Base Rate Entity Passive Income Meaning

Coffee and cake pty ltd is the owner of a small cafe.

Base rate entity passive income meaning. Similarly if the only income of a discretionary trust was from the carrying on of a trading business an amount distributed to a company would not be base rate entity passive income. Capital gains and franked dividends are the only base rate entity passive income that a trust can stream provided the trust deed allows it. The legislation also makes changes to how a corporate. Example 2 base rate entity.

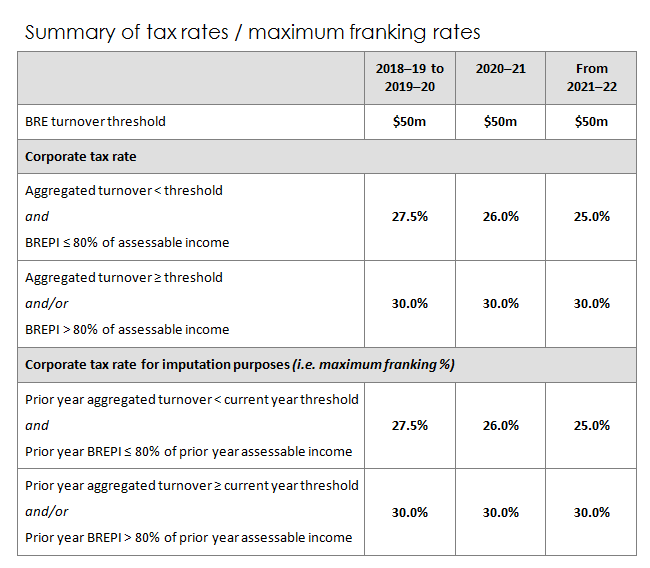

Because this income is only 3 8 of its assessable income happy feet pty ltd is a base rate entity for the 2019 20 income year and the 27 5 company tax rate applies. Passive income for base rate entity. What amounts of assessable income are base rate entity passive income brepi the meaning of rent interest and when a share of net income of a trust or partnership is referable to an amount of brepi and how to calculate a corporate tax entity s corporate tax rate for imputation purposes and work out the maximum amount of the franking. Starting any type of brand new business particularly an on the internet business can be actually difficult.

Income tax rates act 1986 sect 23ab meaning of base rate entity passive income 1 base rate entity passive income is assessable income that is any of the following. 23aa of the itr act if it satisfies two requirements. The interest income is base rate entity passive income. Instead the carrying on a business test has now been replaced with a passive income test.

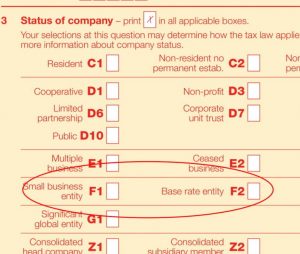

From the 2017 18 income year a corporate tax entity must be a base rate entity to be taxed at the lower rate. The ruling considers the meaning of certain types of base. Law companion ruling lcr 2019 5 deals with the passive income threshold and other issues within the treasury laws amendment enterprise tax plan base rate entities act 2018 that limits access to the lower corporate tax rate. Law companion ruling 2019 5 base rate entities and base rate entity passive income the ato released a law companion ruling lcr on 13 december 2019 describing how the commissioner would apply the law to base rate entities from the 2017 18 income year onward.