Income Tax Calculator Tn 2020

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

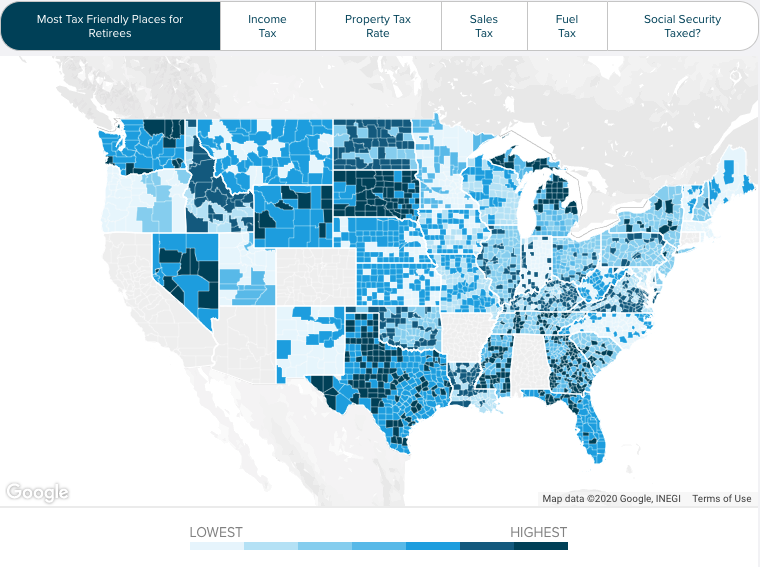

Income tax calculator tn 2020. The hall income tax is being phased out and will decrease 1 every year until it reaches 0. Income tax calculator estimate your 2020 tax refund. The state has a flat 1 tax rate that applies to income earned from interest and dividends though. No tennessee cities have local income taxes.

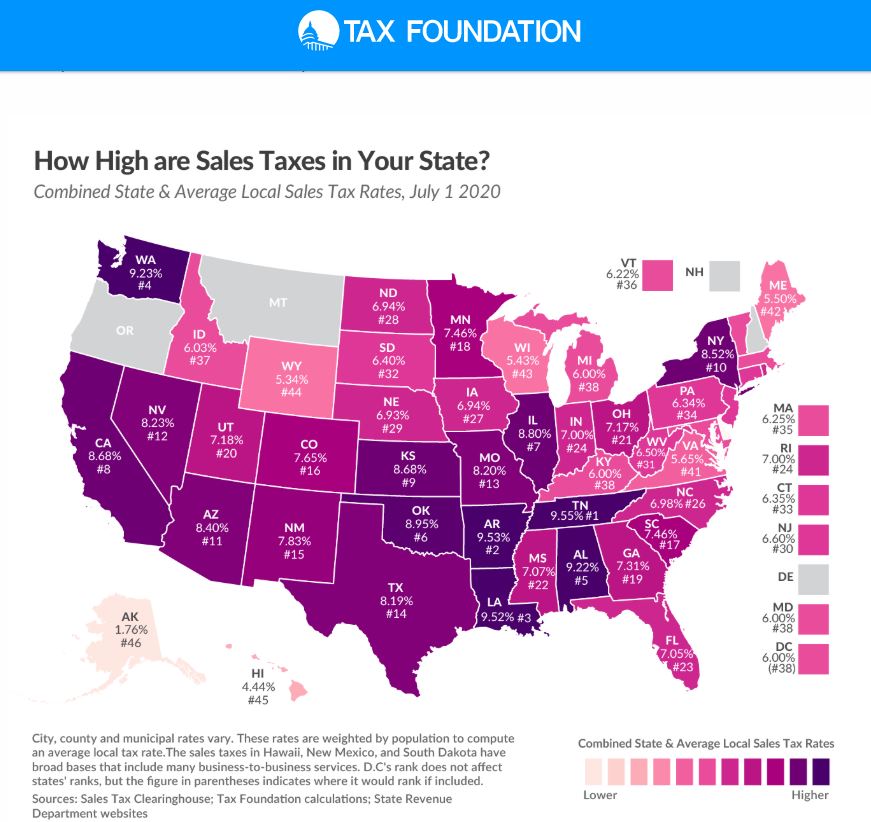

The final tax year with the tax will be 2020. In 2019 the tax was 2. The statewide base sales tax in tennessee is 7 which by itself is the second highest statewide rate in the nation. If you make 55 000 a year living in the region of tennessee usa you will be taxed 9 482 that means that your net pay will be 45 518 per year or 3 793 per month.

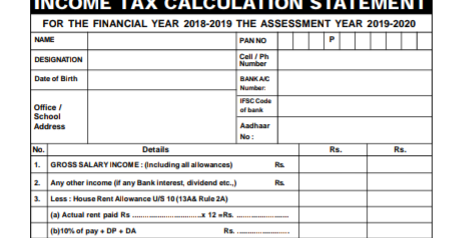

After tax income is your total income net of federal tax provincial tax and payroll tax. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. The 2020 tax calculator uses the 2020 federal tax tables and 2020 federal tax tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The 2020 state personal income tax brackets are updated from the tennessee and tax foundation data.

The basic personal tax amount cpp qpp qpip and ei premiums and the canada employment amount. Tennessee tax forms are sourced from the tennessee income tax forms page and are updated on a yearly. The tennessee tax calculator is designed to provide a simple illlustration of the state income tax due in tennessee to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator. In tennessee there is no income tax on wages.

Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. 2020 tennessee tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Rates are up to date as of april 28 2020. Icalculator aims to make calculating your federal and state taxes and medicare as simple as possible.

How to calculate federal tax based on your annual income. Before the official 2020 tennessee income tax rates are released provisional 2020 tax rates are based on tennessee s 2019 income tax brackets.