Passive Income Subject To Final Tax Philippines

Money market placements 4.

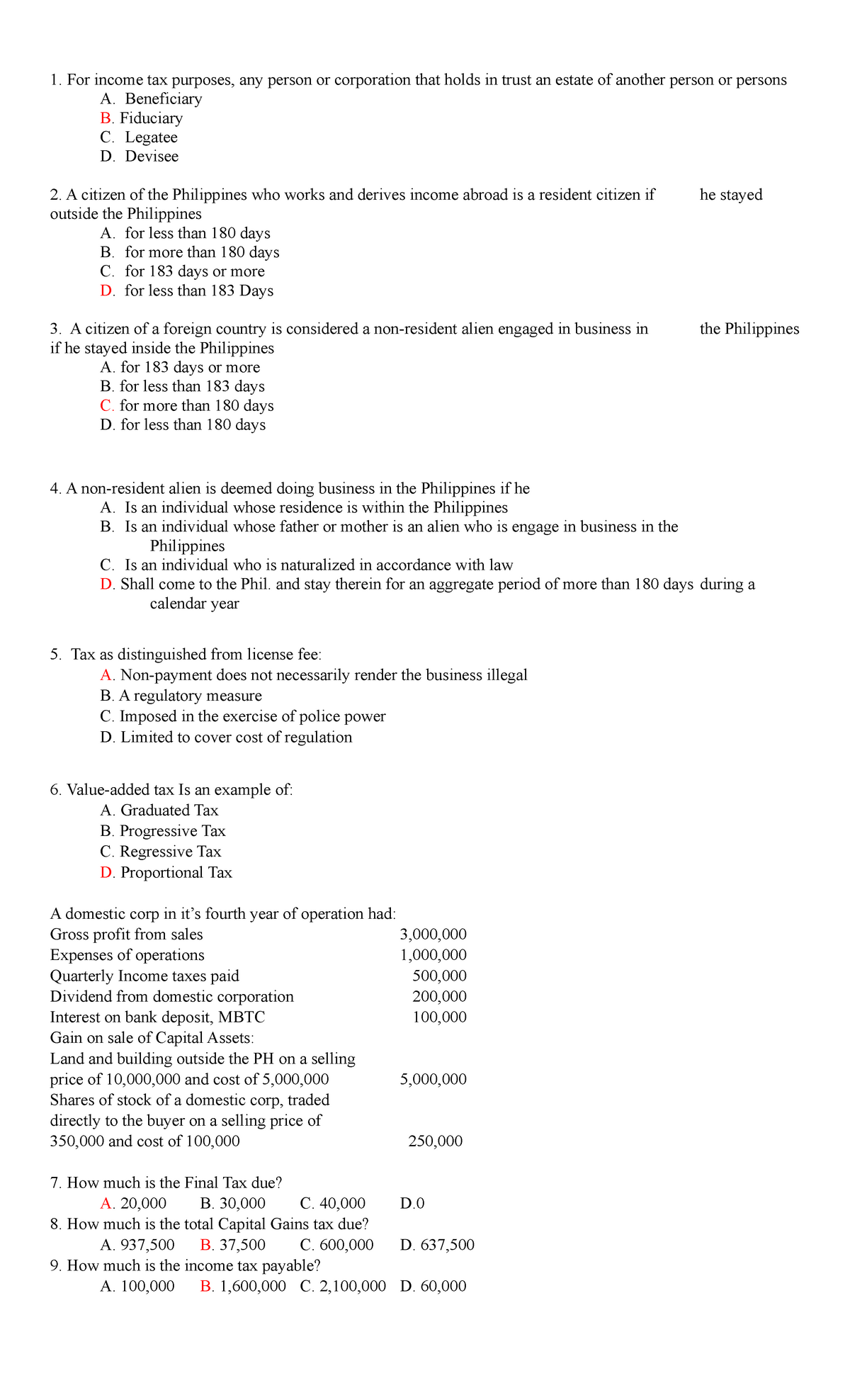

Passive income subject to final tax philippines. Tax rates for income subject to final tax. An improperly accumulated earnings tax of 10 is imposed on improperly accumulated income. Interest income from which of the following sources is subject to final income. Certain passive income from domestic sources is subject to final tax rather than ordinary income tax see the income determination section improperly accumulated earnings tax.

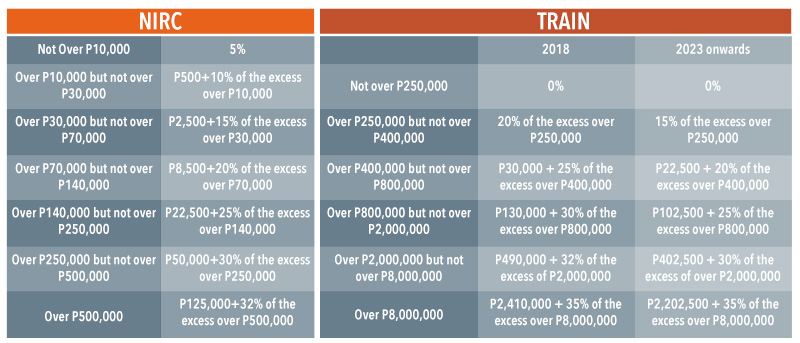

Last february 2018 the bureau of internal revenue bir released revenue regulations no. For local and foreign taxpayers living in the philippines here s the bir tax table showing the tax rates on passive income. 25 a 1 of the tax code. The exemption final tax on interest from long term deposit is not.

Passive income which have been subject to a final tax at source do not form part of gross income for purposes of computing the mcit. Nraetb non resident alien engaged in trade or business within the philippines nranetb non resident alien not engaged in trade or business within the philippines nrfc non resident foreign corporations nr non resident obu offshore banking units. 8 2018 which discusses the income tax provisions of the train law. On certain passive income cash and or property dividend share in the distributable net income of a partnership interest on any bank deposits royalties prizes except prizes amounting to p10 000 or less which is subject to tax under sec.

Cost of goods sold includes all business expenses directly incurred to produce the merchandise to bring them to their present location and use. The tax rate of 20 on prizes over php 10 000 is automatically deducted before you receive it. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. Final tax interests passive income prizes royalties this is subject to final withholding income tax as follows.

The final withholding tax final withholding tax is imposed to certain passive income under the final withholding tax system pm. The final tax does not apply to interest on select the best answer d. Final tax applies only on certain passive income earned within philippines. The newly approved train tax reform law also adjusted the tax rates on certain passive income in addition to revised personal income tax rates and new taxes imposed on oil sugary beverages tobacco mining etc.

The taxpayer has no more responsibility to file an income tax return for the passive income covered subject to fwt. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. Winnings except from philippine charity sweepstake office and lotto. The taxpayer actually shoulders the tax but it is the income payor who withholds and pays the tax the amount of tax withheld if final pm.