Income Driven Repayment Plan Example

An income driven repayment plan allows you to set your monthly student loan payment to an amount that you can afford based on how much you earn.

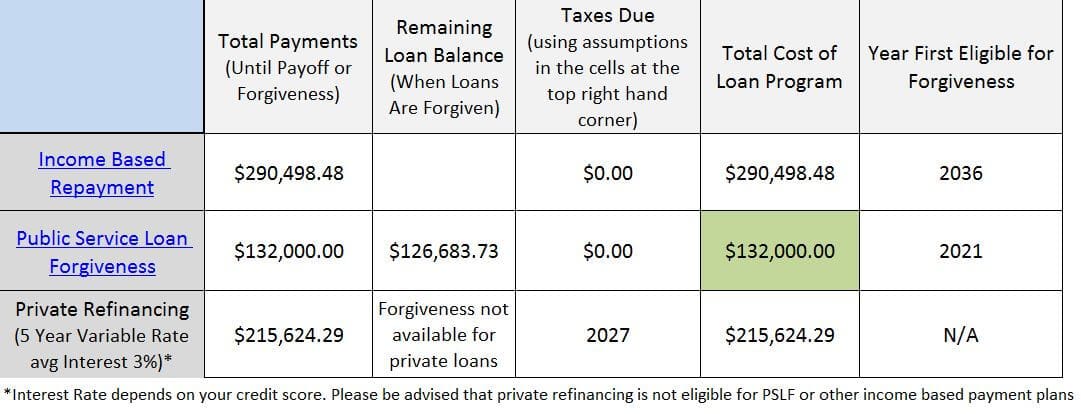

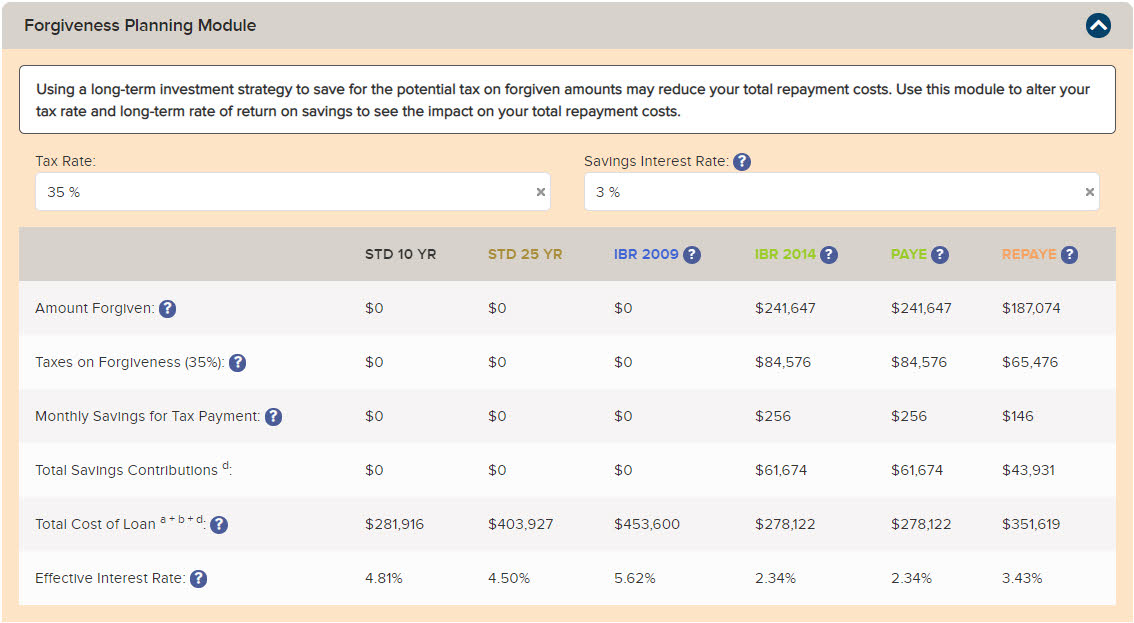

Income driven repayment plan example. After 20 or 25 years depending on the terms of your loan of qualifying payments your remaining loan balance is eligible for forgiveness. The typical borrower in income driven repayment is negatively amortizing and substantial forgiveness is projected for low income borrowers in such plans. Income driven repayment idr plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. Income driven repayment plans lower your monthly payment which can provide flexibility and extra money for living expenses savings and investments.

The results show that income driven repayment plans are heavily used by borrowers with large balances and low earnings. Any remaining student loan balance will be forgiven in 20 or 25 years. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income driven plans may be right for you. However an income driven repayment plan does not lower your interest rate.

Income driven repayment or idr plans are designed to make student loan repayment more affordable by limiting monthly payments to a certain percentage of a borrower s income. If you don t qualify for pslf because you work for a private employer for example you could still receive loan forgiveness after 20 or 25 years of repayment under an income driven repayment plan. You can choose from four different types of federal student aid income driven repayment plans offered by the department of education. Rather than default on your loans which total 32 731 at 4 5.

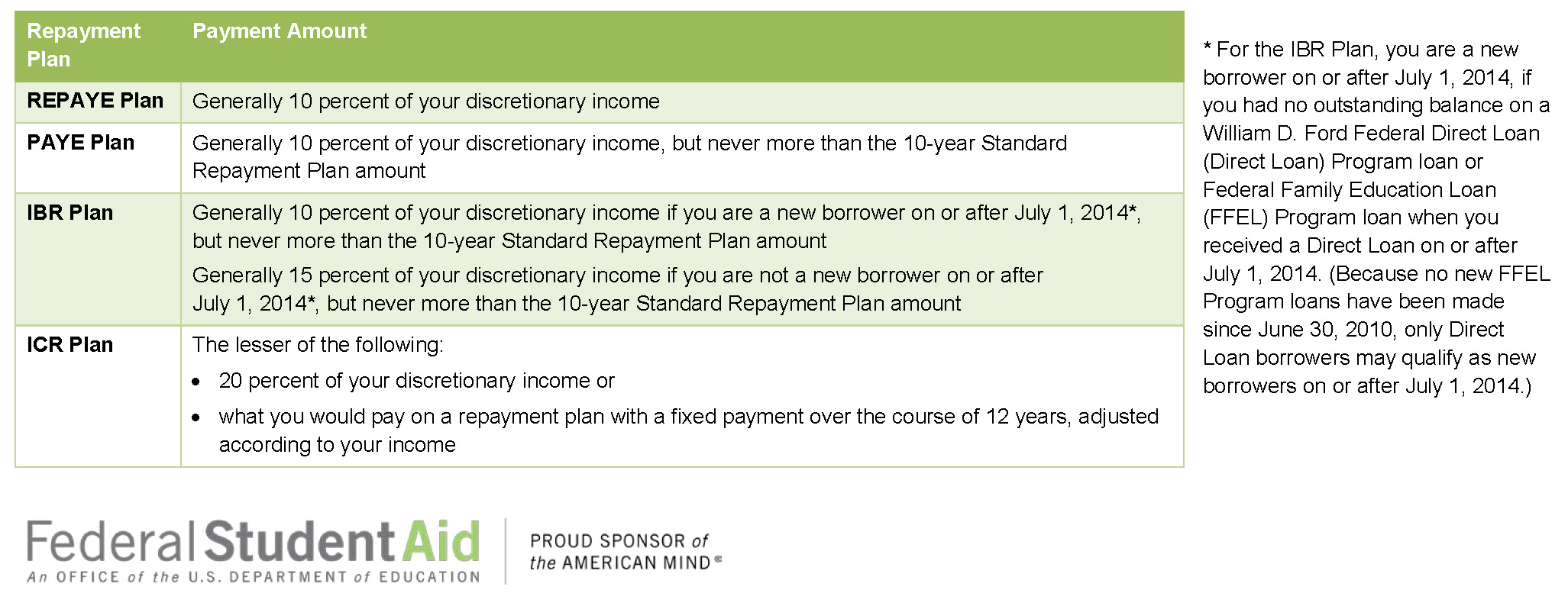

Income based repayment plan example. Types of income driven repayment plans. Here are five income based repayment plans that you can choose from. This plan requires that you have a partial financial hardship as defined on the income driven repayment plan request.

Depending on which you choose you ll pay anywhere between 10 to 20 of your monthly discretionary income based on annual updates. An income driven repayment idr plan is a type of federal plan to pay off your student loans that s based on your income. Revised pay as you earn repayment plan repaye your monthly payment is generally 10 of your discretionary income and is recalculated each year.