Income Brackets For Medicare Payments

If this is your filing situation you ll pay the following amounts for part b.

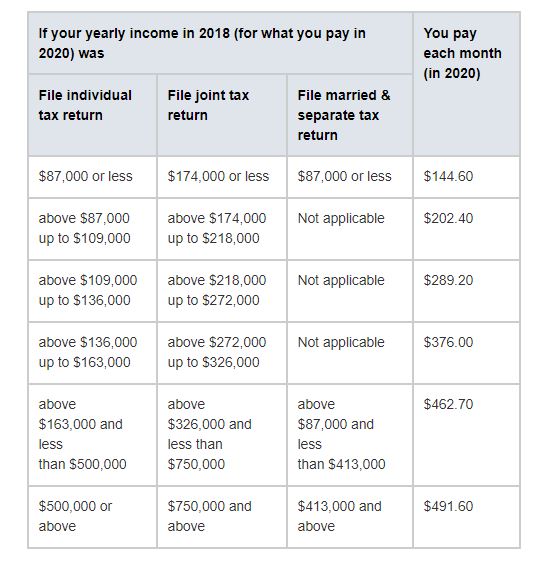

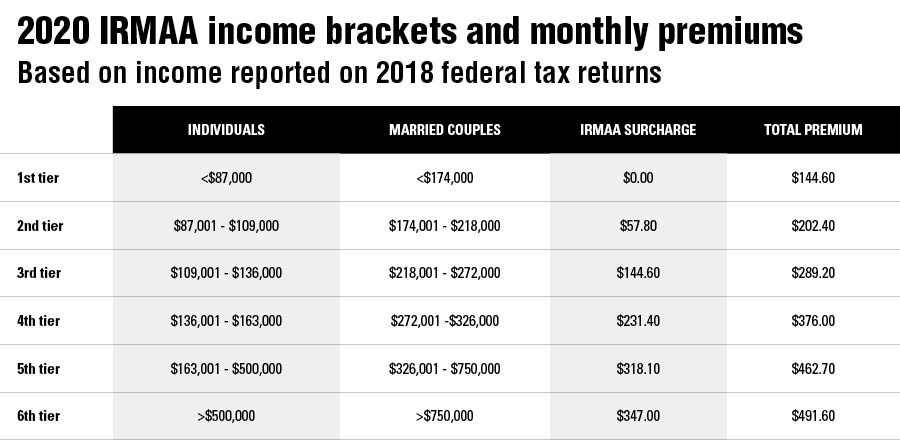

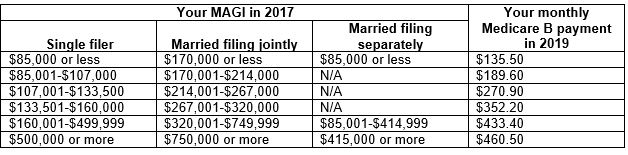

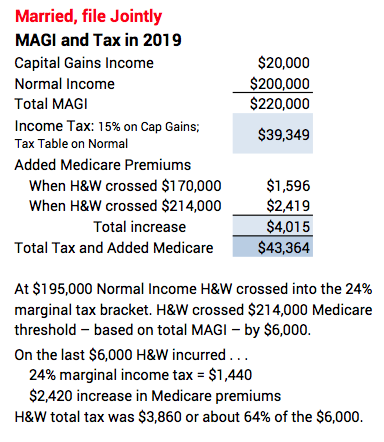

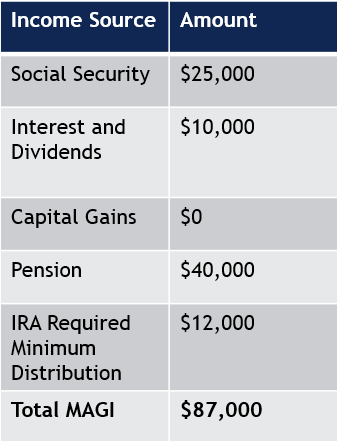

Income brackets for medicare payments. The standard monthly premium for medicare part b enrollees will be 144 60 for 2020 an increase of 9 10 from 135 50 in. If you have part b and or part d benefits which are optional your premiums will be based in part on your reported income level from two years prior. If your magi for 2018 was less than or equal to the higher income threshold 87 000 for an individual taxpayer 174 000 for a married couple filing jointly you pay the standard medicare part b rate for 2020 which is 144 60 a month. The income brackets are the same.

Higher income medicare beneficiaries also pay a surcharge for part d. Cms says 7 of medicare recipients will have to pay income related surcharges. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into part a at a reduced monthly premium rate which will be 259 in 2021 a 7 increase. Here are the income.

You have medicare and medicaid and medicaid pays your premiums. There s a form for this called form ssa 44 medicare income related monthly adjustment amount life changing event. Right now we only have two data points out of 12 to calculate the brackets for 2022. Medicare part b and part d require higher income earners to pay higher premiums for their plan.

Everything else including deductibles to copayments are going to be standard for. The surcharges are relatively smaller in dollars. This means that medicare part b and part d premiums in 2020 are based on a beneficiary s reported income in 2018. For example an individual earning more than 88 000 but less than or equal to 111 000 will pay 207 90 in total.

148 50 per month if you make 88 000. Irmaas are based on the modified adjusted gross income you reported on your taxes two years prior so your 2020 medicare premiums will be based on your 2018 tax return. Your state will pay the standard premium amount of 144 60 in 2020 your modified adjusted gross income as reported on your irs tax return from 2 years ago is above a certain amount. For 2020 the medicare part b monthly premiums and the annual deductible are higher than the 2019 amounts.

There are different brackets for married couples who file taxes separately. If you re in 1 of these 5 groups here s what you ll pay. Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in medicare part a.