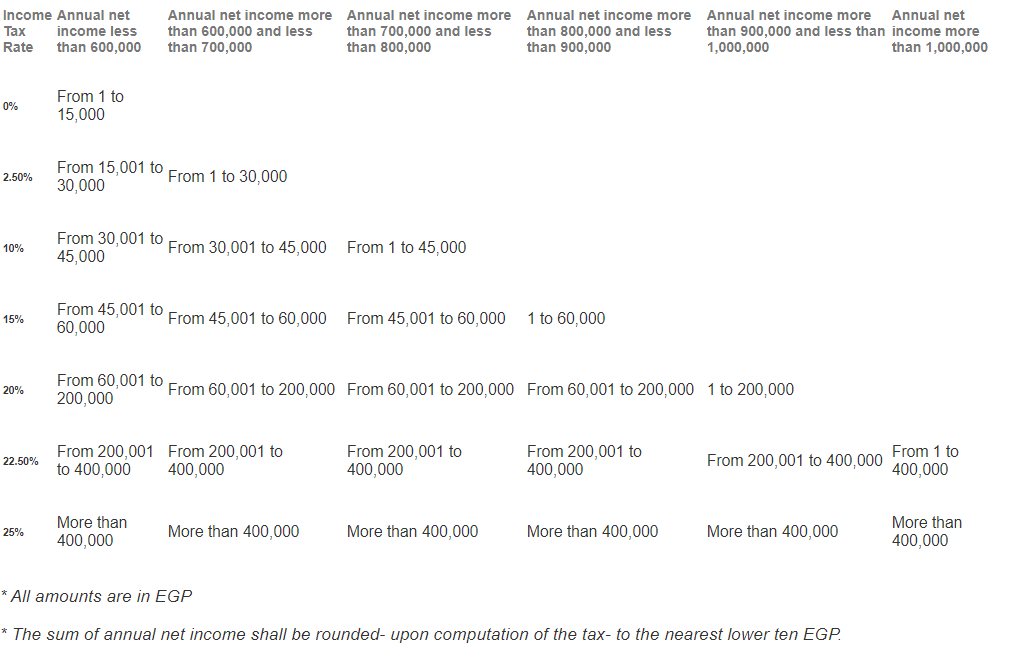

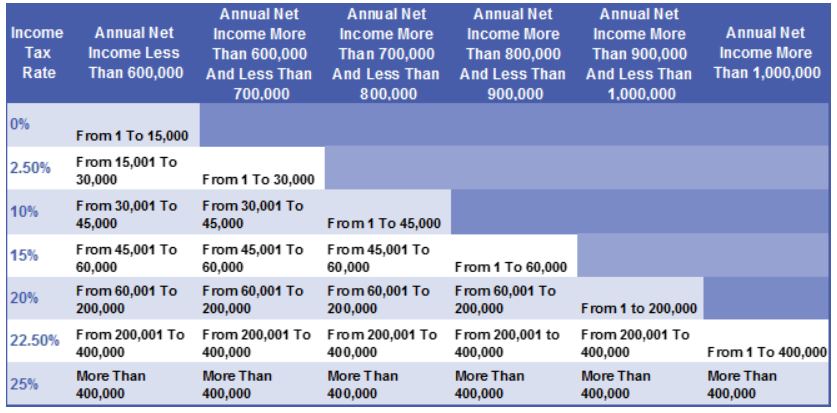

Income Tax Brackets Egypt

Egypt residents income tax tables in 2020.

Income tax brackets egypt. 200 000 45 000 155 000 x 20 31 000. Taxable income taxable income includes income from employment income from commercial or industrial activities and income from noncommercial activities i. The net taxable income of above egp 1 million is not eligible for the 0 2 5 10 15 and 20 tax brackets. Tax thus applies to earned income business and other non commercial profits and wages under this regime.

Income tax rates and thresholds annual tax rate taxable income threshold. Tax rate on income in bracket. Kpmg s individual income tax rates table provides a view of individual income tax rates. Total tax on income below bracket.

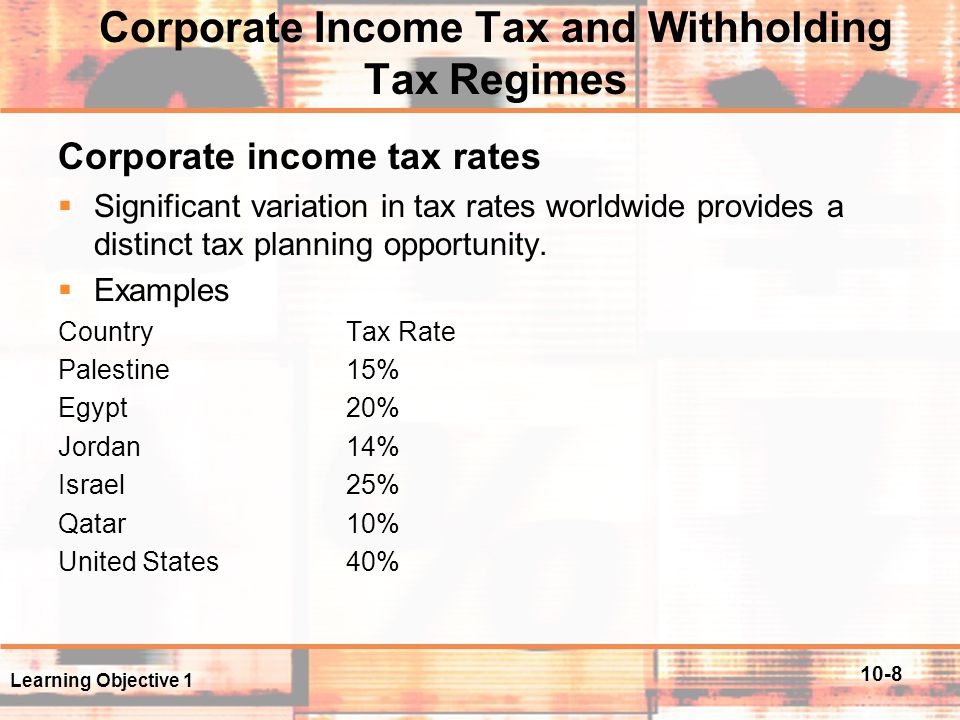

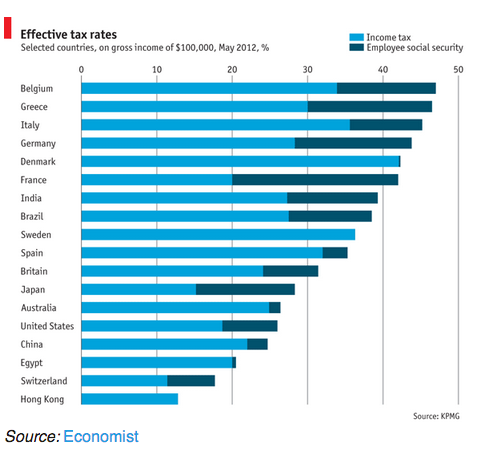

The personal income tax rate in egypt stands at 22 50 percent. 20 of the difference between final tax due as per the egyptian tax authority eta and the tax due as per the tax return this will apply if the difference is less than 50 of the final tax due. Personal income tax applies to all residents and individual companies operating in egypt at a rate reaching up to 20 of the net annual revenue. Kpmg s individual income tax rates table provides a view of individual income tax rates around the world.

30 000 6 500 23 500x 10 2 350. Personal income tax rate in egypt averaged 23 31 percent from 2004 until 2020 reaching an all time high of 34 percent in 2005 and a record low of 20 percent in 2006. This page provides the latest reported value for egypt personal income tax rate plus previous releases historical high and low short term forecast and long term. If you are a contractor and want a calculation on your tax and net retention in egypt we can supply it to you free of charge.

A quick and efficient way to compare salaries in egypt review income tax deductions for income in egypt and estimate your tax returns for your salary in egypt the egypt tax calculator is a diverse tool and we may refer to it as the egypt wage calculator salary calculator or egypt salary. The annual net taxable income ranging between egp 900 000 and egp 1 million is not eligible for the 0 2 5 10 and 15 tax brackets. Egypt highlights 2020 page 4 of 10 basis resident individuals are taxable on their worldwide income if egypt is the center of their commercial interests nonresident individuals are taxed only on their egyptian source income. Income from 45 000 01.

Use our interactive tax rates tool to compare tax rates by country or region. Income tax in egypt can range from 0 to 25 percent and you need to be sure you are placed in the correct tax brackets. These rates and credits are applied. Calculate your take home pay in egypt that s your salary after tax with the egypt salary calculator.

40 of the difference between final tax due as per the eta and the tax due as per the tax return this will apply if the difference is more than 50 of the final tax due.