Passive Activity Loss Form 8582

The passive activity rules limit a taxpayer s losses in an activity if he or she does not materially participate in the activity.

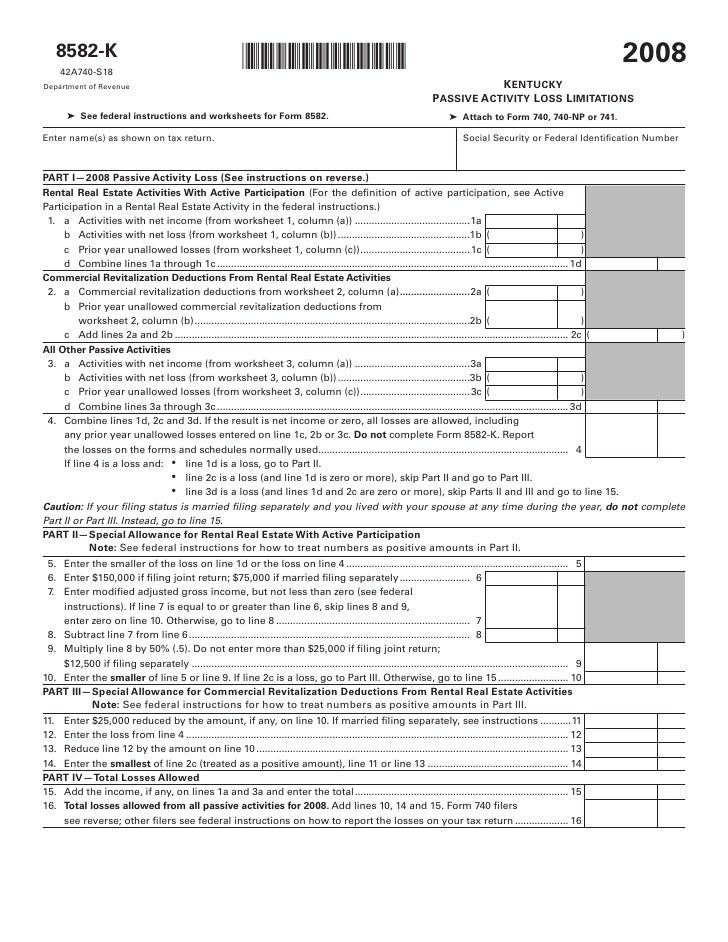

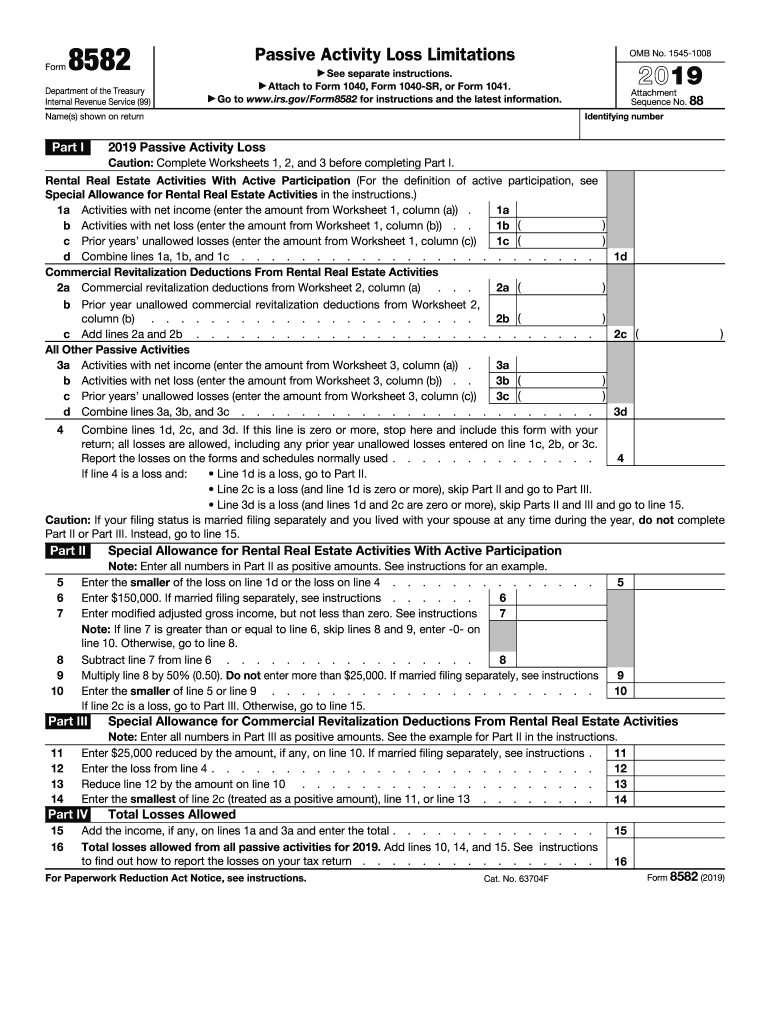

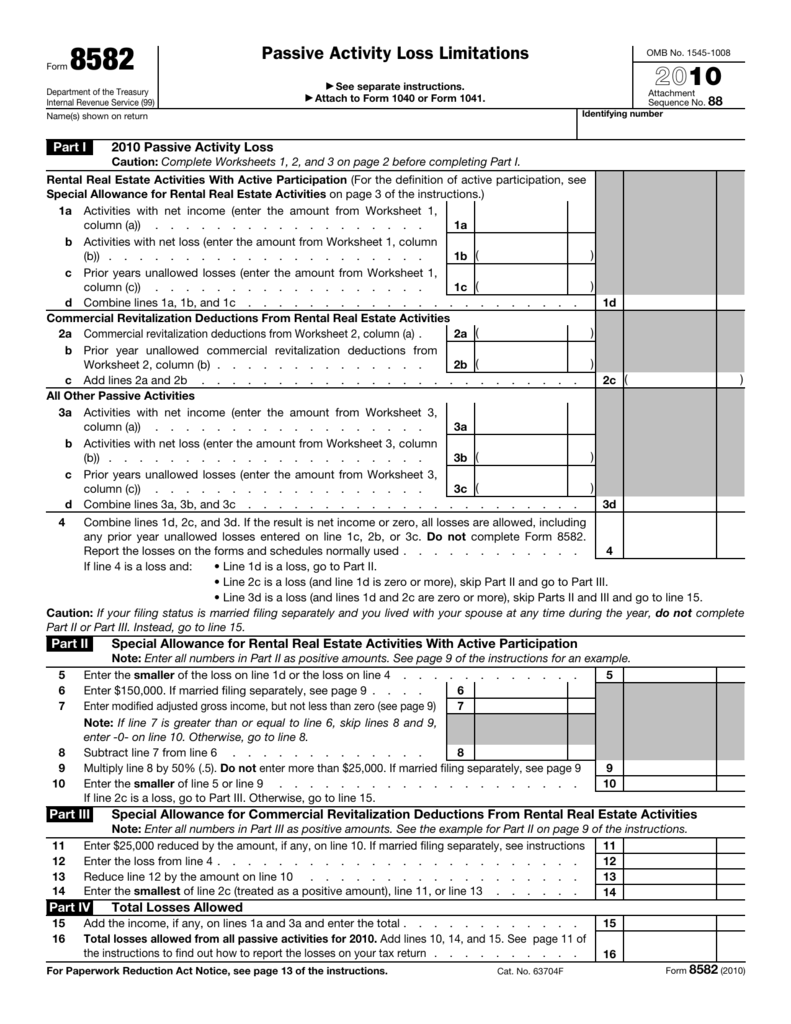

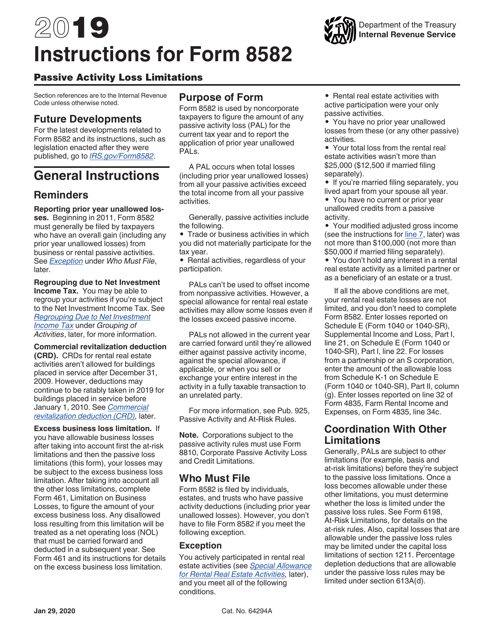

Passive activity loss form 8582. Who must file form 8582 cr is filed by individuals estates and trusts with any of the following credits from passive activities. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss pal for the current year. Information about form 8582 passive activity loss limitations including recent updates related forms and instructions on how to file. Form 8582 passive loss limitations.

Passive loss carryovers for rental activities are not reported on schedule e. Corporations subject to the passive activity rules must use form 8810 corporate passive activity loss and credit limitations. Form 8582 passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Don t report passive income gains or losses from a ptp on form 8582.

925 passive activity and at risk rules. Limiting passive activity losses began with the tax reform act of 1986 as a means of discouraging economic activity undertaken strictly as a tax shelter. Form 8582 has three pages and worksheet 6 appears on the last page. Form 8582 department of the treasury internal revenue service 99 passive activity loss limitations see separate instructions.

Form 8582 is used by individuals estates and trusts with losses from passive activities to figure the amount of any passive activity loss pal allowed for the current tax year. Instead use the following rules to figure and report your income gains and losses from passive activities you held through each ptp you owned during the tax year. Passive activity loss rules for partners in ptps. Attach to form 1040 form 1040 sr or form 1041.

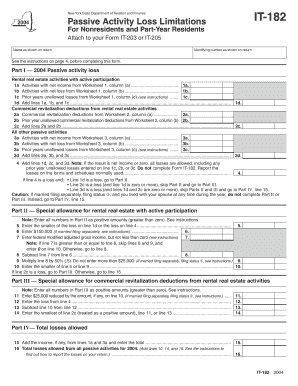

You will find the carryover for next year on form 8582 worksheet 6 column b. Also you will need to report any previously suspended losses from. Non corporate taxpayers will need to use irs form 8582 to determine the amount of passive activity losses for a given tax year. Any difference between the passive activity loss allowed on the federal form 8582 and on the recomputed form 8582 is also a schedule i adjustment.

Write passive activity loss on the line provided. To adjust for this difference the amount of the passive activity loss allowed for federal purposes would be added back to federal income on line 2h.