Qbi Deduction For Passive Income

The inclusion of reits in the qbi deduction therefore provides.

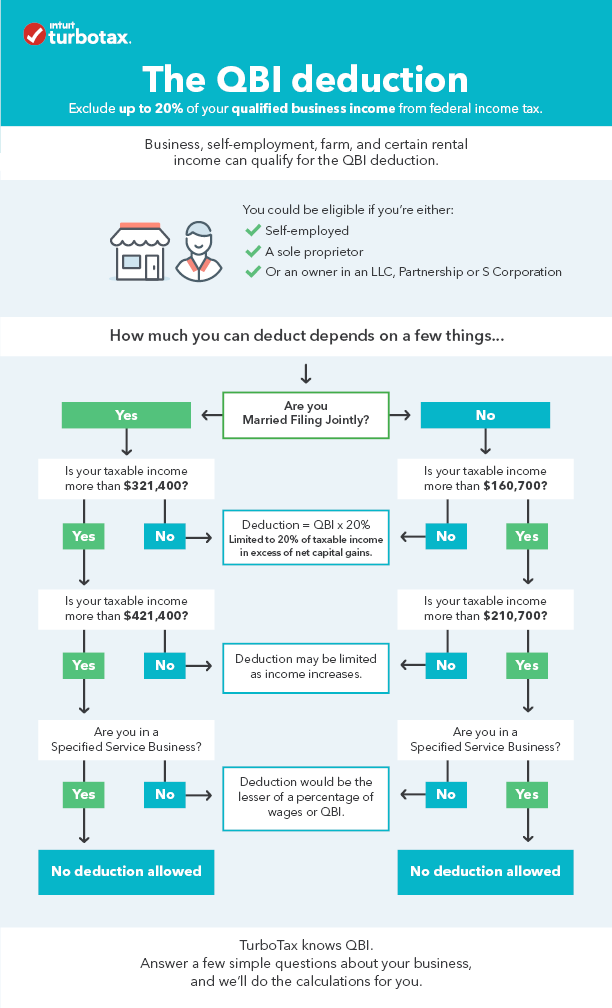

Qbi deduction for passive income. Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another. To qualify for the qualified business income qbi deduction you must be an owner of a pass through entity within the u s have qualified business income and not be barred from taking the deduction due to having substantial income and operating in a particular type of business. This will be explained in detail later. With the qbi deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax.

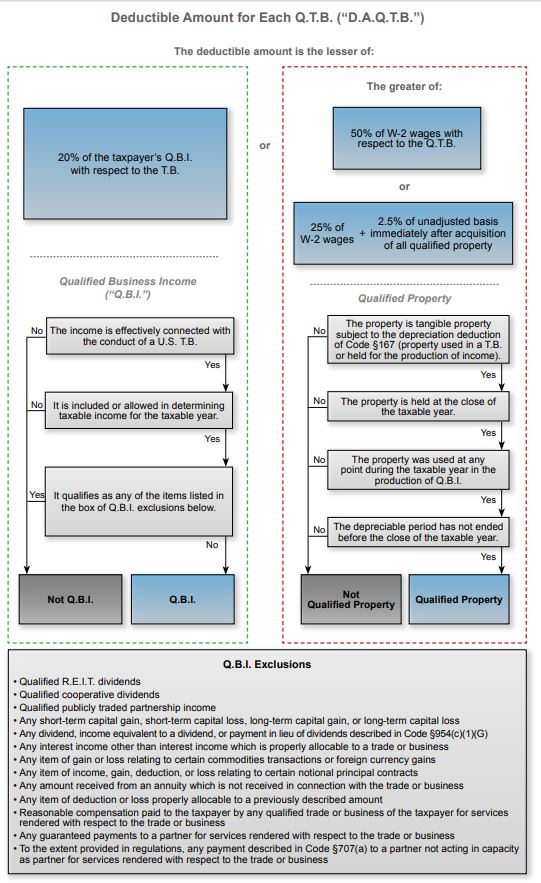

Those who can claim the qbi deduction include sole proprietors the partners of a partnership the shareholders in s corporations as well as some trusts and estates. The qbi deduction is typically not available to those who only receive passive investment income e g dividends interest capital gains. But the 50 000 loss is now carried forward to the next year because the sstb income is no longer qualified and the loss cannot be offset against it. The qualified business income qbi deduction also called pass through deduction or section 199a deduction was created by the 2017 tax cuts and jobs act tcja.

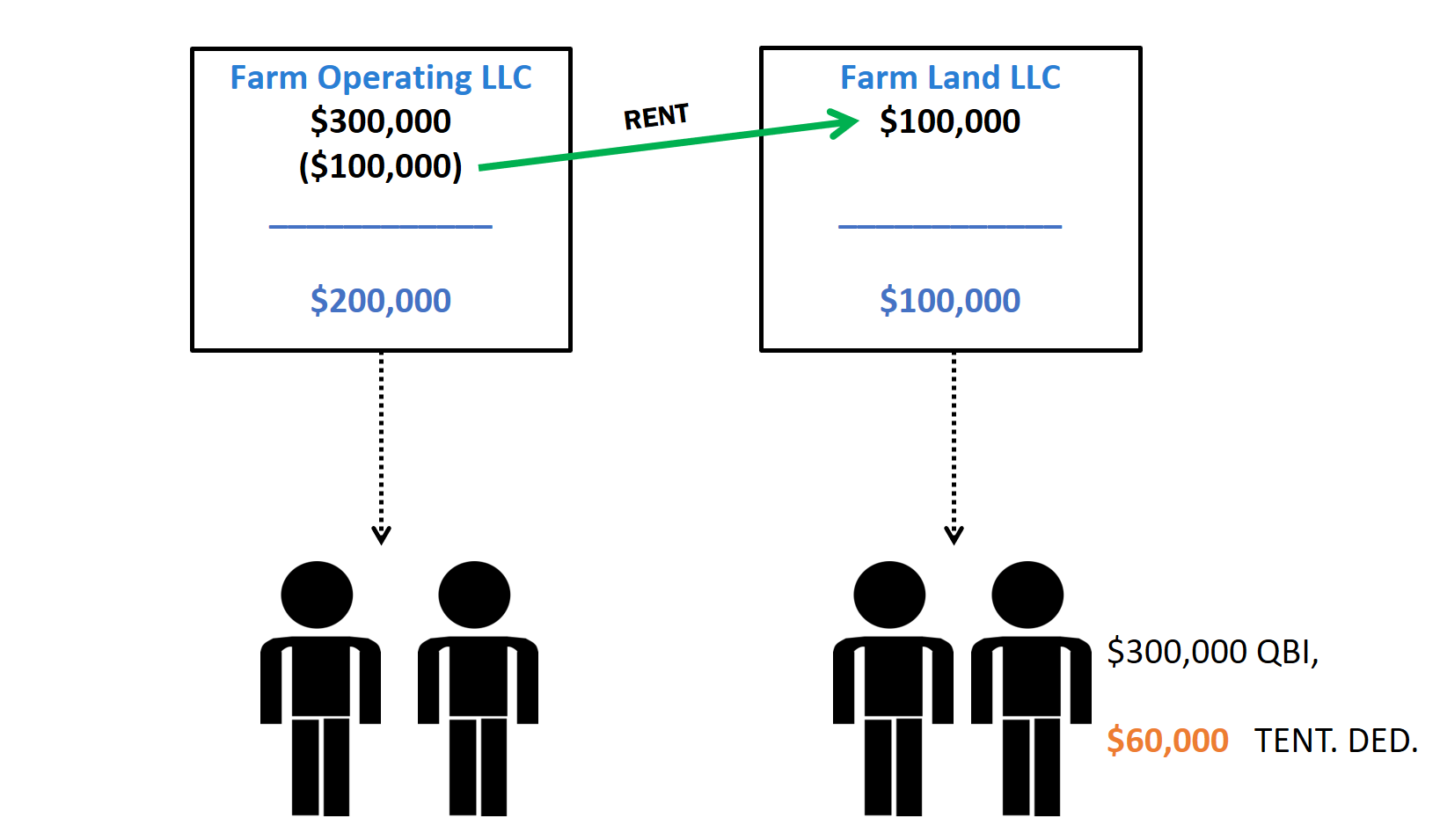

The qualified business income qbi deduction is a tax deduction for pass through entities. In determining if a rental activity is eligible for the qbi deduction many commentators recommended linking the qbi income deduction to material participation. If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction in the following year irc sec. The qualified business income deduction qbi deduction allows some individuals to deduct up to 20 of their business income reit dividends or ptp income on their individual income tax returns.

The qbi deduction is zero since taxable income exceeds the phaseout ceiling. Learn if your business qualifies for the qbi deduction of up to 20. The preamble to the final irc 199a regulations highlight that the u s. The practical result of this situation is that if you are a passive real estate investor you can only take advantage of the qbi deduction if you invest in an reit.

This means that income earned from a taxpayer s passive investment in a real estate activity does not qualify for the qbi deduction.