Passive Income Loss Carryover

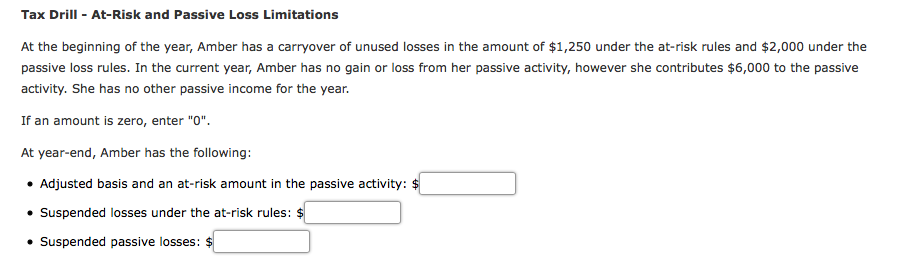

Passive loss carryover occurs when you do not have enough passive income by which to offset these losses for a given tax year.

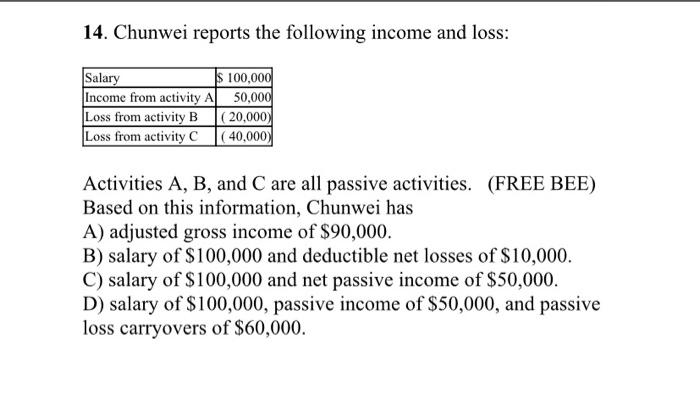

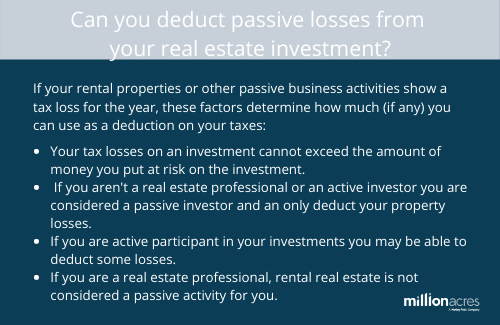

Passive income loss carryover. A taxpayer can apply suspended losses against passive activity income from any source not just from the activity that created the loss. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. The loss continues to be carried over until you use up the entire amount. A passive loss is a financial loss within an investment in any trade or business enterprise in which the investor is not a material participant.

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. You can carry over these losses until you sell the asset or realize. A passive loss carryover is created when you have more expenses than income a loss from passive activities in a prior year that could not be used that year.