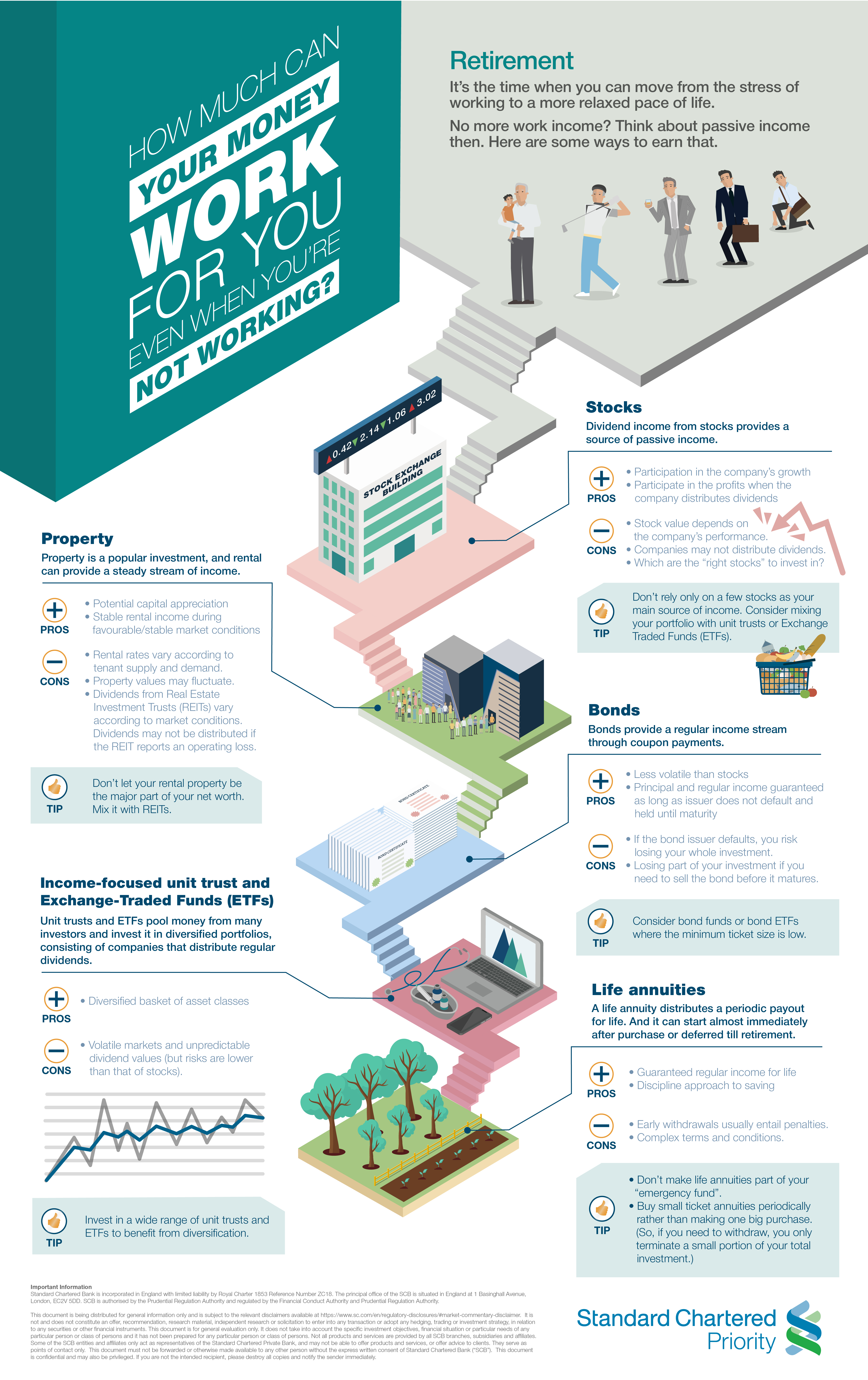

Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income.

Passive income offset passive loss. To qualify your modified adjusted gross income must not exceed 100 000 for the year. The term was defined in 1986 when the passive activity loss rules went into effect to try to close a tax loophole that allowed high income individuals with substantial on paper passive losses to. So if you have a passive loss from a passive activity and nonpassive income from a nonpassive activity such as a sole proprietorship that you own and run you would not be allowed to deduct a loss from the passive activity from a net profit of the sole proprietorship. A limited partner is generally passive due to more restrictive tests for.

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. If the current year non passive activity triggers deductibility of prior year suspended passive activity losses irc 469 f permits a prior year passive loss to offset current year income from the same activity even though that income might be non passive in the current year. As a result of this combination of income and losses the beechers paid no tax on the rental income paid to them by their corporations this amounted to over 85 000 of tax free income over three years. While net income or gain on sale is non passive it may be used to trigger prior year passive losses or credits from.

A passive activity is one wherein the taxpayer did not materially. There are limited partnerships that might pass passive income through a k 1. If you are the owner or landlord of a rental property a special rental loss offset lets you apply up to 25 000 of passive activity losses against your normal income. In a given year she earns 3 000 as her share of partnership profits.

You may not offset passive losses against nonpassive income. Before the passive activity rules these investors were allowed to offset other income like dividends interest and salaries and wages with these losses. They would use this lease income ordinarily passive income to offset the losses from their rentals. The losses can also be claimed to offset gains at the 4me of sale of the equity interest.

Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Rentals and businesses without material participation. At the same 4me tina is a passive investor in an s. According to the irs.

Passive losses are only offset by passive income not income from stocks bonds interest and dividends.