Income Tax Brackets Nz 2020

Individuals pay progressive tax rates.

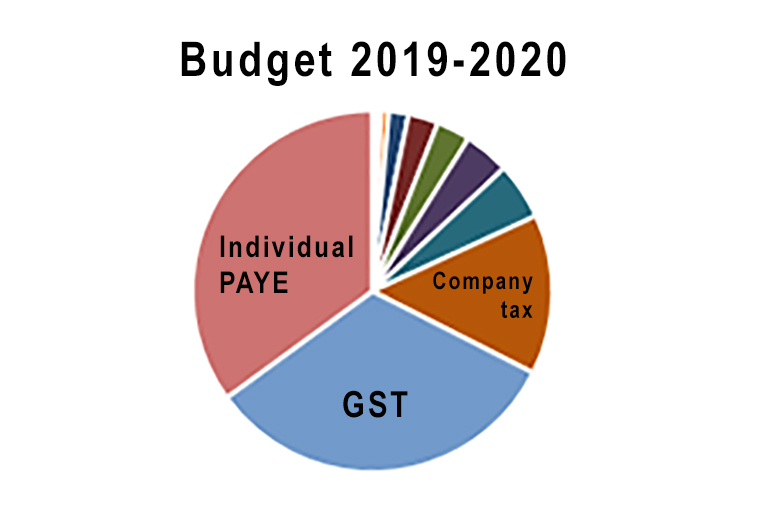

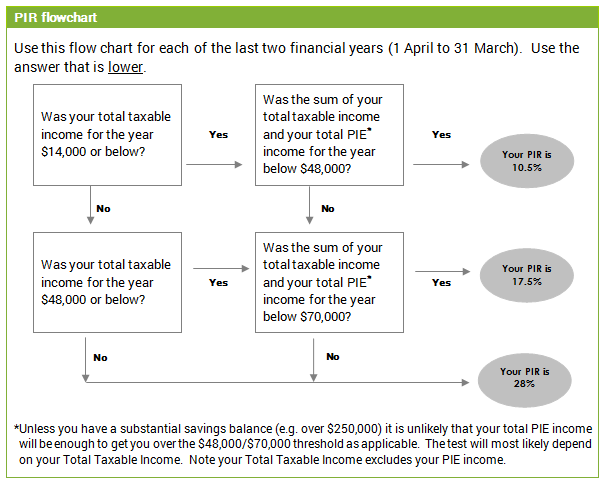

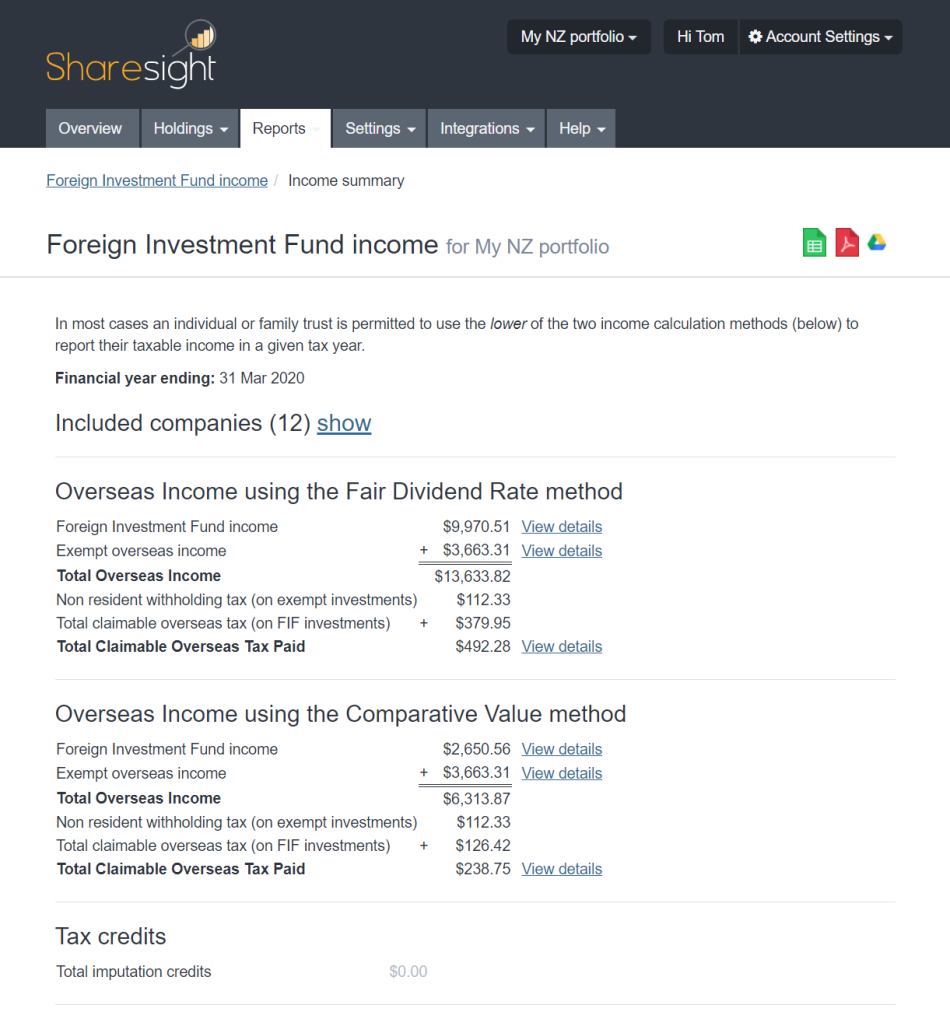

Income tax brackets nz 2020. The top personal tax rate is 33 for income over nz 70 000. Income tax rates 2019 2020. Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources. How income gets taxed income is taxed differently depending on where it comes from.

At the 2020 election labour promised to introduce a new top tax rate of. This includes income from self employment or renting out property and some overseas income. Tax rates income tax. Which tax rate applies to me.

Personal income tax rates. New zealand s tax year runs from the 1st of april to the 31st march. A non resident is subject to tax only on income from sources in new zealand. Tax codes only apply to individuals.

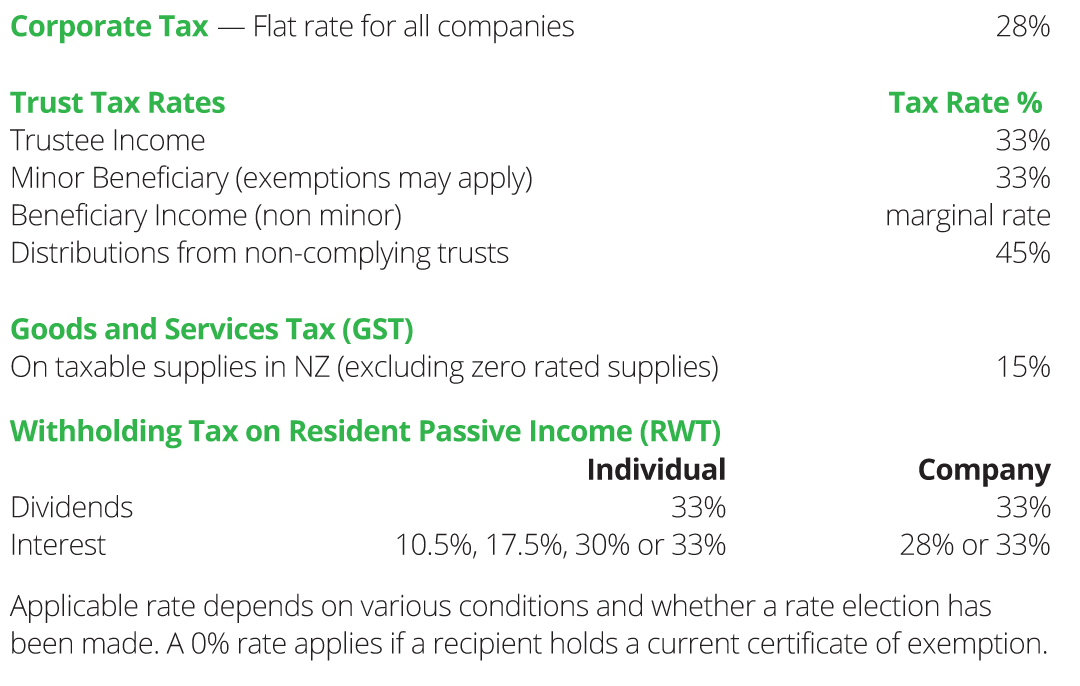

Companies and corporates are taxed at a flat rate of 28. Income tax rates in new zealand. New zealand has a bracketed income tax system with four income tax brackets ranging from a low of 11 50 for those earning under 14 000 to a high of 35 50 for those earning more then 70 000 a year. Companies are required to pay tax on any profit they make.

New zealand s personal income tax rates depend on your income increases. New zealand has progressive or gradual tax rates. Individual tax rates are currently as follows. The tax bands have remained the same from the 2012 tax year onwards.

We either automatically assess you or you need to file an ir3 return. How does the new zealand income tax compare to the rest of the world. Individual taxes on personal income last reviewed 02 october 2020. They help your employer or payer work out how much tax to deduct before they pay you.

Tax codes are different from tax rates. 10 5 percent 17 5 percent 30 percent and 33 percent. The standard tax rate for a company in the 2016 financial year 01 04 2015 31 03 2016 is 28 or 28 cents in the dollar. The amount of tax you pay depends on your total income for the tax year.

There are currently four individual income tax rates in new zealand. Here are the tax bands. The lowest personal tax rate is 10 5 for income up to 14 000. Tax codes and tax rates for individuals how tax rates and tax codes work.

The exception are look through companies ltc s which operate slightly differently and pass on any profit or loss to the shareholders. You pay tax on this income at the end of the tax year. Taxable income nzd tax on column 1 nzd tax on excess over.