Passive Loss Rules Apply To All Corporations

The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder.

Passive loss rules apply to all corporations. This means that any losses passed through to you by partnerships or s corporations will be treated as passive as part of the partnership taxation. An associated regulation defining certain passive activities including rental activities specifies. Passive activities are trades businesses or income producing activities in which you don t materially participate the passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. The pal rules apply to all business activities but are particularly strict for real estate rentals because they were the primary tax shelter.

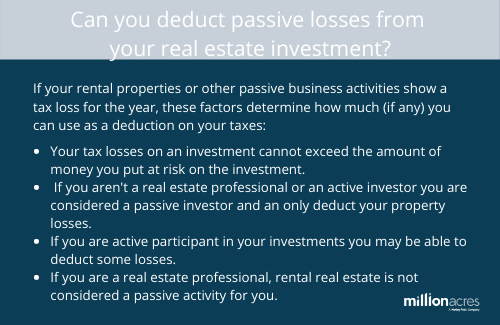

Passive income or loss comes from. The court acknowledged that the passive loss rules do not refer to s corporations at all. Passive activity rules apply to individuals estates trusts other than grantor trusts personal service corporations and closely held corporations. You can t deduct the excess expenses losses against earned income or against other nonpassive income.

Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. Passive activities are trades businesses or income producing activities in which you don t materially participate the passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. Nonpassive income for this purpose includes interest dividends annuities. In addition three other rules discussed below may limit the amount of losses and deductions that may be deducted.

The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. Work you do in your capacity as an investor does not constitute participation in the business unless you are directly involved in the day to day management or operations of the activity. They specifically apply to taxpayers who are individuals estates trusts closely held c corporations and personal service corporations. There are two types of passive income or loss.

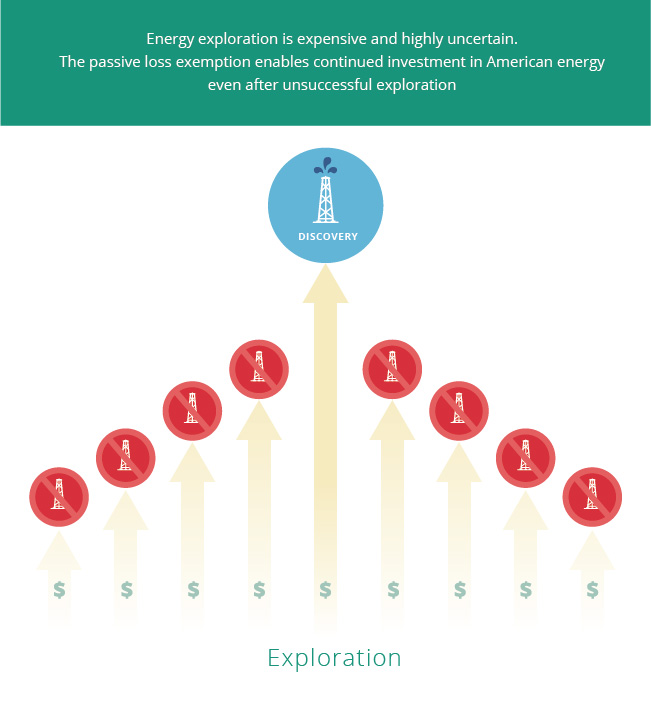

If the ventures are passive activities the passive activity loss rules prevent you from deducting expenses that are generated by them in excess of their income. The passive activity loss rules created a special category of income and loss called passive income or loss.