Income Driven Repayment Plan Married Filing Jointly

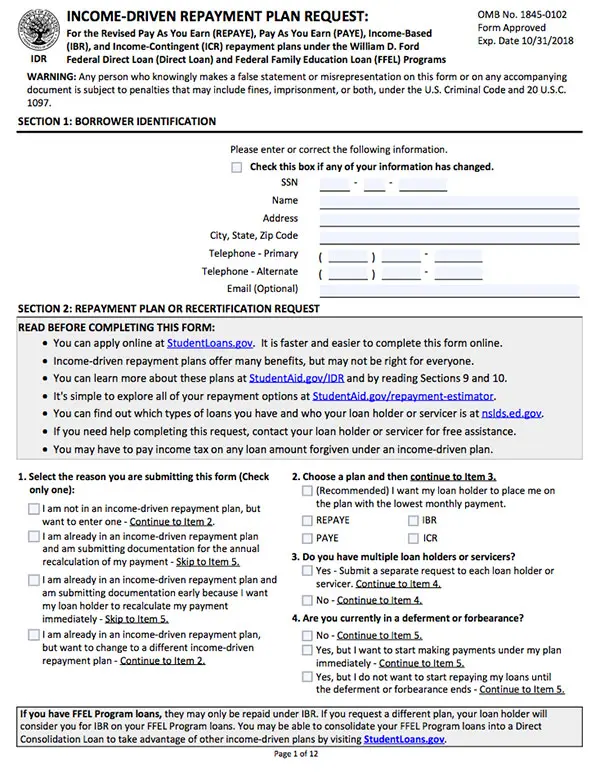

Income driven repayment plans.

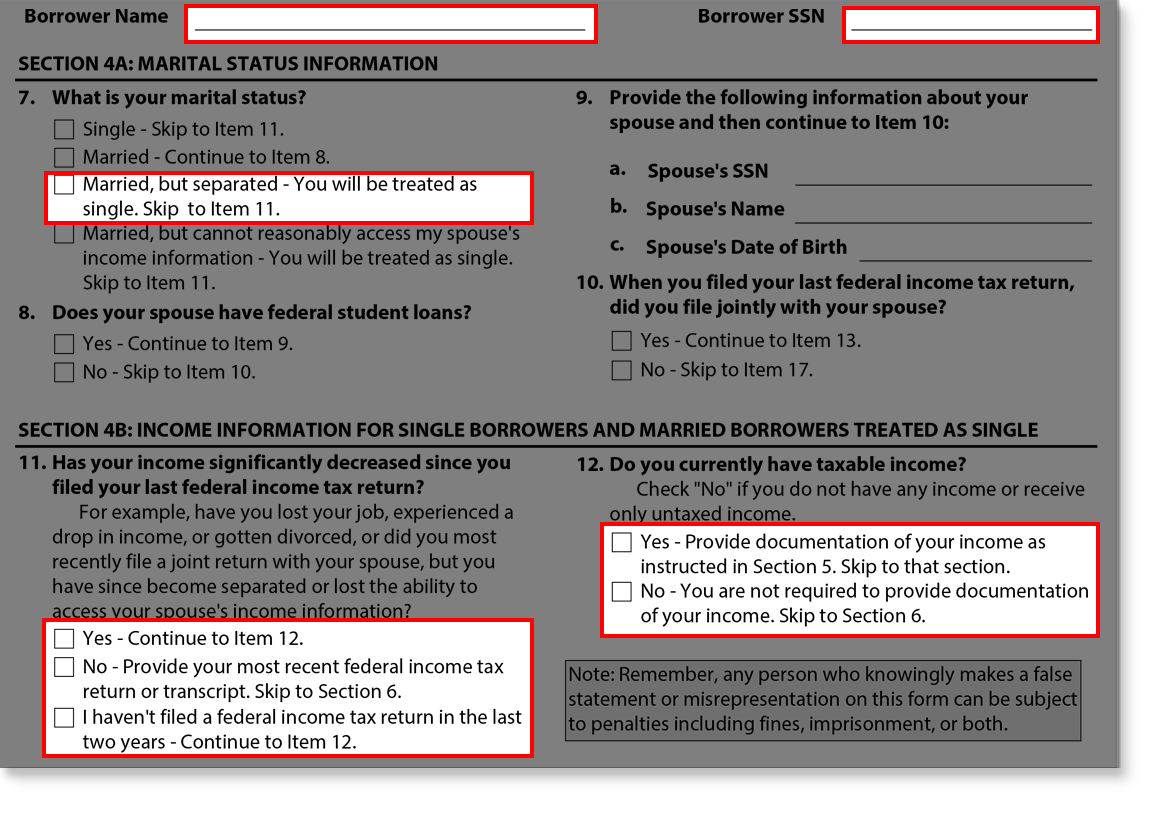

Income driven repayment plan married filing jointly. If you are on an income driven student loan repayment plan such as ibr or paye how you file your taxes can have a huge impact on your monthly payments. File jointly and your spouse s income affects how much you pay. However repaye another popular income driven repayment plan. Revised pay as you earn repaye only direct loans excludes parent plus loans.

If married spo use income and federal loan debt will be considered only if filing taxes jointly. However married filing separately can substantially lower your loan payment explained mark struthers a certified financial planner who founded sona financial. Student loan repayment can get complicated for married couples. Marriage can certainly complicate income driven repayment plans.

For both income based repayment ibr and pay as you earn repayment paye your monthly student loan. For married couples with student loan debt one of the most popular strategies for lowering your monthly student loan payment and potentially qualifying for more student loan forgiveness is to file your taxes married filing separately. Filing jointly means your total household income generated by both you and your spouse is taken into consideration by an income driven repayment plan. Many married couples have learned the hard way that ibr payments can be based upon the income of the couple.