Passive Income Tax Rates Train Law

How about the employee making p1 million a year.

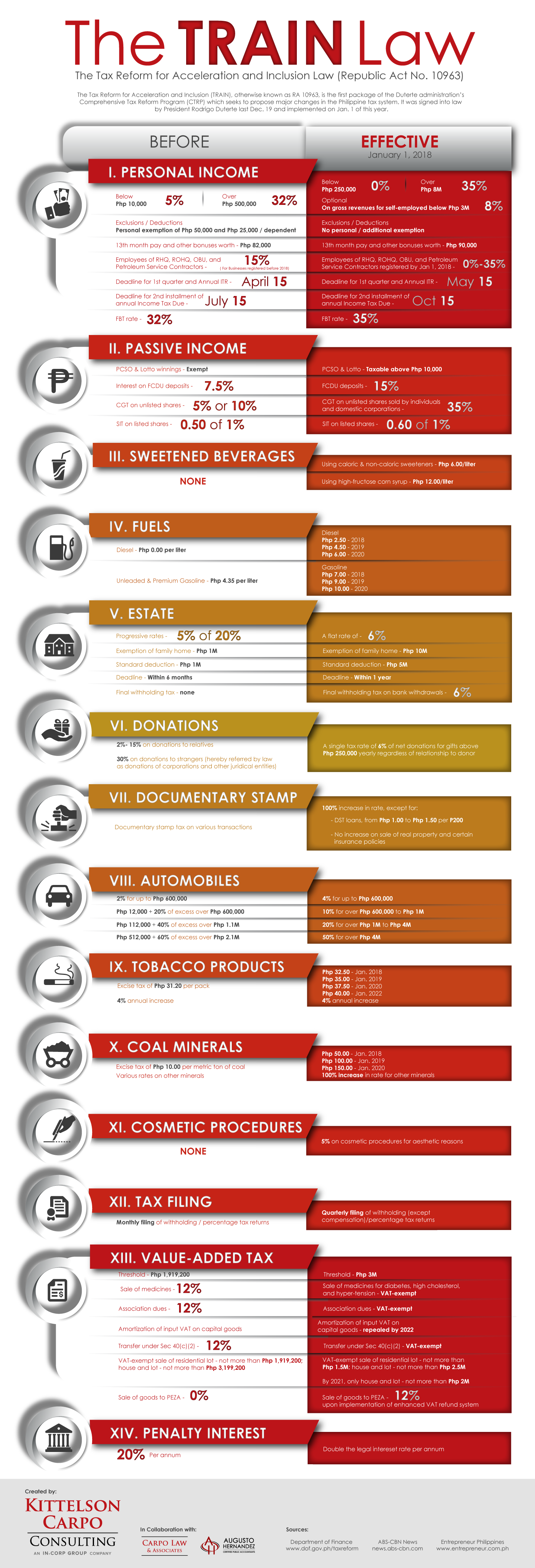

Passive income tax rates train law. Excise tax incremental revenues from tobacco taxes. The new train law will foregone the tax rates from those who have an annual income not over p250 000. Last february 2018 the bureau of internal revenue bir released revenue regulations no. New passive income tax rates.

The current tax rates for short term gains are as follows. View tax rates train law xlsx from math 123 at academy of business computers karimabad karachi. 8 2018 which discusses the income tax. While the two sources of income are relatively similar.

As you will soon discover passive income is technically taxed a lot like active income. Previously the effective income tax rate charged to this taxpayer was 3 33. From 2023 onwards the new effective income tax rate paying p7 500 income tax on p300 000 annual income is down to just 2 5. Income tax due taxable income gross income allowable deductions x tax rate tax withheld sample income tax computation for the taxable year 2020.

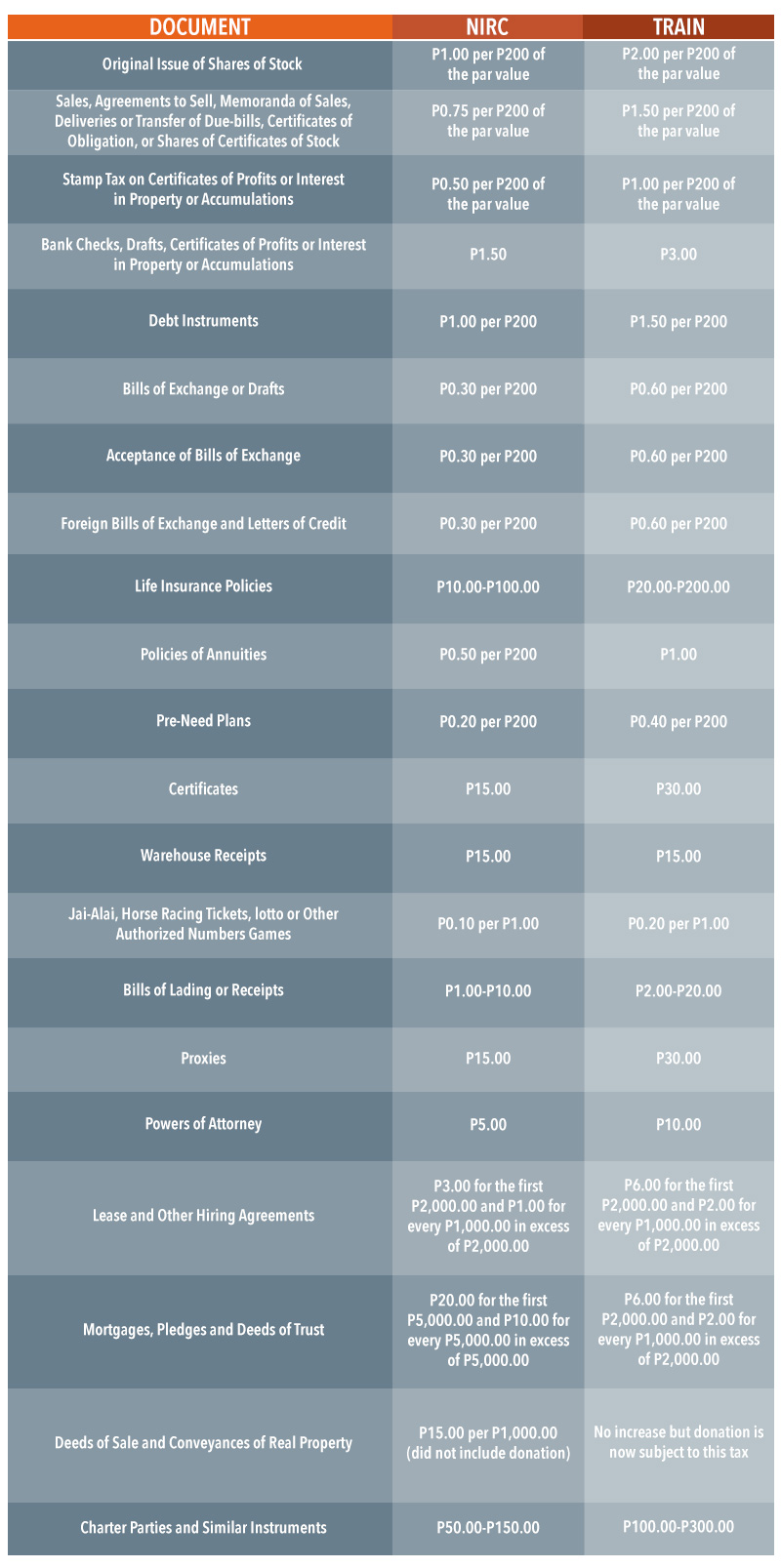

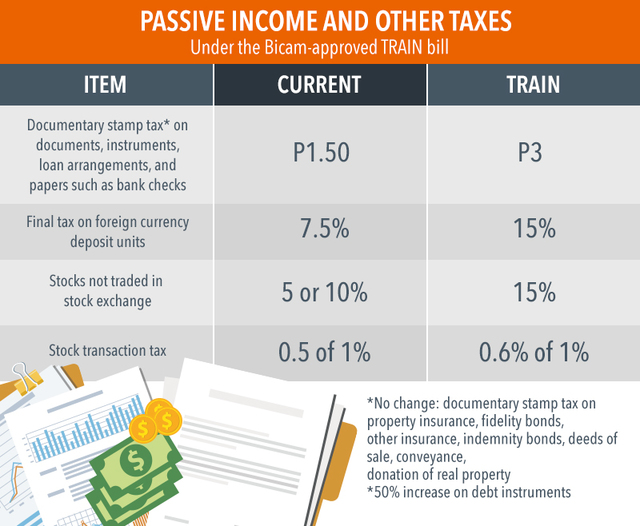

The newly approved train tax reform law also adjusted the tax rates on certain passive income in addition to revised personal income tax rates and new taxes imposed on oil sugary beverages tobacco mining etc. Years after the train law s effectivity i e on or before 1 january 2023. A single rate of 15 in general will be imposed on interest income dividends and capital gains. It is also worth noting one additional difference investors need to account for.

Short term passive income tax rates. Passive income broadly refers to money you don t earn from actively engaging in a trade or business. Certain passive income final withholding tax interest income from local cdu short term. 10 000 of citizens and resident aliens.

Interest income on fcdu deposits. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. By its broadest definition passive income would include nearly all investment income. 10 12 22 24 32 35 and 37.

The passive income tax rate. Harmonization of business taxes on financial intermediaries. Pcso and lotto winnings exceeding php. Unification of tax rates on passive income.

Employee with a gross monthly salary of php 30 000 and receiving 13th month pay of the same amount. In other words short term capital gains are taxed at the same rate as your income tax. This is because the train tax rates were reduced even further from 2023 onwards.